Entries for sale of fixed asset Equipment acquired on January 8 at a cost of $133,980 has an estimated useful life of 13 years,

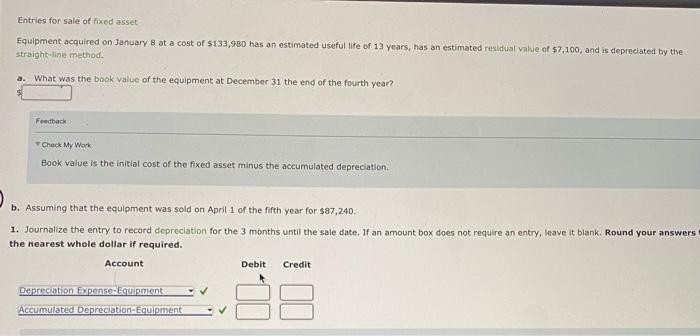

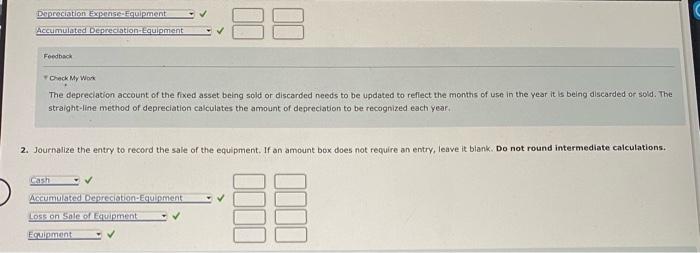

Entries for sale of fixed asset Equipment acquired on January 8 at a cost of $133,980 has an estimated useful life of 13 years, has an estimated residual value of $7,100, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year? Feedback Check My Work Book value is the initial cost of the fixed asset minus the accumulated depreciation. b. Assuming that the equipment was sold on April 1 of the fifth year for $87,240. 1. Journalize the entry to record depreciation for the 3 months until the sale date. If an amount box does not require an entry, leave it blank. Round your answers t the nearest whole dollar if required. Account Depreciation Expense-Equipment Accumulated Depreciation-Equipment Debit Credit Depreciation Expense-Equipment Accumulated Depreciation Equipment Feedback Check My Work 88 The depreciation account of the fixed asset being sold or discarded needs to be updated to reflect the months of use in the year it is being discarded or sold. The straight-line method of depreciation calculates the amount of depreciation to be recognized each year. 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Cash Accumulated Depreciation-Equipment Loss on Sale of Equipment Equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started