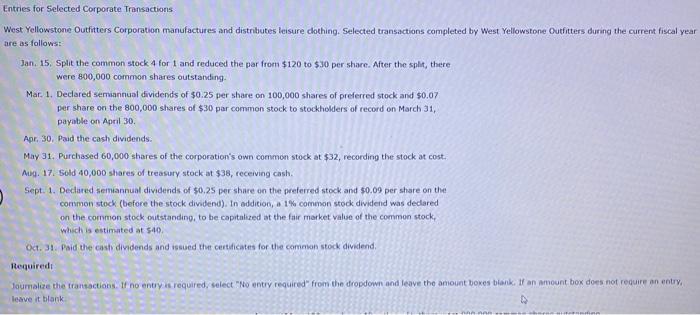

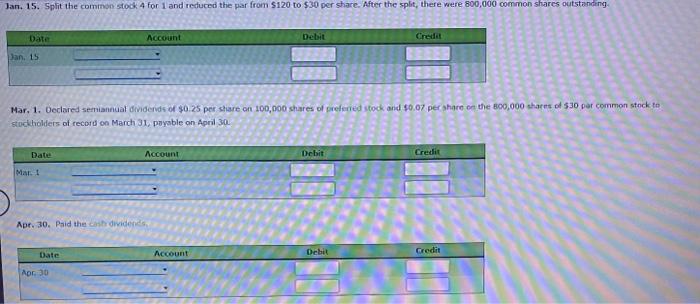

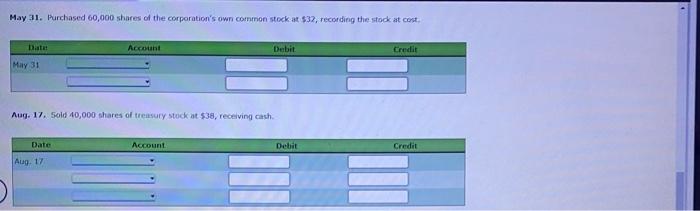

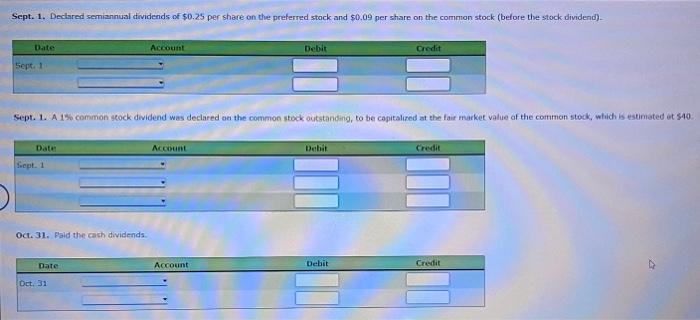

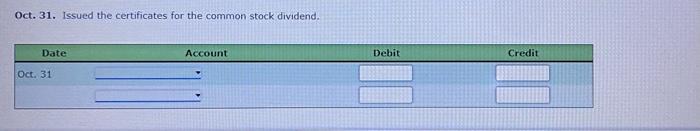

Entries for Selected Corporate Transactions. West Yellowstone Outfitters Corporation manufactures and distributes leisure clothing. Selected transactions completed by West Yellowstone Outfitters during the current fiscal year are as follows: Jan. 15, Split the common stock 4 for 1 and reduced the par from $120 to $30 per share. After the split, there were 800,000 common shares outstanding. Mar. 1. Declared semiannual dividends of $0.25 per share on 100,000 shares of preferred stock and $0.07 per share on the 800,000 shares of $30 par common stock to stockholders of record on March 31 , payable on April 30. Apr, 30, Paid the cash dividends: May 31. Purchased 60,000 stares of the corporation's own common stock at $32, recording the stock at cost. Aup. 17. Bold 40,000 shares of treasury stock at $38, receiving cash. Sept. 1. Declared semiannual dividends of $0,25 per share on the preferred stock and 50.09 per share on the cornmon stock (before the stock dividend). In addition, a 1% common stock dividend was declared on the common stock outstanding, to be capitalized at the fair morket value of the common stock, which is estimated at 540 . Oct. 31. Paid the cashrdindends and issued the certicates for the comnon stock dividend. Reguiredi faumalize the transactions. If no entry is required, select "No entry required" from the dropdown and leave the amiount boxes biank, if an amount box does not require an entry, leave it blank Nar. 1. Oeclared semiannuaf divdends of $0.25 per share on 100,000 shares of preferied stock and 40.07 per ahare oe the 800,000 shares of 530 per common stock to stoctholders of record on March 31, poysble on April 30. Apr. 30. Paid the cintrowidends? May 31. Purchased 60,000 shares of the corporation's own common stock at $32, recording the stock at cost. Au9. 17, 5old 40,000 shares of trensury stock at $38, receiving cash. Sept. 1. Dectared semiannual dividends of $0.25 per share on the preferred stack and $0.09 per share on the common stock (before the stock dividend). Sept. 1. A 15e common scock dividend was declared en the common stock outstanding, to be copitalired at the lair market value of the common stock, whild OCt. 31. Faid the cach dividends. Oct. 31. Issued the certificates for the common stock dividend