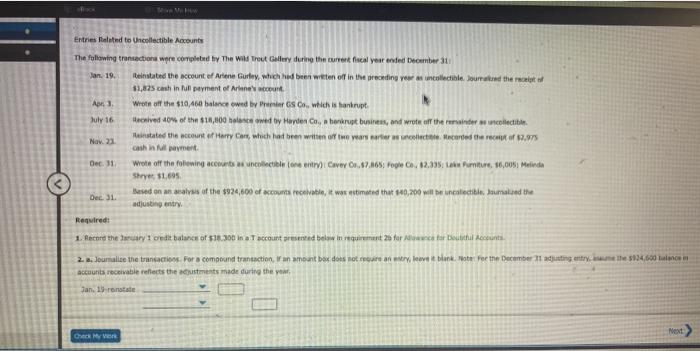

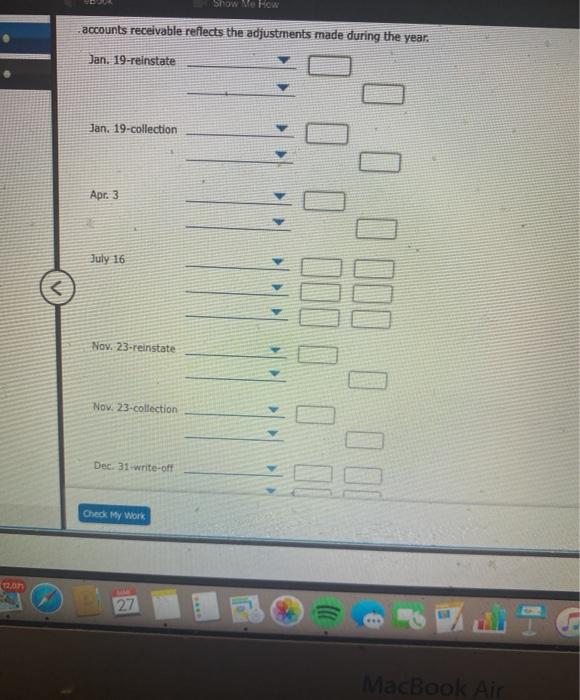

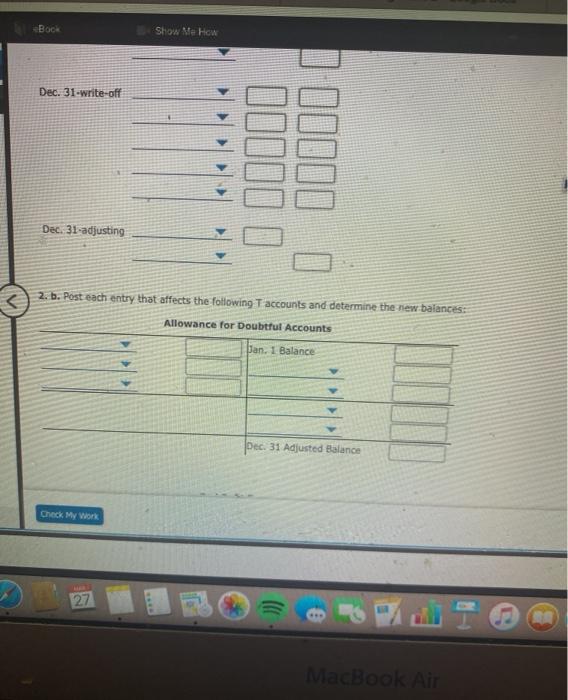

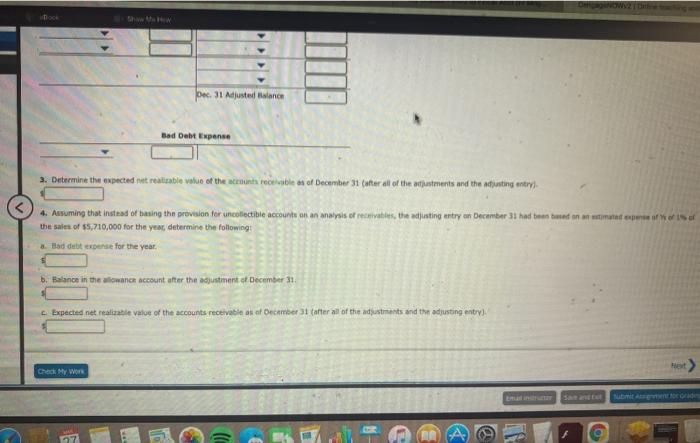

Entries Related to collectible Accounts The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended tomber Jan. 19. beinstated the account of Arlene Gurley, which had been written off in the preceding your collectible Journered the 12,825 cash in un peyment of Arlene count Apr Wrote off the $10.460 balance owed by Press, which is bankrupt July 16 Henved 40% of the $1,000 howed by Hayden Casa enkrupt business, and wrote of the remainder Helistated the account of Harry Cars, which had been written the war w cel. corded the recit. Nov. 23 cash in Ml payment Dec. 31 Wote off the following continencils one enti) Cave 0,87305; Pogle C, 82,33, Future, 16,005 Melinda Shyet 51.695 Dec 31 Based on an analysis of the $924,800 of accounts receivable, it was estimated that 840,200 will be uncalectible, Jaumaland the adjusting entry Required 1. Record the dry credit balance of 532.300 in Taccount presented below in requirements for star Det Accounts 2. Joumalize the transactions. For a compound transaction, an amant box does not country leave a blank Note for the December 11 ating entry the 134,600 alone in accounts receivable reflects the custments made during the year Jan. 19-rotate Next Check My Von SHOW Me How accounts receivable reflects the adjustments made during the year. Jan. 19-reinstate Jan. 19-collection Apr. 3 July 16 [ - 1 ll. J BON Nov. 23-reinstate Nov. 23-collection Dec. 31 write-off Check My Work 12.07 27 MacBook Air Bock Show Me How Dec. 31-write-off 10000 1 00000 Dec 31-adjusting 2. b. Post each entry that affects the following T accounts and determine the new balances Allowance for Doubtful Accounts Jan. 1 Balance Dec. 31 Adjusted Balance Check My Work 27 MacBook Air Dec.31 Adjusted talan Bad Debt Expense 2. Determine the expected that realisable value of the scenaris receble as of December 31 (after all of the artistments and the atjusting entry). 4. Aasuming that instead of being the provision for uncollectible accounts on an analysis of receivitiesthe adjusting entry on December 31 had been twed on er utmanat pure of the sales of 5,710,000 for the year, determine the following 3. Bad de expense for the year b. Balance in the allowance account after the adjustment of December 11, Expected net realizzate atoe of the accounts receivable au of