Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EPPD1033 28. What are the appropriate adjusting entries on June 30, 2018 to record the adjustment related to the insurance payment in transaction number I?

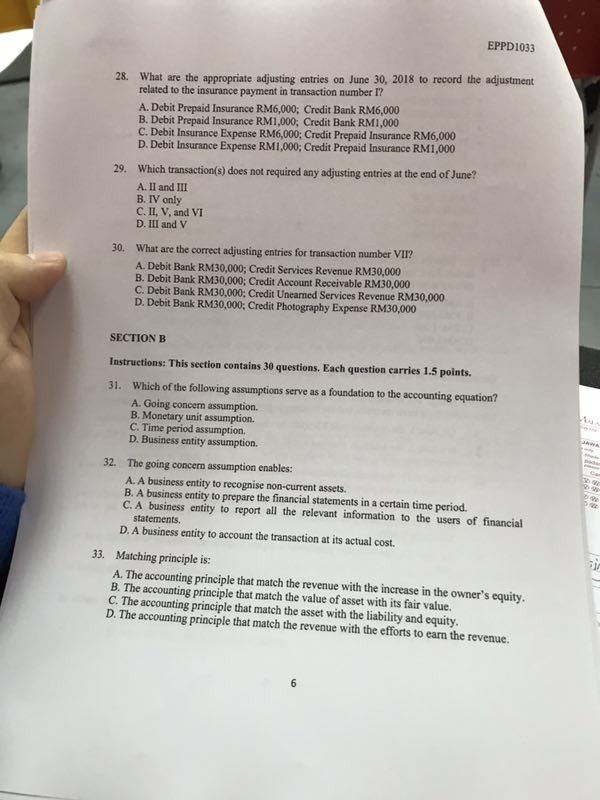

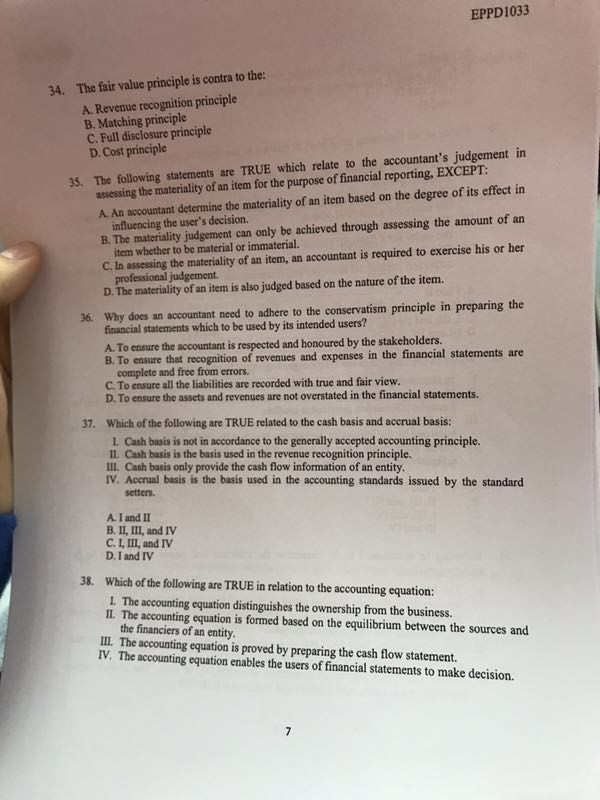

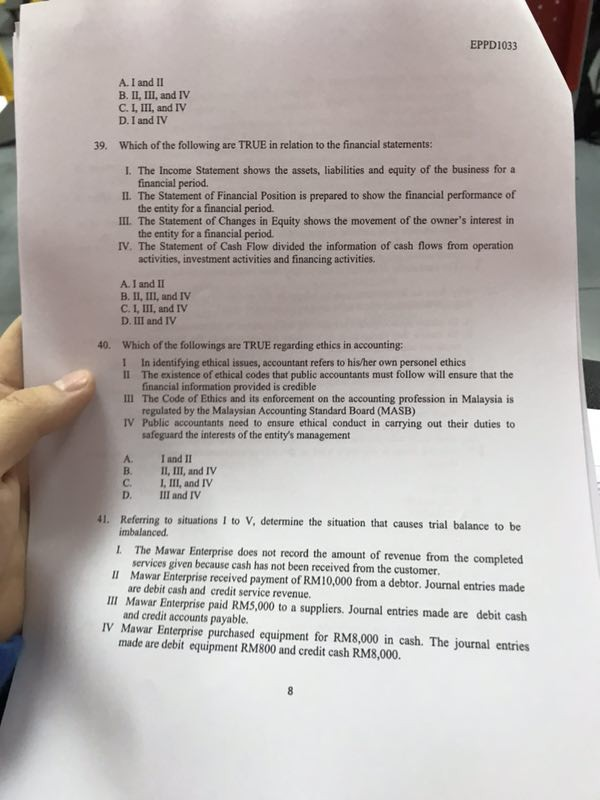

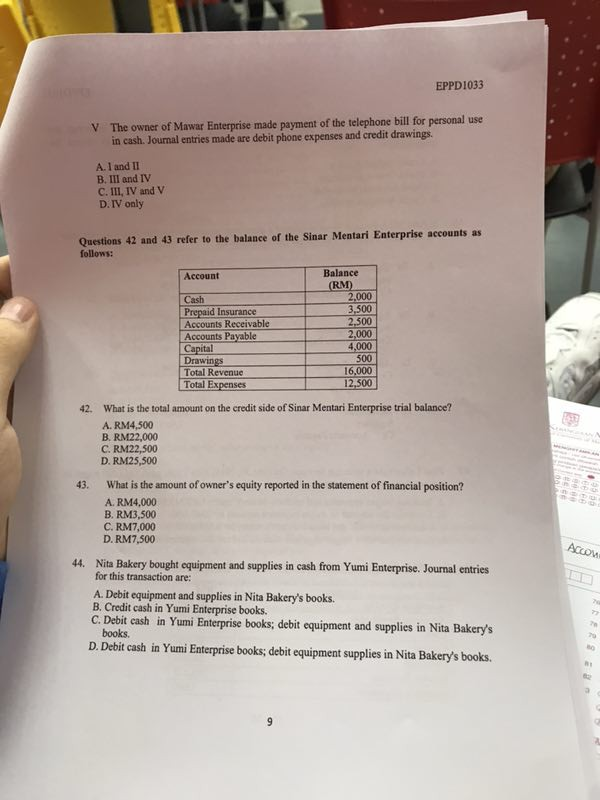

EPPD1033 28. What are the appropriate adjusting entries on June 30, 2018 to record the adjustment related to the insurance payment in transaction number I? A. Debit Prepaid Insurance RM6,000; Credit Bank RM6,000 B. Debit Prepaid Insurance RM1,000; Credit Bank RM1,000 C. Debit Insurance Expense RM6,000; Credit Prepaid Insurance RM6,000 D. Debit Insurance Expense RM1,000, Credit Prepaid Insurance RM1,000 Which transaction(s) does not required any adjusting entries at the end of June? A. II and III B. IV only C. II, V, and VI D. III and V 29. What are the correct adjusting entries for transaction number VII? A. Debit Bank RM30,000; Credit Services Revenue RM30,000 B. Debit Bank RM30,000; Credit Account Receivable RM30,000 C. Debit Bank RM30,000 Credit Unearned Services Revenue RM30,000 D. Debit Bank RM30,000: Credit Photography Expense RM30,000 30. SECTION B Instructions: This section contains 30 questions. Each question carries 1.5 points. 31. Which of the following assumptions serve as a foundation to the accounting equation? A. Going concern assumption. B. Monetary unit assumption. C. Time period assumption D. Business entity assumption. 32. The going concern assumption enables: A. A business entity to recognise non-current assets B. A business entity to prepare the financial statements in a certain time period. C. A business entity to report all the relevant information to the users of financial statements. D. A business entity to account the transaction at its actual cost. 33. Matching principle is: A. The accounting principle that match the revenue with the increase in the owner's equity B. The accounting principle that match the value of asset with its fair value. C. The