Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eric and Chrissy file a joint tax return. During the year, they had to relocate from Dallas to Houston because of Chrissy's job as a

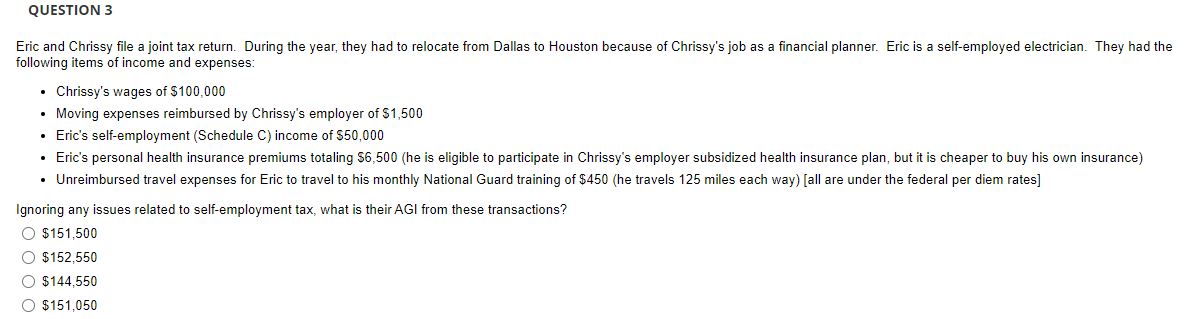

Eric and Chrissy file a joint tax return. During the year, they had to relocate from Dallas to Houston because of Chrissy's job as a financial planner. Eric is a self-employed electrician. They had the following items of income and expenses: - Chrissy's wages of $100,000 - Moving expenses reimbursed by Chrissy's employer of $1,500 - Eric's self-employment (Schedule C) income of $50,000 - Eric's personal health insurance premiums totaling $6,500 (he is eligible to participate in Chrissy's employer subsidized health insurance plan, but it is cheaper to buy his own insurance) - Unreimbursed travel expenses for Eric to travel to his monthly National Guard training of $450 (he travels 125 miles each way) [all are under the federal per diem rates] Ignoring any issues related to self-employment tax, what is their AGl from these transactions? $151,500$152,550$144,550$151,050

Eric and Chrissy file a joint tax return. During the year, they had to relocate from Dallas to Houston because of Chrissy's job as a financial planner. Eric is a self-employed electrician. They had the following items of income and expenses: - Chrissy's wages of $100,000 - Moving expenses reimbursed by Chrissy's employer of $1,500 - Eric's self-employment (Schedule C) income of $50,000 - Eric's personal health insurance premiums totaling $6,500 (he is eligible to participate in Chrissy's employer subsidized health insurance plan, but it is cheaper to buy his own insurance) - Unreimbursed travel expenses for Eric to travel to his monthly National Guard training of $450 (he travels 125 miles each way) [all are under the federal per diem rates] Ignoring any issues related to self-employment tax, what is their AGl from these transactions? $151,500$152,550$144,550$151,050 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started