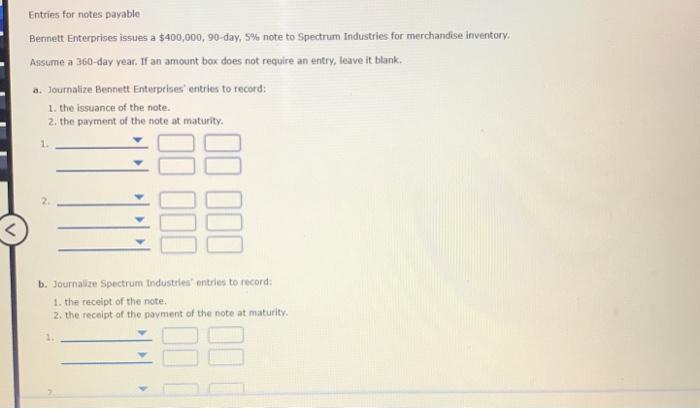

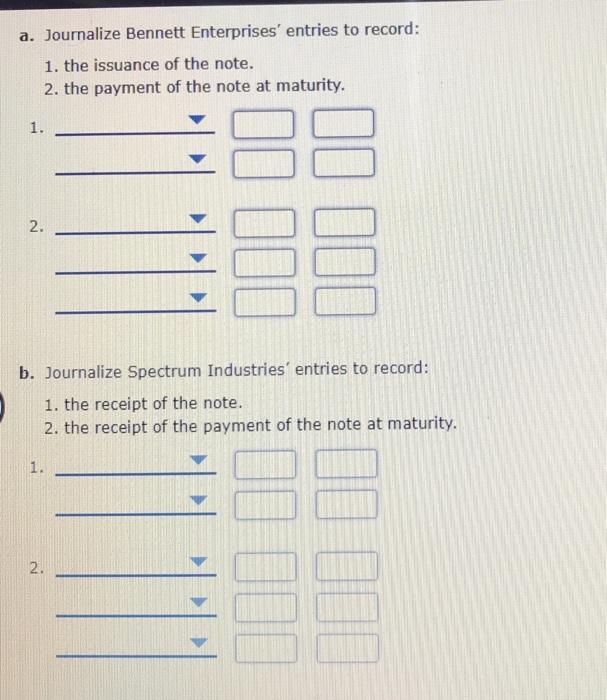

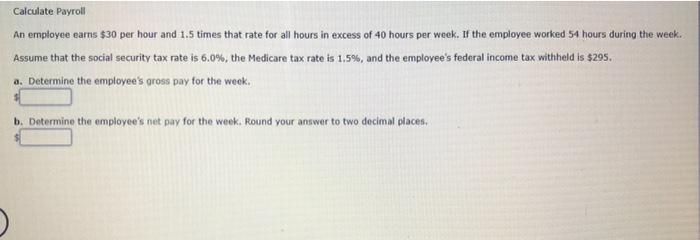

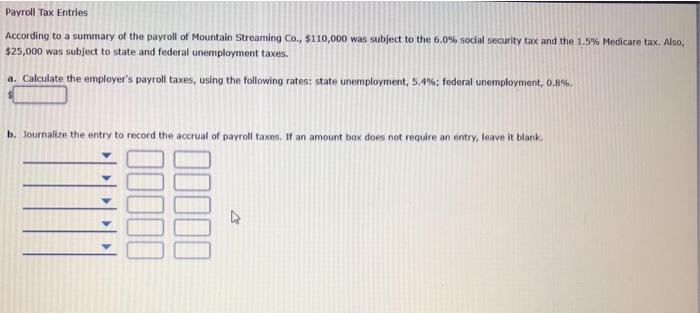

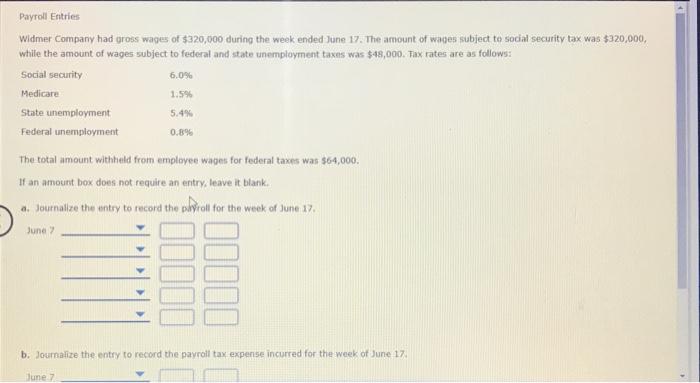

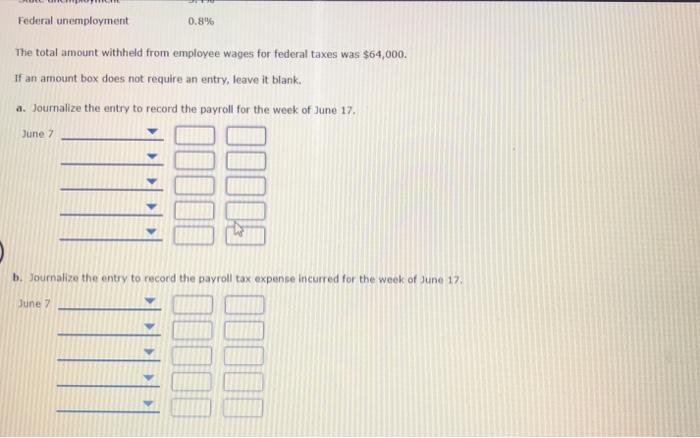

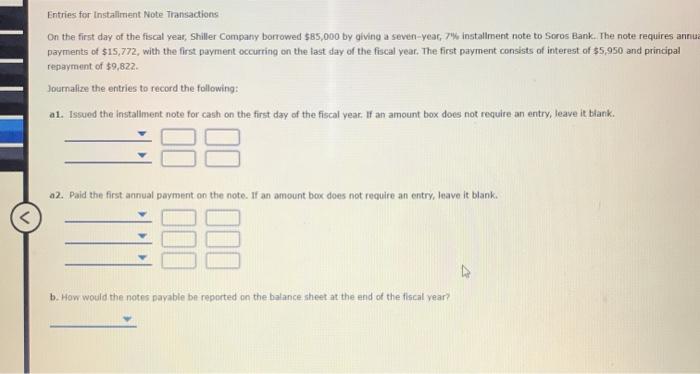

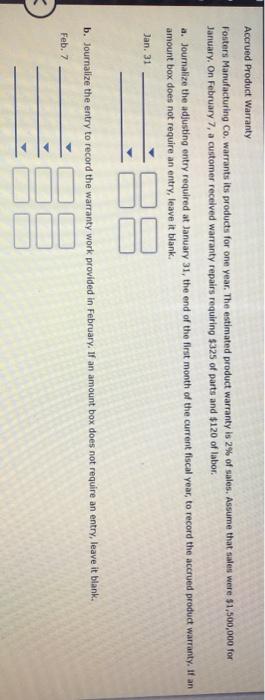

Entries for notes payable Bennett Enterprises issues a $400,000, 90-day, 5% note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If an amount box does not require an entry, leave it blank. a. Journalize Bennett Enterprises entries to record: 1. the issuance of the note. 2. the payment of the note at maturity II III II III b. Journalize Spectrum Industries entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity. a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. 1. 2. 1000 0 ll. b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity. 1. 2. UN Calculate Payroll An employee earns $30 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 54 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $295. a. Determine the employee's gross pay for the we week. b. Determine the employee's net pay for the week. Round your answer to two decimal places. Payroll Tax Entries According to a summary of the payroll of Mountain Streaming Co., $110,000 was subject to the 6.0% sodal security tax and the 1.5% Medicare tax. Also, $25,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.8% b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank ll Payroll Entries Widmer Company had gross wages of $320,000 during the week ended June 17. The amount of wages subject to social security tax was $320,000, while the amount of wages subject to federal and state unemployment taxes was $48,000. Fax rates are as follows: Social security 6.096 Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $64,000. If