Answered step by step

Verified Expert Solution

Question

1 Approved Answer

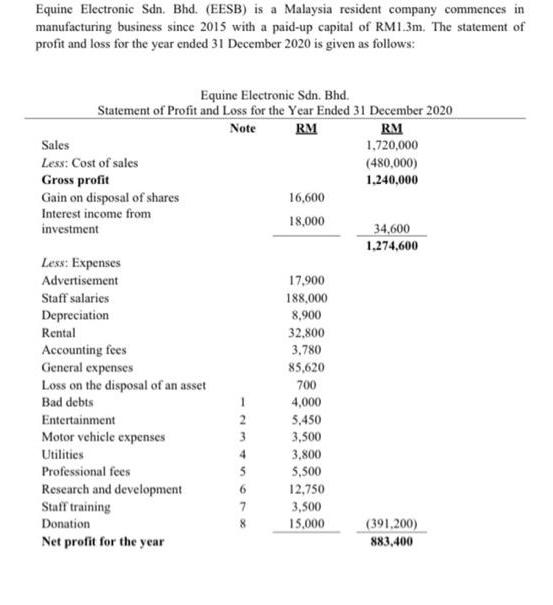

Equine Electronic Sdn. Bhd. (EESB) is a Malaysia resident company commences in manufacturing business since 2015 with a paid-up capital of RM1.3m. The statement

