Answered step by step

Verified Expert Solution

Question

1 Approved Answer

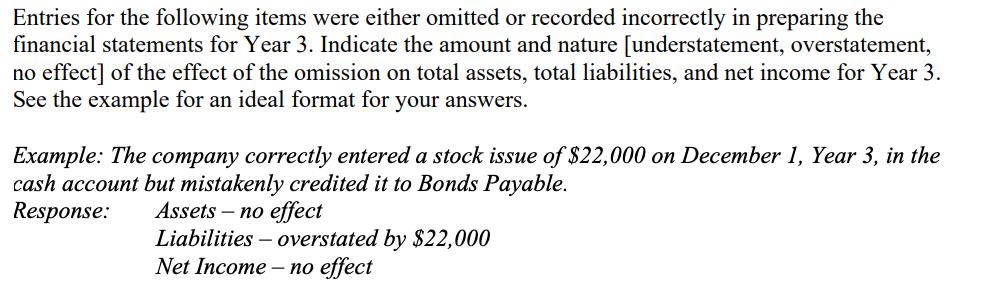

Entries for the following items were either omitted or recorded incorrectly in preparing the financial statements for Year 3. Indicate the amount and nature

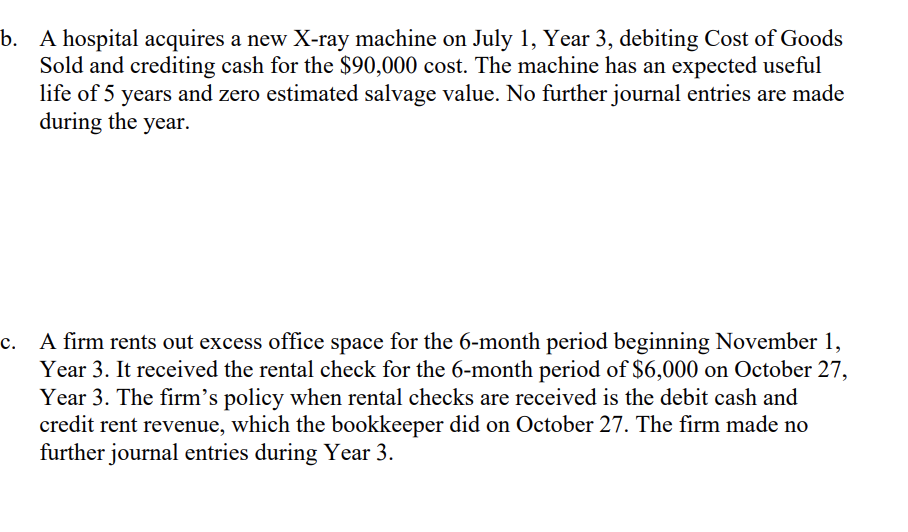

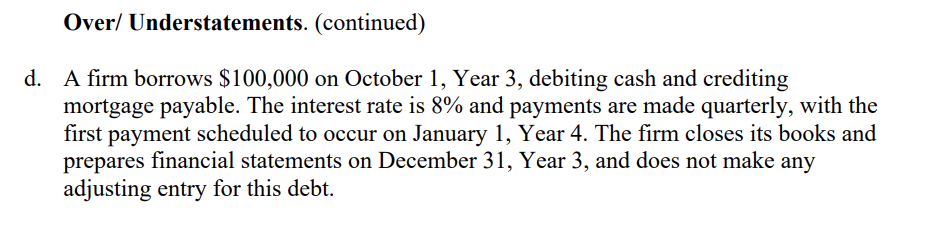

Entries for the following items were either omitted or recorded incorrectly in preparing the financial statements for Year 3. Indicate the amount and nature [understatement, overstatement, no effect] of the effect of the omission on total assets, total liabilities, and net income for Year 3. See the example for an ideal format for your answers. Example: The company correctly entered a stock issue of $22,000 on December 1, Year 3, in the cash account but mistakenly credited it to Bonds Payable. Response: Assets no effect Liabilities overstated by $22,000 Net Income - no effect b. A hospital acquires a new X-ray machine on July 1, Year 3, debiting Cost of Goods Sold and crediting cash for the $90,000 cost. The machine has an expected useful life of 5 years and zero estimated salvage value. No further journal entries are made during the year. A firm rents out excess office space for the 6-month period beginning November 1, Year 3. It received the rental check for the 6-month period of $6,000 on October 27, Year 3. The firm's policy when rental checks are received is the debit cash and credit rent revenue, which the bookkeeper did on October 27. The firm made no further journal entries during Year 3. Over/Understatements. (continued) d. A firm borrows $100,000 on October 1, Year 3, debiting cash and crediting mortgage payable. The interest rate is 8% and payments are made quarterly, with the first payment scheduled to occur on January 1, Year 4. The firm closes its books and prepares financial statements on December 31, Year 3, and does not make any adjusting entry for this debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started