Answered step by step

Verified Expert Solution

Question

1 Approved Answer

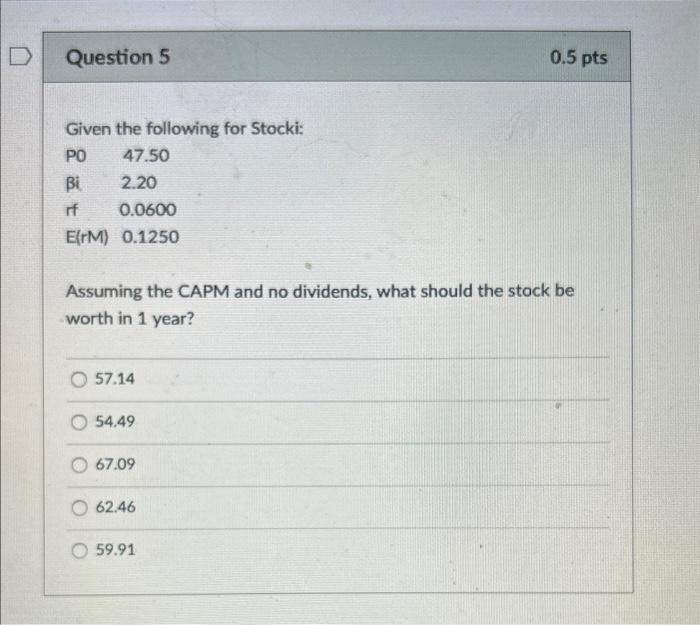

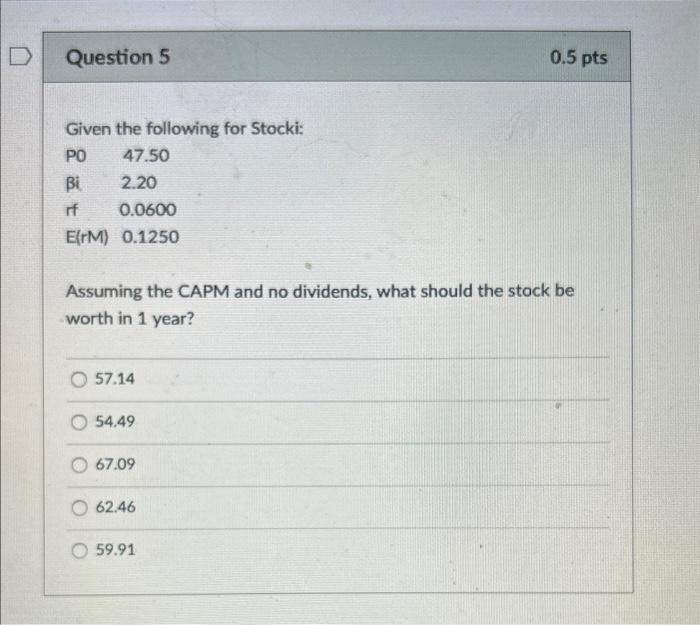

EOM L7 Given the following for Stocki: Assuming the CAPM and no dividends, what should the stock be worth in 1 year? 57.14 54.49 67.09

