Question

Environ Ltd requests you to evaluate two new capital budgeting proposals and provide your recommendations. You are required to submit a report by responding to

Environ Ltd requests you to evaluate two new capital budgeting proposals and provide your recommendations. You are required to submit a report by responding to the underlisted questions. In your report, state any assumptions made and clearly show all your steps in the calculations undertaken towards reaching your conclusions.

Instructions are as follows:

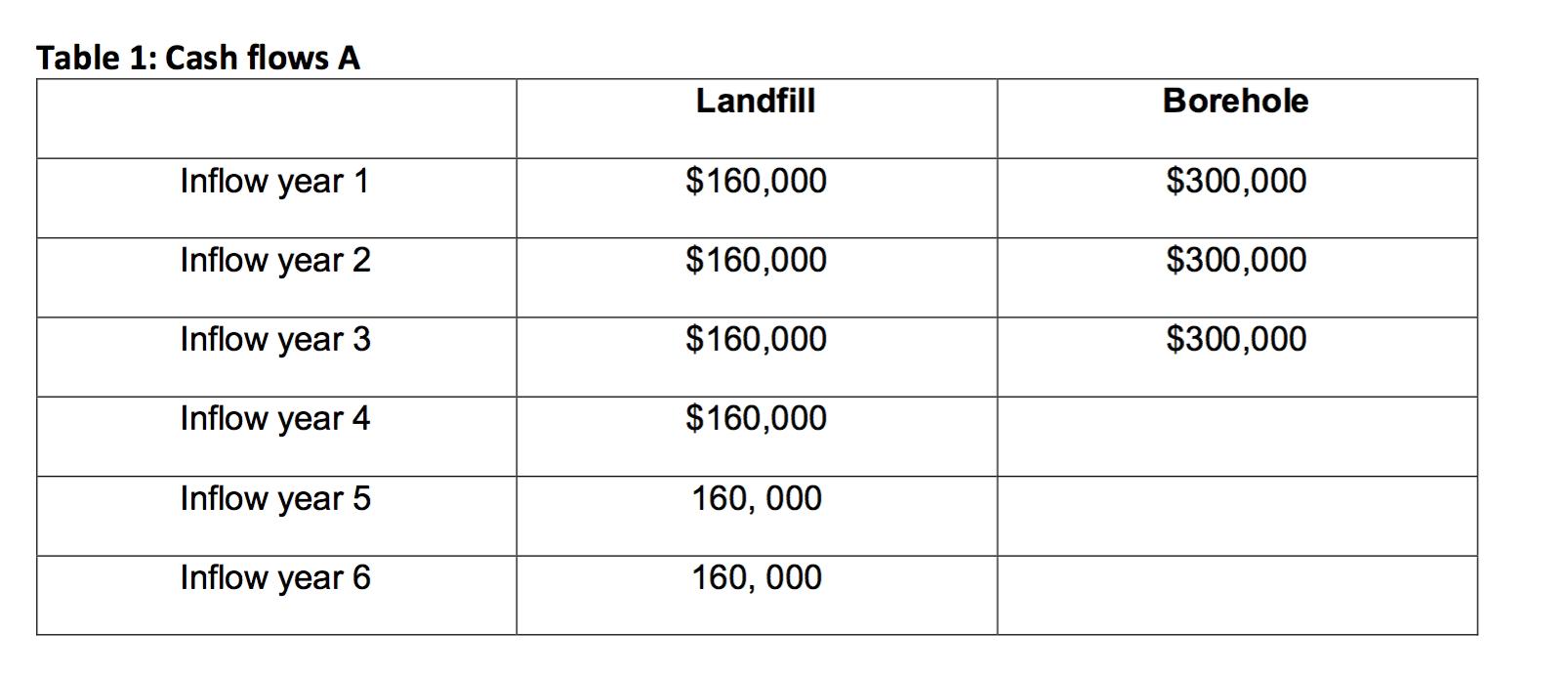

Provide an evaluation of two proposed projects: landfill and borehole. The initial outlays are $100,000 and $250, 000, respectively for the landfill and borehole. Environ Ltd has set the required rate of return for both projects to 15%. The expected after-tax cash flows from each project are as presented in the Table 1 below.

