Answered step by step

Verified Expert Solution

Question

1 Approved Answer

entry Health Smart Limited (HSL) purchased a manufacturing assembly machine for its new prod. uct launch: The Total Health Watch on March 2, 2017 for

entry

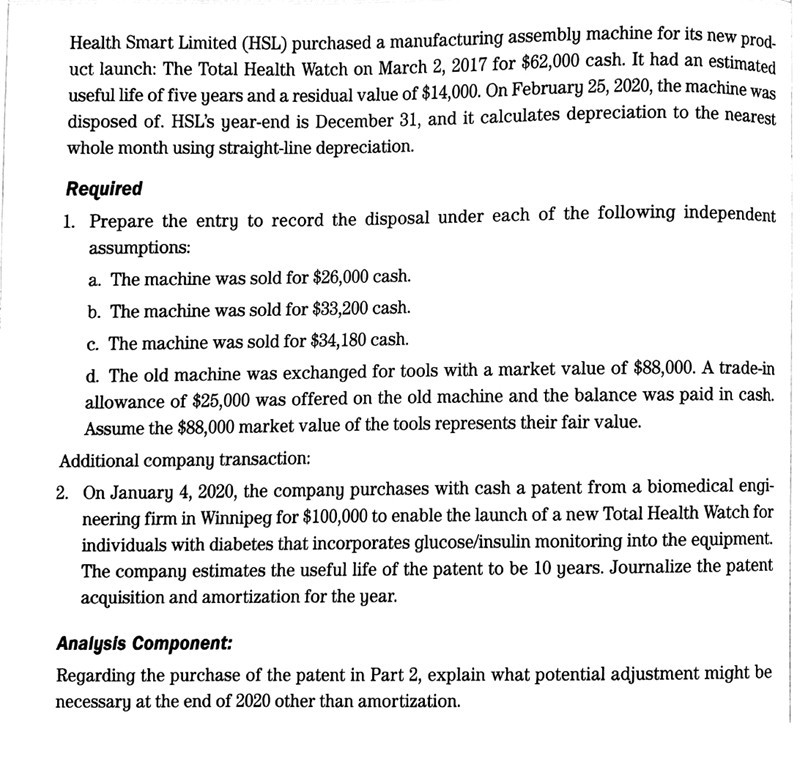

Health Smart Limited (HSL) purchased a manufacturing assembly machine for its new prod. uct launch: The Total Health Watch on March 2, 2017 for $62,000 cash. It had an estimated useful life of five years and a residual value of $14,000. On February 25, 2020, the machine was disposed of. HSL's year-end is December 31, and it calculates depreciation to the nearest whole month using straight-line depreciation. Required 1. Prepare the entry to record the disposal under each of the following independent assumptions: a. The machine was sold for $26,000 cash. b. The machine was sold for $33,200 cash. c. The machine was sold for $34,180 cash. d. The old machine was exchanged for tools with a market value of $88,000. A trade-in allowance of $25,000 was offered on the old machine and the balance was paid in cash. Assume the $88,000 market value of the tools represents their fair value. Additional company transaction: 2. On January 4, 2020, the company purchases with cash a patent from a biomedical engi- neering firm in Winnipeg for $100,000 to enable the launch of a new Total Health Watch for individuals with diabetes that incorporates glucose/insulin monitoring into the equipment. The company estimates the useful life of the patent to be 10 years. Journalize the patent acquisition and amortization for the year. Analysis Component: Regarding the purchase of the patent in Part 2, explain what potential adjustment might be necessary at the end of 2020 other than amortizationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started