Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Equity Method Homework On January 1, 2022, Rudy Company acquired 40% of the common stock of Beau Company for $420,000 in cash. Beau's owners'

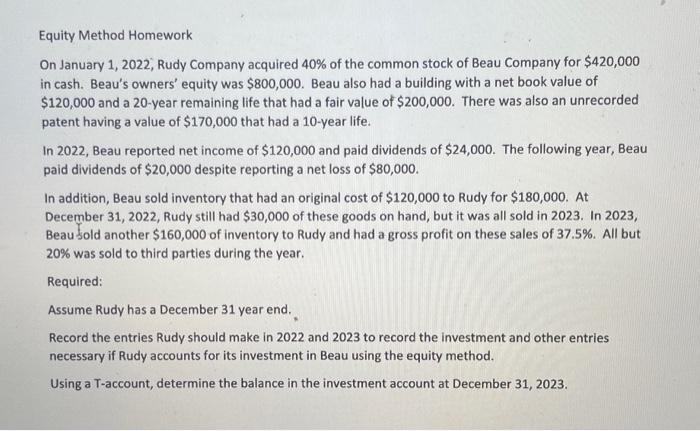

Equity Method Homework On January 1, 2022, Rudy Company acquired 40% of the common stock of Beau Company for $420,000 in cash. Beau's owners' equity was $800,000. Beau also had a building with a net book value of $120,000 and a 20-year remaining life that had a fair value of $200,000. There was also an unrecorded patent having a value of $170,000 that had a 10-year life. In 2022, Beau reported net income of $120,000 and paid dividends of $24,000. The following year, Beau paid dividends of $20,000 despite reporting a net loss of $80,000. In addition, Beau sold inventory that had an original cost of $120,000 to Rudy for $180,000. At December 31, 2022, Rudy still had $30,000 of these goods on hand, but it was all sold in 2023. In 2023, Beau sold another $160,000 of inventory to Rudy and had a gross profit on these sales of 37.5%. All but 20% was sold to third parties during the year. Required: Assume Rudy has a December 31 year end. Record the entries Rudy should make in 2022 and 2023 to record the investment and other entries necessary if Rudy accounts for its investment in Beau using the equity method. Using a T-account, determine the balance in the investment account at December 31, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This question requires you to record entries for investments using the equity method and to calculate the balance of the investment at the end of a sp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started