EOM L7

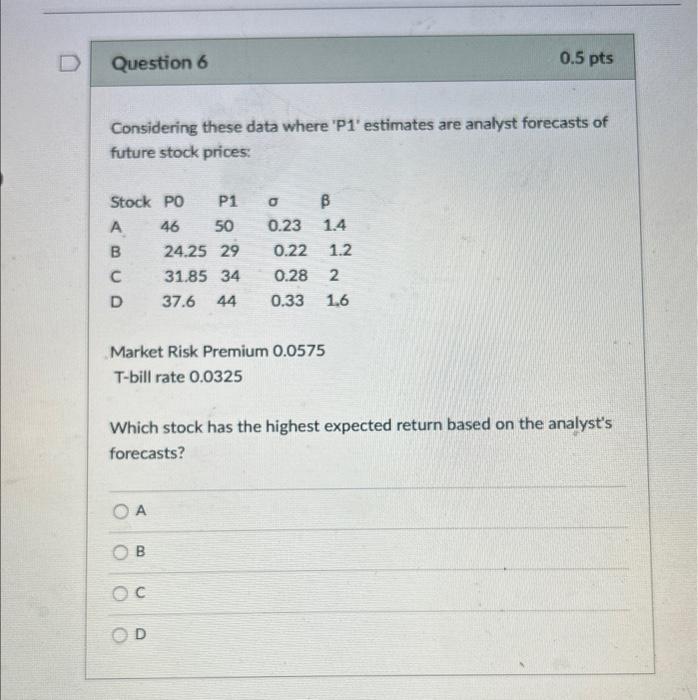

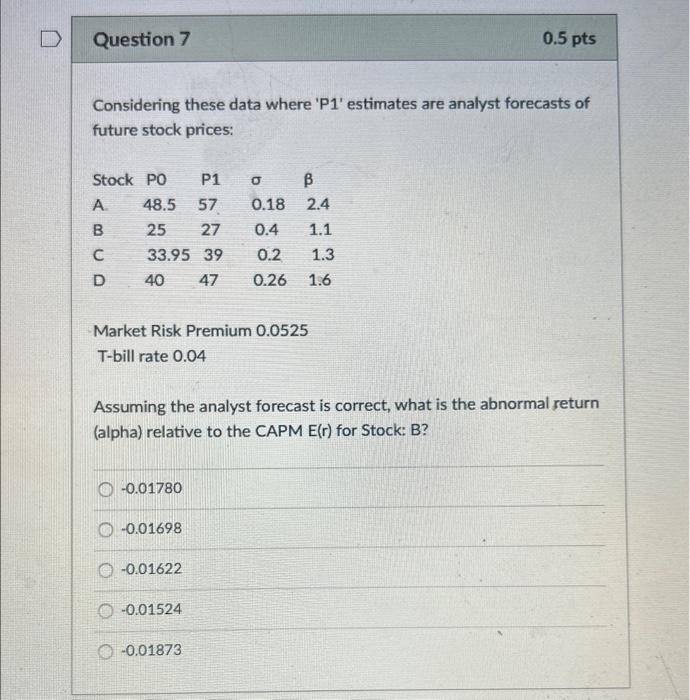

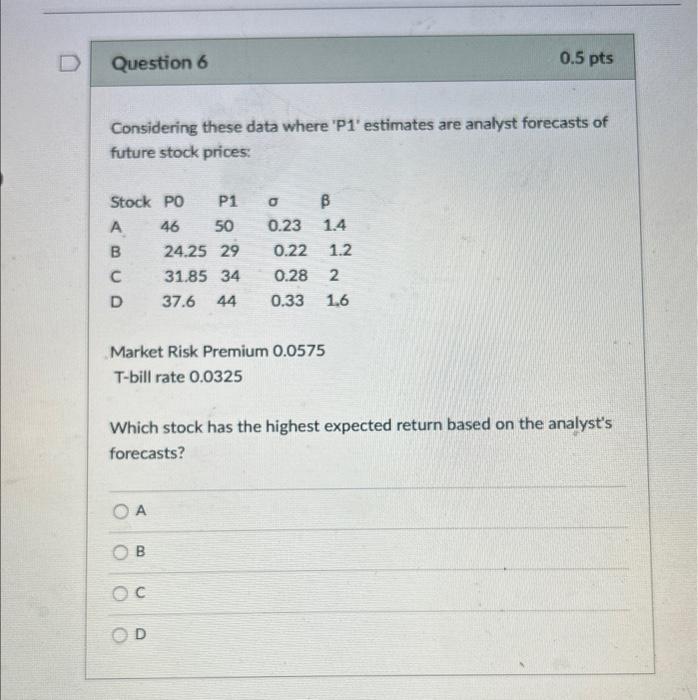

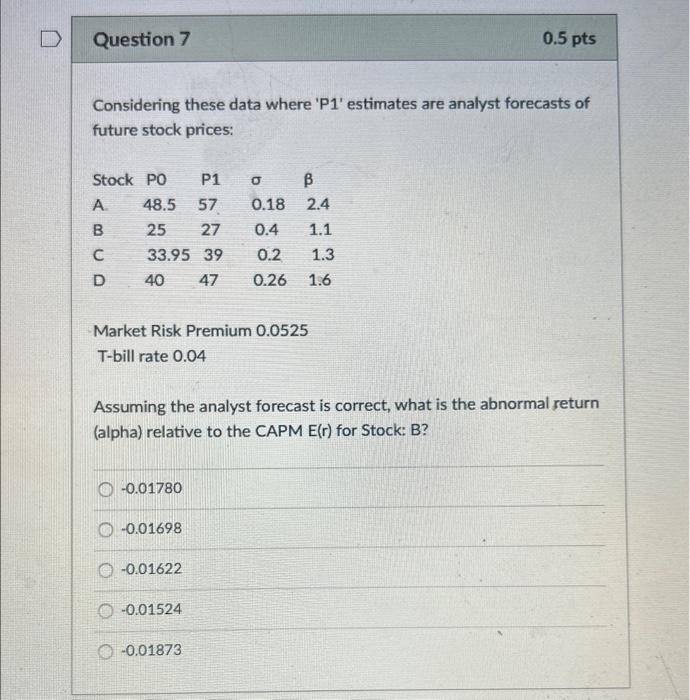

Given the following for Stocki: Assuming the CAPM and no dividends, what should the stock be worth in 1 year? 57.14 54.49 67.09 62.46 59.91 Considering these data where 'P1' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.0575 T-bill rate 0.0325 Which stock has the highest expected return based on the analyst's forecasts? A B C D Considering these data where 'P1' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.0525 T-bill rate 0.04 Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: B? 0.01780 0.01698 0.01622 0.01524 0.01873

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started