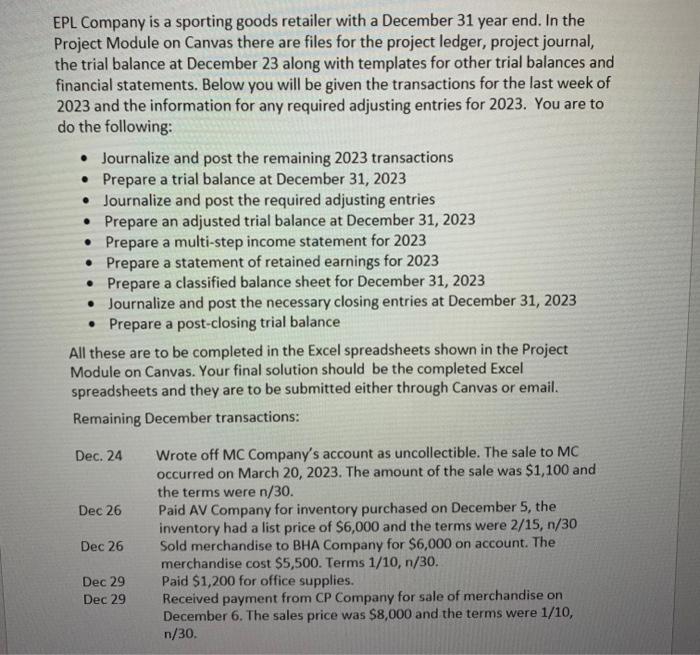

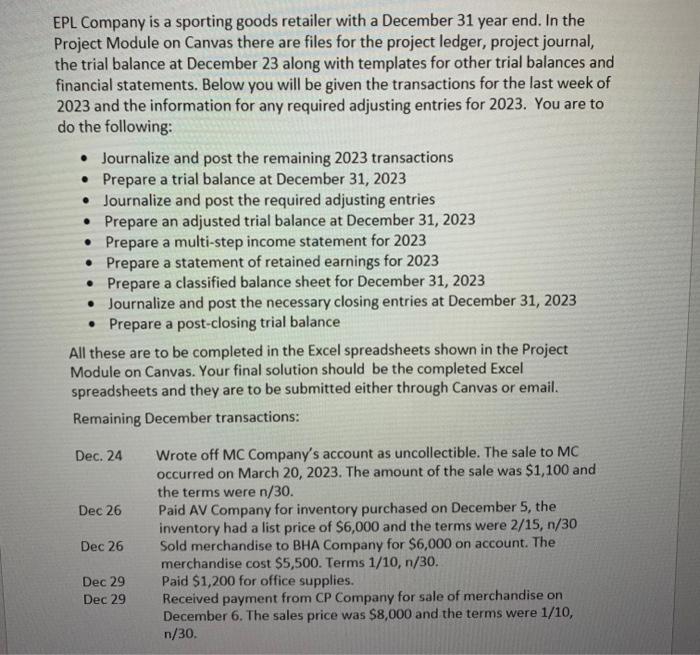

EPL Company is a sporting goods retailer with a December 31 year end. In the Project Module on Canvas there are files for the project ledger, project journal, the trial balance at December 23 along with templates for other trial balances and financial statements. Below you will be given the transactions for the last week of 2023 and the information for any required adjusting entries for 2023. You are to do the following:

