Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Equity in Net Income and Noncontrolling Interest in Net Income At the beginning of the current year, Packwild Tours Inc. acquired 60 percent of

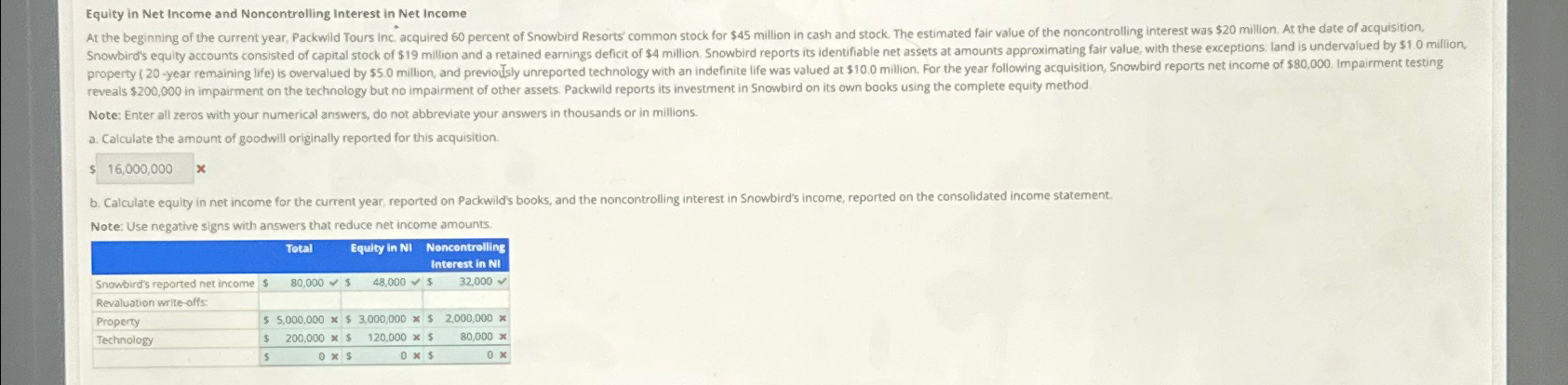

Equity in Net Income and Noncontrolling Interest in Net Income At the beginning of the current year, Packwild Tours Inc. acquired 60 percent of Snowbird Resorts' common stock for $45 million in cash and stock. The estimated fair value of the noncontrolling interest was $20 million. At the date of acquisition, Snowbird's equity accounts consisted of capital stock of $19 million and a retained earnings deficit of $4 million. Snowbird reports its identifiable net assets at amounts approximating fair value, with these exceptions. land is undervalued by $1.0 million, property (20-year remaining life) is overvalued by $5.0 million, and previously unreported technology with an indefinite life was valued at $10.0 million. For the year following acquisition, Snowbird reports net income of $80,000. Impairment testing reveals $200,000 in impairment on the technology but no impairment of other assets. Packwild reports its investment in Snowbird on its own books using the complete equity method Note: Enter all zeros with your numerical answers, do not abbreviate your answers in thousands or in millions. a. Calculate the amount of goodwill originally reported for this acquisition. $16,000,000 b. Calculate equity in net income for the current year, reported on Packwild's books, and the noncontrolling interest in Snowbird's income, reported on the consolidated income statement. Note: Use negative signs with answers that reduce net income amounts. Equity in NI Noncontrolling Interest in NI Total Snowbird's reported net income $ 80,000 $ 48,000 $ 32,000 Revaluation write-offs: Property $ 5,000,000 x $ 3,000,000 x $ 2,000,000 x Technology $ $ 200,000 x $ 0 x $ 120,000 x $ 0 * $ 80,000 x 0x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started