Question: Journal Entry 14 15 17 19 SESSION DATE - APRIL 14, 2023 Memo #4 Dated April 8/23 From Owner: Cheque #5033 for $2 435.60 from

Journal Entry

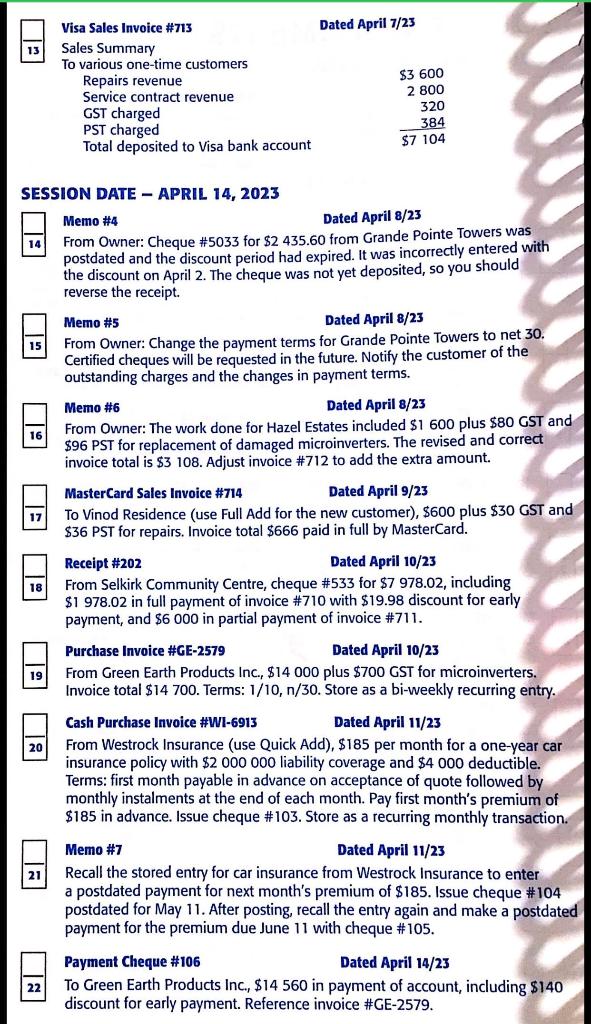

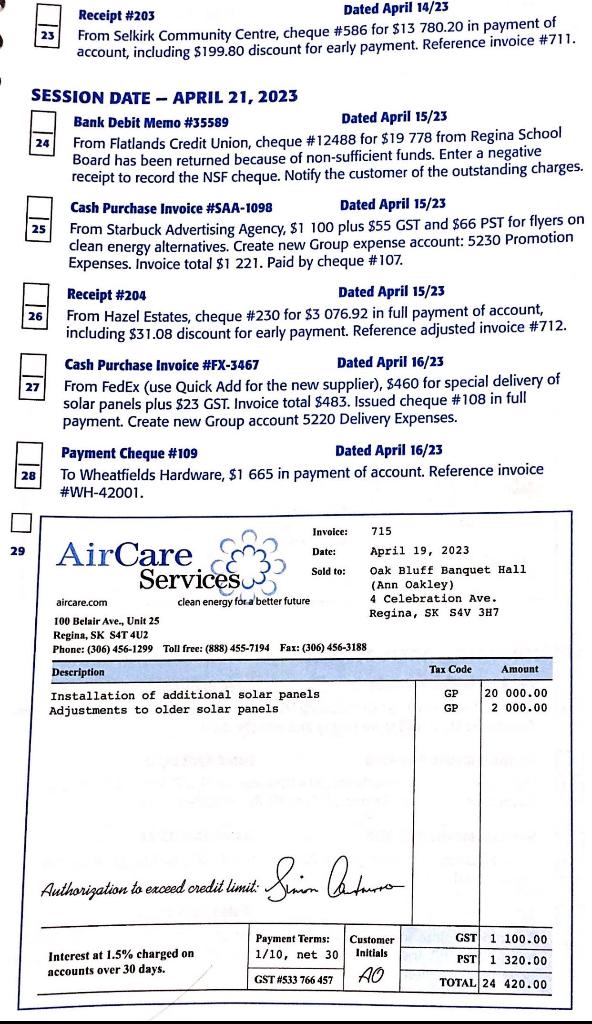

14 15 17 19 SESSION DATE - APRIL 14, 2023 Memo #4 Dated April 8/23 From Owner: Cheque #5033 for $2 435.60 from Grande Pointe Towers was postdated and the discount period had expired. It was incorrectly entered with the discount on April 2. The cheque was not yet deposited, so you should reverse the receipt. 20 21 Visa Sales Invoice #713 Sales Summary To various one-time customers Repairs revenue Service contract revenue 22 GST charged PST charged Total deposited to Visa bank account Dated April 7/23 $3 600 2 800 320 384 $7 104 Memo #5 Dated April 8/23 From Owner: Change the payment terms for Grande Pointe Towers to net 30. Certified cheques will be requested in the future. Notify the customer of the outstanding charges and the changes in payment terms. Memo #6 Dated April 8/23 From Owner: The work done for Hazel Estates included $1 600 plus $80 GST and $96 PST for replacement of damaged microinverters. The revised and correct invoice total is $3 108. Adjust invoice #712 to add the extra amount. MasterCard Sales Invoice #714 Dated April 9/23 To Vinod Residence (use Full Add for the new customer), $600 plus $30 GST and $36 PST for repairs. Invoice total $666 paid in full by MasterCard. Receipt #202 Dated April 10/23 From Selkirk Community Centre, cheque # 533 for $7 978.02, including $1 978.02 in full payment of invoice #710 with $19.98 discount for early payment, and $6 000 in partial payment of invoice #711. Purchase Invoice #GE-2579 Dated April 10/23 From Green Earth Products Inc., $14 000 plus $700 GST for microinverters. Invoice total $14 700. Terms: 1/10, n/30. Store as a bi-weekly recurring entry. Cash Purchase Invoice #WI-6913 Dated April 11/23 From Westrock Insurance (use Quick Add), $185 per month for a one-year car insurance policy with $2 000 000 liability coverage and $4 000 deductible. Terms: first month payable in advance on acceptance of quote followed by monthly instalments at the end of each month. Pay first month's premium of $185 in advance. Issue cheque #103. Store as a recurring monthly transaction. Memo #7 Dated April 11/23 Recall the stored entry for car insurance from Westrock Insurance to enter a postdated payment for next month's premium of $185. Issue cheque #104 postdated for May 11. After posting, recall the entry again and make a postdated payment for the premium due June 11 with cheque #105. Payment Cheque #106 Dated April 14/23 To Green Earth Products Inc., $14 560 in payment of account, including $140 discount for early payment. Reference invoice #GE-2579.

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Required Journal Entry Journal Entry Date Particulars Debit Credit Apr 07 2023 Cash in Hand 7104 To Repairs Revenue 3600 To Service Contract Revenue 2... View full answer

Get step-by-step solutions from verified subject matter experts