- Journalize and post the remaining 2023 transactions

- Prepare a trial balance at December 31, 2023

- Journalize and post the required adjusting entries

- Prepare an adjusted trial balance at December 31, 2023

- Prepare a multi-step income statement for 2023

- Prepare a statement of retained earnings for 2023

- Prepare a classified balance sheet for December 31, 2023

- Journalize and post the necessary closing entries at December 31, 2023

- Prepare a post-closing trial balance

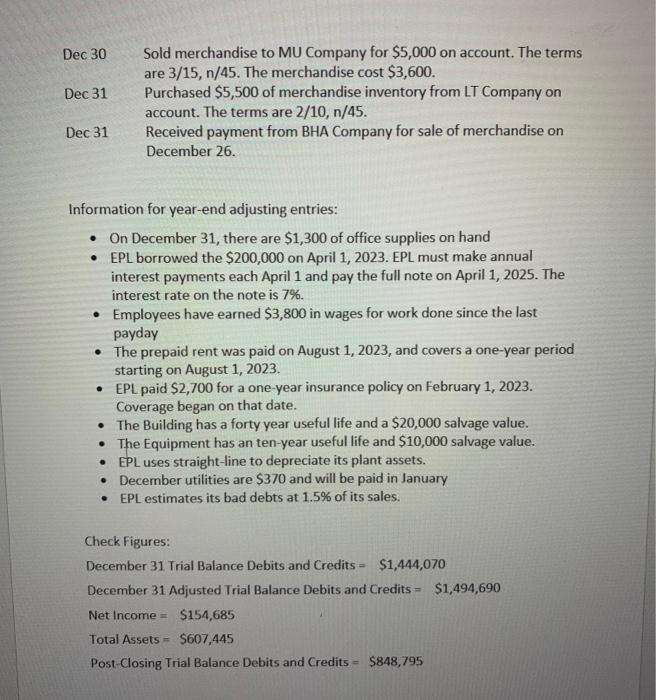

EPL Company is a sporting goods retailer with a December 31 year end. In the Project Module on Canvas there are files for the project ledger, project journal, the trial balance at December 23 along with templates for other trial balances and financial statements. Below you will be given the transactions for the last week of 2023 and the information for any required adjusting entries for 2023. You are to do the following: - Journalize and post the remaining 2023 transactions - Prepare a trial balance at December 31, 2023 - Journalize and post the required adjusting entries - Prepare an adjusted trial balance at December 31, 2023 - Prepare a multi-step income statement for 2023 - Prepare a statement of retained earnings for 2023 - Prepare a classified balance sheet for December 31, 2023 - Journalize and post the necessary closing entries at December 31, 2023 - Prepare a post-closing trial balance All these are to be completed in the Excel spreadsheets shown in the Project Module on Canvas. Your final solution should be the completed Excel spreadsheets and they are to be submitted either through Canvas or email. Remaining December transactions: Dec. 24 Dec 26 Dec26 Dec 29 Dec 29 Wrote off MC Company's account as uncollectible. The sale to MC occurred on March 20, 2023. The amount of the sale was $1,100 and the terms were n/30. Paid AV Company for inventory purchased on December 5 , the inventory had a list price of $6,000 and the terms were 2/15,n/30 Sold merchandise to BHA Company for $6,000 on account. The merchandise cost $5,500. Terms 1/10,n/30. Paid $1,200 for office supplies. Received payment from CP Company for sale of merchandise on December 6 . The sales price was $8,000 and the terms were 1/10, n/30. Dec 30 Sold merchandise to MU Company for $5,000 on account. The terms are 3/15,n/45. The merchandise cost $3,600. Dec 31 Purchased $5,500 of merchandise inventory from LT Company on account. The terms are 2/10,n/45. Dec 31 Received payment from BHA Company for sale of merchandise on December 26. Information for year-end adjusting entries: - On December 31, there are $1,300 of office supplies on hand - EPL borrowed the $200,000 on April 1, 2023. EPL must make annual interest payments each April 1 and pay the full note on April 1, 2025. The interest rate on the note is 7%. - Employees have earned $3,800 in wages for work done since the last payday - The prepaid rent was paid on August 1, 2023, and covers a one-year period starting on August 1, 2023. - EPL paid \$2,700 for a one-year insurance policy on February 1, 2023. Coverage began on that date. - The Building has a forty year useful life and a $20,000 salvage value. - The Equipment has an ten-year useful life and $10,000 salvage value. - EPL uses straight-line to depreciate its plant assets. - December utilities are $370 and will be paid in January - EPL estimates its bad debts at 1.5% of its sales. Check Figures: December 31 Trial Balance Debits and Credits =$1,444,070 December 31 Adjusted Trial Balance Debits and Credits =$1,494,690 Net Income =$154,685 Total Assets =$607,445 Post-Closing Trial Balance Debits and Credits =$848,795