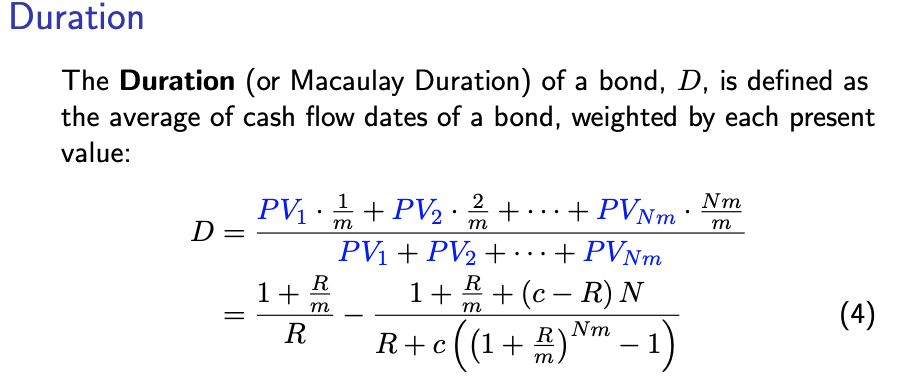

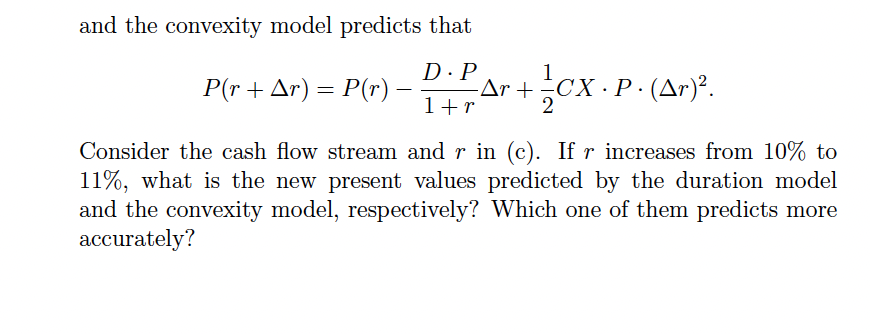

Equation 4

Equation 4

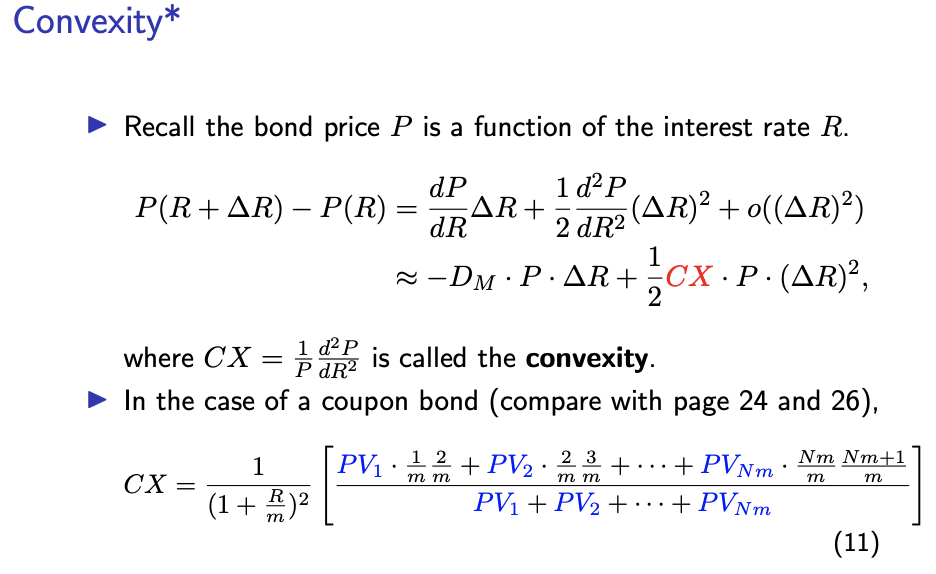

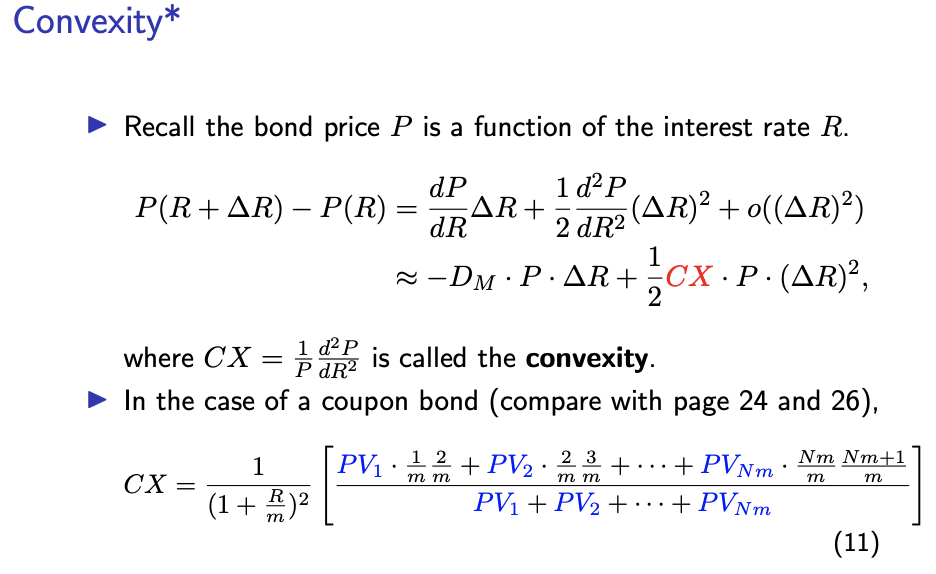

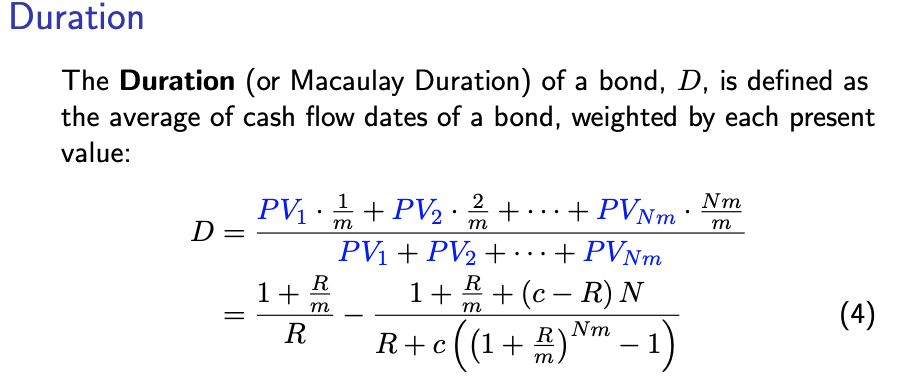

Equation 11

Equation 11

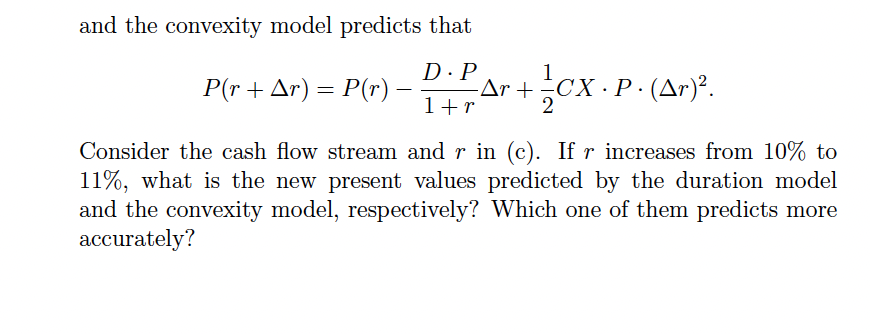

- 3. (Duration and Convexity for General Cashflow Streams) Equation (4) and (11) in the Lecture Notes 2 give the duration and convexity for the coupon bonds. This question illustrates duration and convexity calculations for general cash flow streams. Consider the n-period cash flow stream (n > 1) depicted on Page 23 of Lecture Notes 2, with Xo = 0, Ik > 0 for k=1,2,...,n-1, and xn > 0. Assume that all periods have equal length of 1 year (therefore, R=r). Denote the present value of this cash flow stream as X2 P= P(r) = + + + (1) 1+r (1 + r)2 (1+r)ni Required precision: 4 digits after decimal point. (a) The duration is defined as D = - 15 d. Find out the expression for Wk, k=1,...,n which satisfy the following conditions: Wi+W2+...+wn = 1, Wk > 0, k = 1,...,n, and X1 In - = = P dr. = - 7 D=W1:1+ W22+...+wn: n. - . = - 7 = = = = 1 (b) The convexity is defined as CX = 5d, 2. Find out the expression for wk, P dr2 k= 1, ..., n which satisfy the following conditions: Wi+w2+...+Wn=1, Wk > 0, k = 1, ..., n, and 1 CX= [w1 1:2+W2 2-3+...+wn:n(n + 1)]. 1.2 (1+r)2 (c) Now consider a 5-period cash flow stream Xi = 0, X2 = 2, X3 = 0, X4 = 0,25 = 5, with r = 10%. Calculate its present value, duration and convex- X5 ity. (d) If the interest rate changes from r to r + Ar, the present value of the cash flow stream changes from P(r) to P(r + Ar). The duration model predicts