December 31 (after all of the adjustments and the adjusting entry) Check My Wor O 57 Entries Related to collectible Accounts The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended tomber Jan. 19. beinstated the account of Arlene Gurley, which had been written off in the preceding your collectible Journered the 12,825 cash in un peyment of Arlene count Apr Wrote off the $10.460 balance owed by Press, which is bankrupt July 16 Henved 40% of the $1,000 howed by Hayden Casa enkrupt business, and wrote of the remainder Helistated the account of Harry Cars, which had been written the war w cel. corded the recit. Nov. 23 cash in Ml payment Dec. 31 Wote off the following continencils one enti) Cave 0,87305; Pogle C, 82,33, Future, 16,005 Melinda Shyet 51.695 Dec 31 Based on an analysis of the $924,800 of accounts receivable, it was estimated that 840,200 will be uncalectible, Jaumaland the adjusting entry Required 1. Record the dry credit balance of 532.300 in Taccount presented below in requirements for star Det Accounts 2. Joumalize the transactions. For a compound transaction, an amant box does not country leave a blank Note for the December 11 ating entry the 134,600 alone in accounts receivable reflects the custments made during the year Jan. 19-rotate Next Check My Von SHOW Me How accounts receivable reflects the adjustments made during the year. Jan. 19-reinstate Jan. 19-collection Apr. 3 July 16 [ - 1 ll. J BON Nov. 23-reinstate Nov. 23-collection Dec. 31 write-off Check My Work 12.07 27 MacBook Air Bock Show Me How Dec. 31-write-off 10000 1 00000 Dec 31-adjusting 2. b. Post each entry that affects the following T accounts and determine the new balances Allowance for Doubtful Accounts Jan. 1 Balance Dec. 31 Adjusted Balance Check My Work 27 MacBook Air Dec.31 Adjusted talan Bad Debt Expense 2. Determine the expected that realisable value of the scenaris receble as of December 31 (after all of the artistments and the atjusting entry). 4. Aasuming that instead of being the provision for uncollectible accounts on an analysis of receivitiesthe adjusting entry on December 31 had been twed on er utmanat pure of the sales of 5,710,000 for the year, determine the following 3. Bad de expense for the year b. Balance in the allowance account after the adjustment of December 11, Expected net realizzate atoe of the accounts receivable au of December 31 (after all of the adjustments and the adjusting entry) Check My Wor O 57