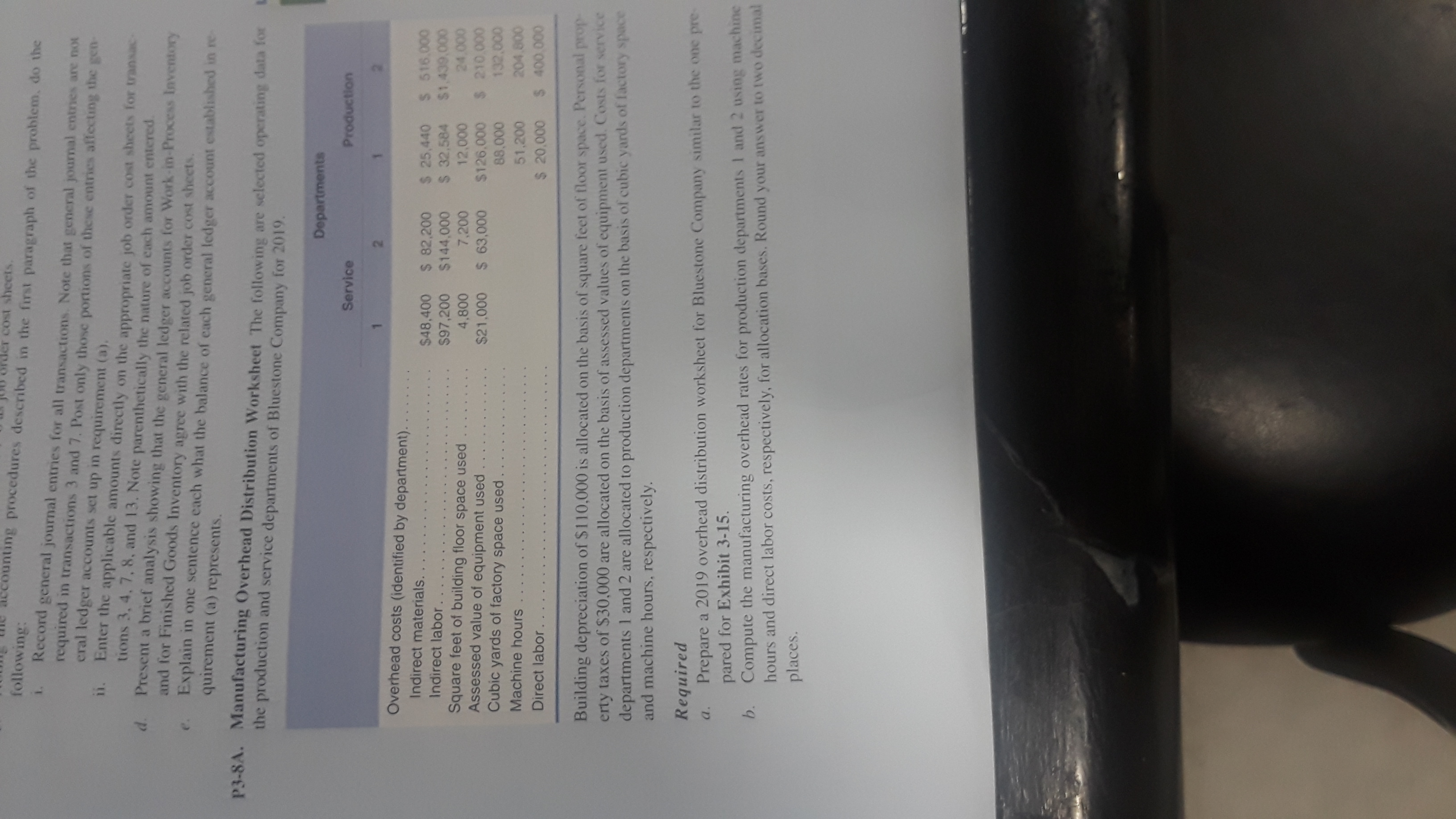

er cost sheets. following: counting procedures described in the first paragraph of the problem, do the Record general journal entries for all transactions. Note that general journal entries are not required in transactions 3 and 7. Post only those portions of these entries affecting the gen eral ledger accounts set up in requirement (a). Enter the applicable amounts directly on the appropriate job order cost sheets for transac tions 3, 4. 7, 8, and 13. Note parenthetically the nature of each amount entered Present a brief analysis showing that the general ledger accounts for Work- in-Process Inventory and for Finished Goods Inventory agree with the related job order cost sheets. Explain in one sentence each what the balance of each general ledger account established in re quirement (a) represents P3-8A. Manufacturing Overhead Distribution Worksheet The following are selected operating data for the production and service departments of Bluestone Company for 2019. Departments Service Production Overhead costs (identified by department). . ... Indirect materials. ... $48.400 $ 82.200 $ 25,440 $ 516.000 Indirect labor . .. $97,200 $144,000 $ 32,584 $1,439,000 Square feet of building floor space used . ....... 4.800 7,200 12,000 24,000 Assessed value of equipment used $21,000 $ 63,000 $126,000 $ 210.000 Cubic yards of factory space used .. 88,000 132.000 Machine hours 51,200 204.800 Direct labor . ............ .. . . .... $ 20,000 $ 400.000 Building depreciation of $1 10,000 is allocated on the basis of square feet of floor space. Personal prop- erty taxes of $30,000 are allocated on the basis of assessed values of equipment used. Costs for service departments 1 and 2 are allocated to production departments on the basis of cubic yards of factory space and machine hours, respectively Required a. Prepare a 2019 overhead distribution worksheet for Bluestone Company similar to the one pre- pared for Exhibit 3-15 Compute the manufacturing overhead rates for production departments 1 and 2 using machine hours and direct labor costs, respectively, for allocation bases. Round your answer to two decimal places