that D.P P(r + Ar) = P(r) -Ar, 1tr = = = and the convexity model predicts that D.P P(r + Ar) = P(r) Ar+-CX P. (Ar)?. cx. + 1+r Consider the cash flow stream and r in (c). If r increases from 10% to 11%, what is the new present values predicted by the duration model and the convexity model, respectively? Which one of them predicts more accurately? Duration The Duration (or Macaulay Duration) of a bond, D, is defined as the average of cash flow dates of a bond, weighted by each present value: 1 m . 2 m Nm m = PV. + PV2: + ... + PVNm: D= PV1 + PV2 + + PVNm 1+ B +(c R) N c R R+c c(( + m) - 1) 1+ R m R (4) 1 R Nm Convexity* Recall the bond price P is a function of the interest rate R. P(R+AR) P(R) = 1 d P (AR)2 +0((AR)) ~-DM P.AR+_cx . P. (AR)? dP AR+ dR 2 dR2 1 2 = where CX 1 d2P is called the convexity. PdR2 In the case of a coupon bond (compare with page 24 and 26), 1 PV1.12 + PVNm Nm Nm+1 . + PV2 23 +.. PV1 + PV2 + ... + PVNm CX m = (1 + i)2 )2 m (11) - 3. (Duration and Convexity for General Cashflow Streams) Equation (4) and (11) in the Lecture Notes 2 give the duration and convexity for the coupon bonds. This question illustrates duration and convexity calculations for general cash flow streams. Consider the n-period cash flow stream (n > 1) depicted on Page 23 of Lecture Notes 2, with Xo = 0, Ik > 0 for k=1,2,...,n-1, and xn > 0. Assume that all periods have equal length of 1 year (therefore, R=r). Denote the present value of this cash flow stream as X2 P= P(r) = + + + (1) 1+r (1 + r)2 (1+r)ni Required precision: 4 digits after decimal point. (a) The duration is defined as D = - 15 d. Find out the expression for Wk, k=1,...,n which satisfy the following conditions: Wi+W2+...