Answered step by step

Verified Expert Solution

Question

1 Approved Answer

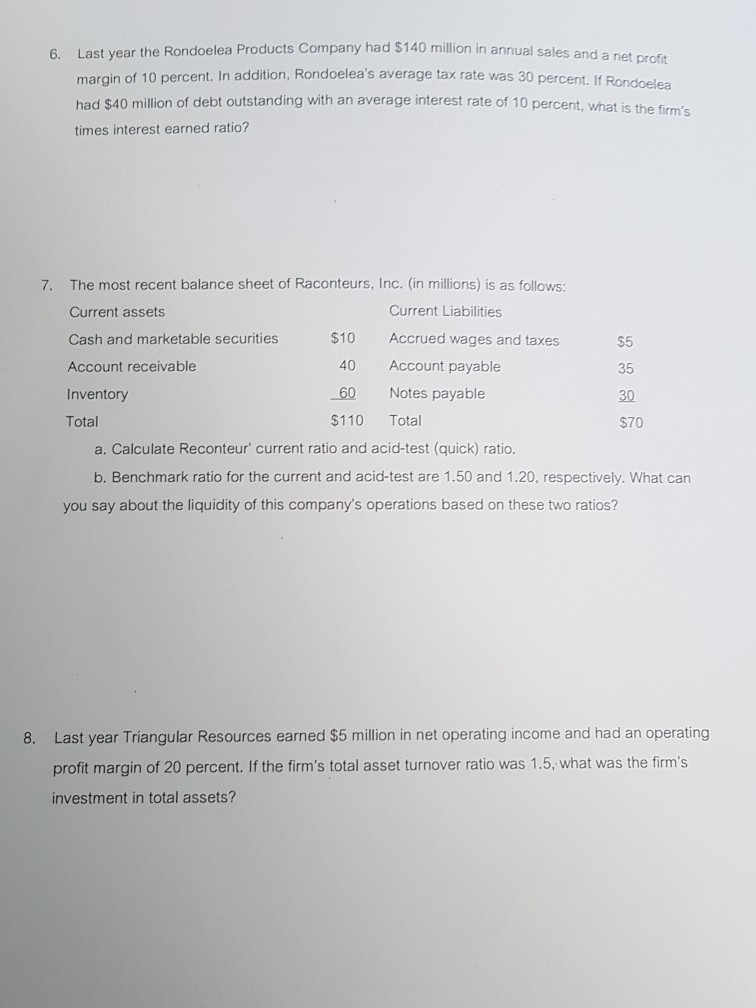

erage tax rate was 30 percent. If Rondoelea 6. Last year the Rondoelea Products Company had $140 million in annus doelea Products Company had $140

erage tax rate was 30 percent. If Rondoelea 6. Last year the Rondoelea Products Company had $140 million in annus doelea Products Company had $140 million in annual sales and a net profit margin of 10 percent. In addition, Rondoelea's average tax rate was 30 percent had $40 million of debt outstanding with an average interest rate of 10 percent what times interest earned ratio? 7. The most recent balance sheet of Raconteurs, Inc. (in millions) is as follows: Current assets Current Liabilities Cash and marketable securities $10 Accrued wages and taxes Account receivable 40 Account payable Inventory 60 Notes payable Total $110 Total a. Calculate Reconteur' current ratio and acid-test (quick) ratio. b. Benchmark ratio for the current and acid-test are 1.50 and 1.20, respectively. What can you say about the liquidity of this company's operations based on these two ratios? 8. Last year Triangular Resources earned $5 million in net operating income and had an operating profit margin of 20 percent. If the firm's total asset turnover ratio was 1.5, what was the firm's investment in total assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started