an amount box does not require an entry leave it blank. a. Journalize the entry to record the payroll for the week of June 17 June 110 b. Journalize the entry to record the payroll tax expense incurred for the week of June 17 June 7 Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $64,000. If an amount box does not require an entry, leave it blank. a. Journalize the entry to record the payroll for the week of June 17. June 2 1111, b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. June Entries for installment Note Transactions On the first day of the fiscal year, Shiller Company borrowed $85,000 by giving a seven-year, 7% installment note to Soros Bank. The note requires annua payments of $15,772, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $5,950 and principal repayment of $9,822 Journalize the entries to record the following: al. Issued the installment note for cash on the first day of the fiscal year. If an amount box does not require an entry, leave it blank. 12. Paid the first annual payment on the note. If an amount boc does not require an entry, leave it blank. b. How would the notes payable be reported on the balance sheet at the end of the fiscal year? Accrued Product Warranty Fosters Manufacturing Co. warrants its products for one year. The estimated product warranty is 2% of sales. Assume that sales were $1,500,000 for January, On February 7, a customer received warranty repairs requiring $325 of parts and $120 of labor. a. Journalize the adjusting entry required at January 31, the end of the first month of the current fiscal year, to record the accrued product warranty. If an amount box does not require an entry, leave it blank. Jan. 31 b. Journalize the entry to record the warranty work provided in February. If an amount box does not require an entry, leave it blank. Feb. 7