Answered step by step

Verified Expert Solution

Question

1 Approved Answer

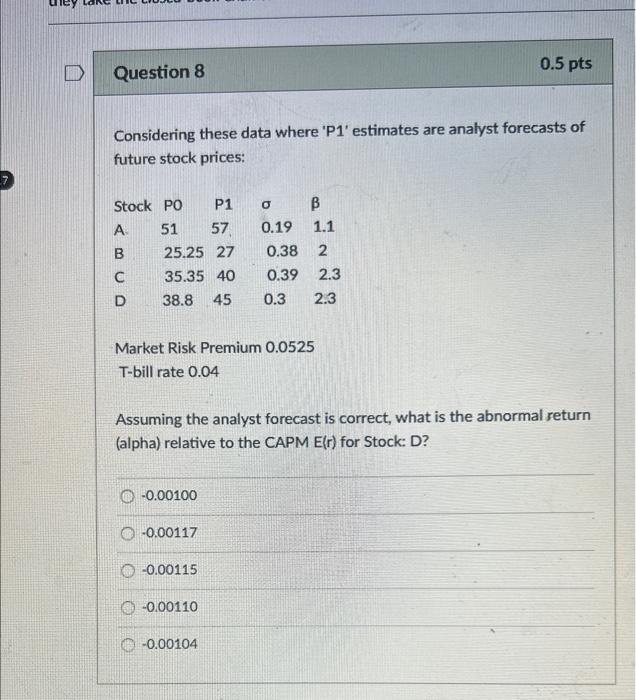

EOM L7 Considering these data where 'P1' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.0525 T-bill rate 0.04 Assuming the analyst

EOM L7

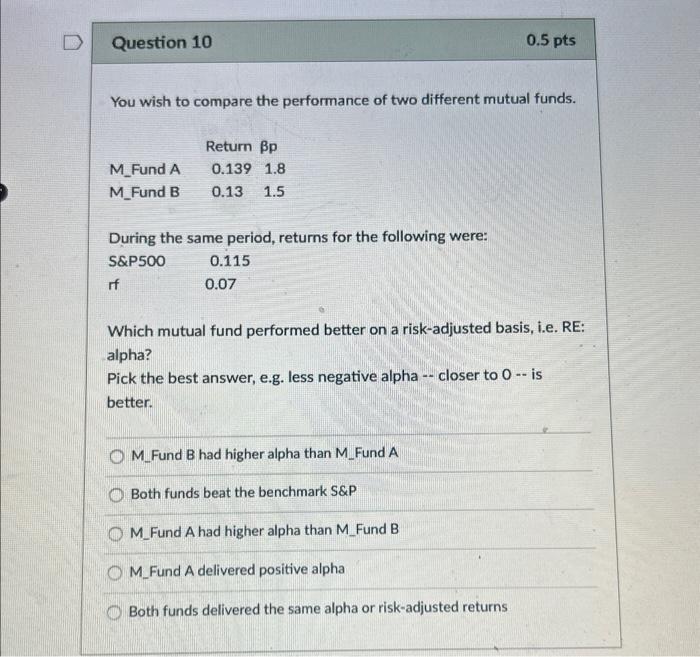

Considering these data where 'P1' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.0525 T-bill rate 0.04 Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: D? 0.00100 0.00117 0.00115 0.00110 0.00104 You wish to compare the performance of two different mutual funds. During the same period, returns for the following were: Which mutual fund performed better on a risk-adjusted basis, i.e. RE: alpha? Pick the best answer, e.g. less negative alpha - closer to 0 - is better. M_Fund B had higher alpha than M_Fund A Both funds beat the benchmark S\&P M_Fund A had higher alpha than M_Fund B M_Fund A delivered positive alpha Both funds delivered the same alpha or risk-adjusted returns

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started