accounting principle that match the asset with the liability and equity D. The accounting principle that match the revenue with the efforts to earn the revenue. EPPD1033 28. What are the appropriate adjusting entries on June 30, 2018 to record the adjustment related to the insurance payment in transaction number I? A. Debit Prepaid Insurance RM6,000; Credit Bank RM6,000 B. Debit Prepaid Insurance RM1,000; Credit Bank RM1,000 C. Debit Insurance Expense RM6,000; Credit Prepaid Insurance RM6,000 D. Debit Insurance Expense RM1,000, Credit Prepaid Insurance RM1,000 Which transaction(s) does not required any adjusting entries at the end of June? A. II and III B. IV only C. II, V, and VI D. III and V 29. What are the correct adjusting entries for transaction number VII? A. Debit Bank RM30,000; Credit Services Revenue RM30,000 B. Debit Bank RM30,000; Credit Account Receivable RM30,000 C. Debit Bank RM30,000 Credit Unearned Services Revenue RM30,000 D. Debit Bank RM30,000: Credit Photography Expense RM30,000 30. SECTION B Instructions: This section contains 30 questions. Each question carries 1.5 points. 31. Which of the following assumptions serve as a foundation to the accounting equation? A. Going concern assumption. B. Monetary unit assumption. C. Time period assumption D. Business entity assumption. 32. The going concern assumption enables: A. A business entity to recognise non-current assets B. A business entity to prepare the financial statements in a certain time period. C. A business entity to report all the relevant information to the users of financial statements. D. A business entity to account the transaction at its actual cost. 33. Matching principle is: A. The accounting principle that match the revenue with the increase in the owner's equity B. The accounting principle that match the value of asset with its fair value. C. The accounting principle that match the asset with the liability and equity D. The accounting principle that match the revenue with the efforts to earn the revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started