+wn = 1, Wk > 0, k = 1,...,n, and X1 In - = = P dr. = - 7 D=W1:1+ W22+...+wn: n. - . = - 7 = = = = 1 (b) The convexity is defined as CX = 5d, 2. Find out the expression for wk, P dr2 k= 1, ..., n which satisfy the following conditions: Wi+w2+...+Wn=1, Wk > 0, k = 1, ..., n, and 1 CX= [w1 1:2+W2 2-3+...+wn:n(n + 1)]. 1.2 (1+r)2 (c) Now consider a 5-period cash flow stream Xi = 0, X2 = 2, X3 = 0, X4 = 0,25 = 5, with r = 10%. Calculate its present value, duration and convex- X5 ity. (d) If the interest rate changes from r to r + Ar, the present value of the cash flow stream changes from P(r) to P(r + Ar). The duration model predicts that D.P P(r + Ar) = P(r) -Ar, 1tr = = = and the convexity model predicts that D.P P(r + Ar) = P(r) Ar+-CX P. (Ar)?. cx. + 1+r Consider the cash flow stream and r in (c). If r increases from 10% to 11%, what is the new present values predicted by the duration model and the convexity model, respectively? Which one of them predicts more accurately? Duration The Duration (or Macaulay Duration) of a bond, D, is defined as the average of cash flow dates of a bond, weighted by each present value: 1 m . 2 m Nm m = PV. + PV2: + ... + PVNm: D= PV1 + PV2 + + PVNm 1+ B +(c R) N c R R+c c(( + m) - 1) 1+ R m R (4) 1 R Nm Convexity* Recall the bond price P is a function of the interest rate R. P(R+AR) P(R) = 1 d P (AR)2 +0((AR)) ~-DM P.AR+_cx . P. (AR)? dP AR+ dR 2 dR2 1 2 = where CX 1 d2P is called the convexity. PdR2 In the case of a coupon bond (compare with page 24 and 26), 1 PV1.12 + PVNm Nm Nm+1 . + PV2 23 +.. PV1 + PV2 + ... + PVNm CX m = (1 + i)2 )2 m (11)

Equation 4

Equation 4 Equation 11

Equation 11