Answered step by step

Verified Expert Solution

Question

1 Approved Answer

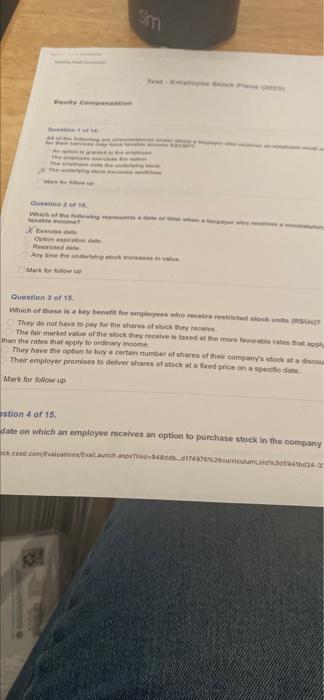

Equity Compensation 3000 sm Question 1 of 15. All of the following are circumst for their services may have taxable income EXCEPT X Exercise date.

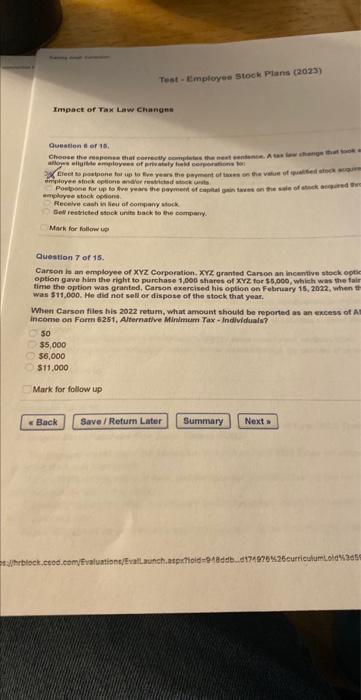

Equity Compensation 3000 sm Question 1 of 15. All of the following are circumst for their services may have taxable income EXCEPT X Exercise date. Test-Employee Stock Pins (2023) An option is granted to the employee. The employee exercises the option. Question 2 of 15. taxable income? Which of the following represents a date or time when a taxpayer who receives a nonstatutory The employee sells the underlying stock. The underlying stock becomes worthless. Mark for follow up 31 Option expiration date. Restricted date. Any time the underlying stock increases in value. Mark for follow up Mark for follow up Question 3 of 15. Which of these is a key benefit for employees who receive restricted stock units (RSUs)? They do not have to pay for the shares of stock they receive. than the rates that apply to ordinary income. The fair market value of the stock they receive is taxed at the more favorable rates that apply They have the option to buy a certain number of shares of their company's stock at a discou Their employer promises to deliver shares of stock at a fixed price on a specific date. estion 4 of 15. date on which an employee receives an option to purchase stock in the company ock.csod.com/Evaluations/EvalLaunch.aspx?loid=948ddb...d174976%26curriculum Lold%3d5941bd24-32

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started