Erdemir is a Turkish crude steel producer with a 47% debt-to-value ratio (D/V) and a 9% cost of equity. Its debt is now yielding

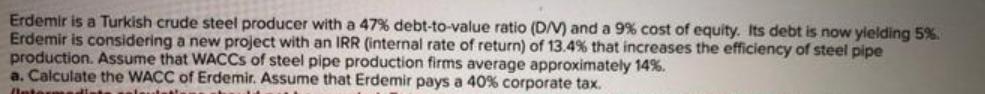

Erdemir is a Turkish crude steel producer with a 47% debt-to-value ratio (D/V) and a 9% cost of equity. Its debt is now yielding 5%. Erdemir is considering a new project with an IRR (internal rate of return) of 13.4% that increases the efficiency of steel pipe production. Assume that WACCs of steel pipe production firms average approximately 14%. a. Calculate the WACC of Erdemir. Assume that Erdemir pays a 40 % corporate tax. (intermediate selsuts b. Assume that Erdemir will discount the project cash flows at the firm's WACC? Would it be a correct decision to make? c. Should Erdemir accept the new project?

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The WACC of Erdemir can be calculated using the following formula WACC EV ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started