Question

a. Which project should Environ Ltd accept? Use the net present value (NPV) criterion to evaluate both projects. Explain in detail, including all calculations. Also, clearly state all your assumptions.

b. Determine the IRR for each project. According to the IRR, which project should be accepted? Explain in detail, including all calculations.

Would your conclusions in parts (a) and (b) change if the required rate of return increased to 14%? Explain in detail, including all calculations.

Question

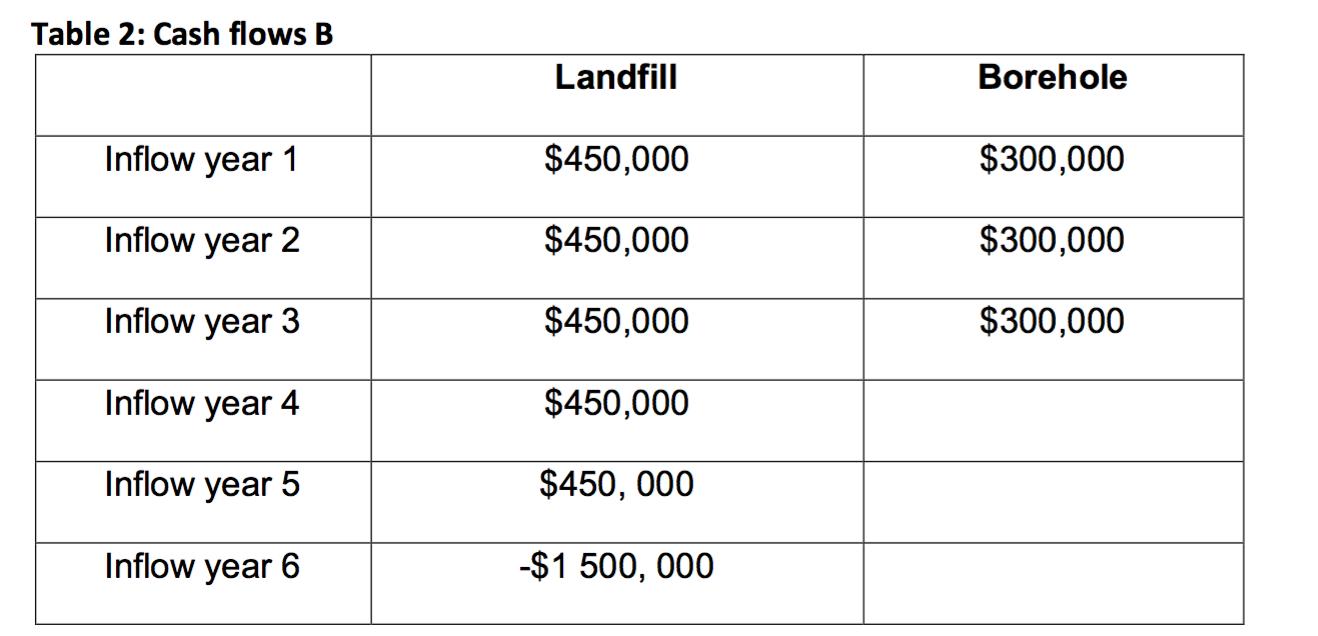

Environ Ltd has revised its estimates of expected after-tax cash flows as shown in Table 2. The initial outlays are $800,000 for the landfill and $250, 000 for the borehole. Environ Ltd maintains the required rate of return at 12% for both projects.

Based on the net present value (NPV) criterion, which project should Environ Ltd accept? Explain in detail, including all calculations. Also, clearly state all your assumptions.

Based on the internal rate of return (IRR) criterion, which project should Environ Ltd accept? Explain in detail, with the graph of IRR and all working steps. Also, clearly state all your assumptions.

Question

Some financial mangers prefer capital budgeting models such as internal rate of return (IRR) or non- discounted payback models over the net present value (NPV) the model, which is preferred by academic financial analysts. Why? Briefly discuss.

Table 1: Cash flows A Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 Inflow year 5 Inflow year 6 Landfill $160,000 $160,000 $160,000 $160,000 160, 000 160, 000 Borehole $300,000 $300,000 $300,000

Step by Step Solution

3.21 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Report on Capital Budgeting Proposals a Net Present Value NPV Evaluation To evaluate the two proposed projects landfill and borehole we will calculate the net present value NPV for each project The NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started