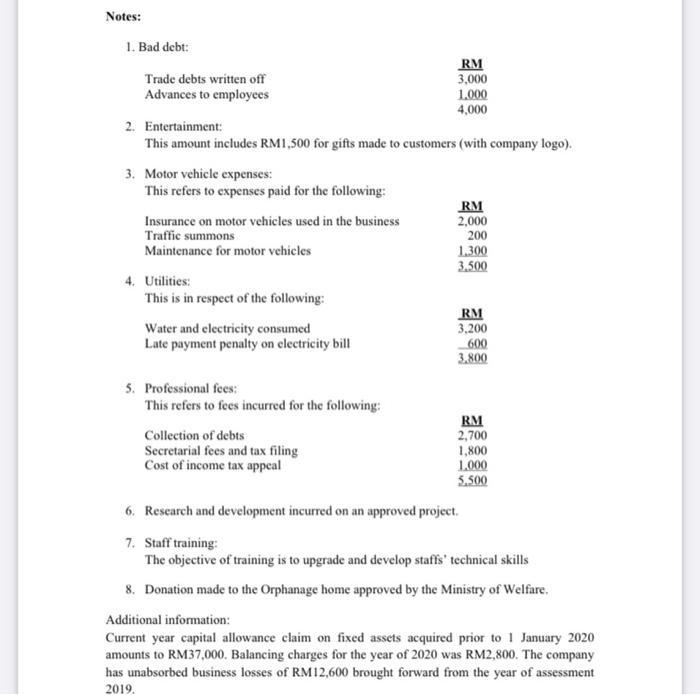

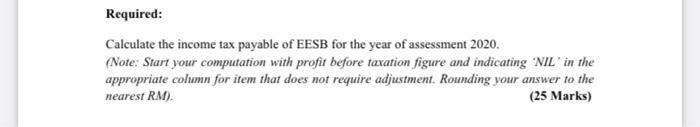

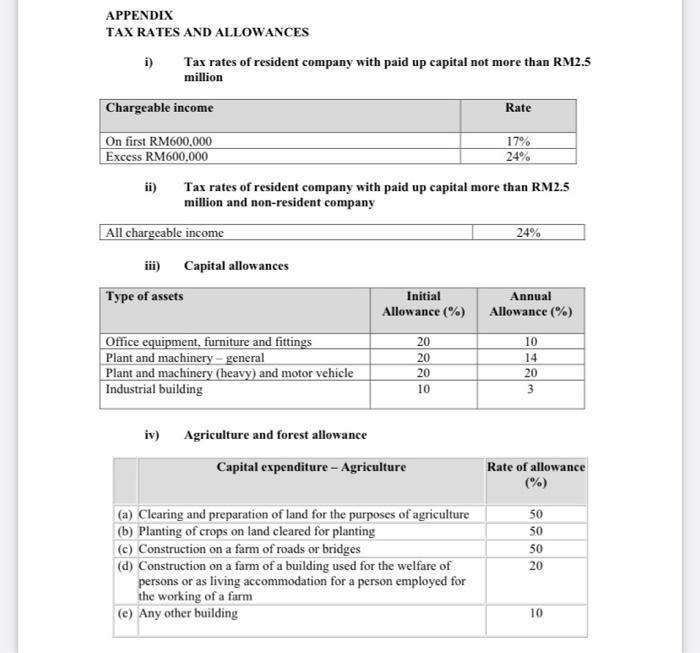

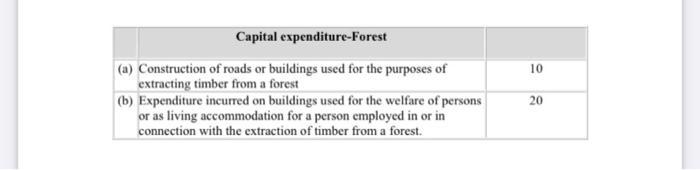

Equine Electronic Sdn. Bhd. (EESB) is a Malaysia resident company commences in manufacturing business since 2015 with a paid-up capital of RM1.3m. The statement of profit and loss for the year ended 31 December 2020 is given as follows: Equine Electronic Sdn. Bhd. Statement of Profit and Loss for the Year Ended 31 December 2020 Note RM Sales Less: Cost of sales Gross profit Gain on disposal of shares Interest income from investment Less: Expenses Advertisement Staff salaries Depreciation Rental Accounting fees General expenses Loss on the disposal of an asset Bad debts Entertainment Motor vehicle expenses Utilities Professional fees Research and development Staff training Donation Net profit for the year 4 5 6 7 8 16,600 18,000 17,900 188,000 8,900 32,800 3,780 85,620 700 4,000 5,450 3,500 3,800 5,500 12,750 3,500 15,000 RM 1,720,000 (480,000) 1,240,000 34,600 1,274,600 (391,200) 883,400 Notes: 1. Bad debt: Trade debts written off Advances to employees 2. Entertainment: This amount includes RM1,500 for gifts made to customers (with company logo). 3. Motor vehicle expenses: This refers to expenses paid for the following: Insurance on motor vehicles used in the business Traffic summons Maintenance for motor vehicles 4. Utilities: This is in respect of the following: Water and electricity consumed Late payment penalty on electricity bill 5. Professional fees: This refers to fees incurred for the following: RM 3,000 1.000 4,000 Collection of debts Secretarial fees and tax filing Cost of income tax appeal RM 2,000 200 1.300 3.500 RM 3,200 600 3.800 RM 2,700 1,800 1.000 5.500 6. Research and development incurred on an approved project. 7. Staff training: The objective of training is to upgrade and develop staffs' technical skills 8. Donation made to the Orphanage home approved by the Ministry of Welfare. Additional information: Current year capital allowance claim on fixed assets acquired prior to 1 January 2020 amounts to RM37,000. Balancing charges for the year of 2020 was RM2,800. The company has unabsorbed business losses of RM12,600 brought forward from the year of assessment 2019. Required: Calculate the income tax payable of EESB for the year of assessment 2020. (Note: Start your computation with profit before taxation figure and indicating 'NIL' in the appropriate column for item that does not require adjustment. Rounding your answer to the nearest RM). (25 Marks) APPENDIX TAX RATES AND ALLOWANCES i) Tax rates of resident company with paid up capital not more than RM2.5 million Chargeable income On first RM600,000 Excess RM600,000 ii) All chargeable income iii) Type of assets iv) Tax rates of resident company with paid up capital more than RM2.5 million and non-resident company Capital allowances Office equipment, furniture and fittings Plant and machinery - general Plant and machinery (heavy) and motor vehicle Industrial building Agriculture and forest allowance Initial Allowance (%) Capital expenditure - Agriculture 20 20 20 10 Rate (a) Clearing and preparation of land for the purposes of agriculture (b) Planting of crops on land cleared for planting (c) Construction on a farm of roads or bridges (d) Construction on a farm of a building used for the welfare of persons or as living accommodation for a person employed for the working of a farm (e) Any other building 17% 24% 24% Annual Allowance (%) 10 14 20 3 Rate of allowance (%) 50 50 50 20 10 Capital expenditure-Forest (a) Construction of roads or buildings used for the purposes of extracting timber from a forest (b) Expenditure incurred on buildings used for the welfare of persons or as living accommodation for a person employed in or in connection with the extraction of timber from a forest. 10 20

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the income tax payable for Equine Electronic Sdn Bhd EESB for the year of assessment 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started