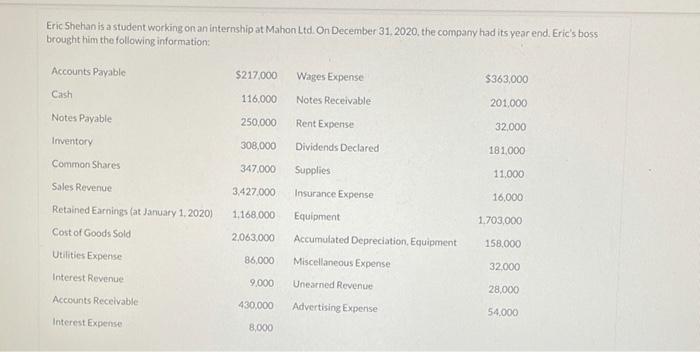

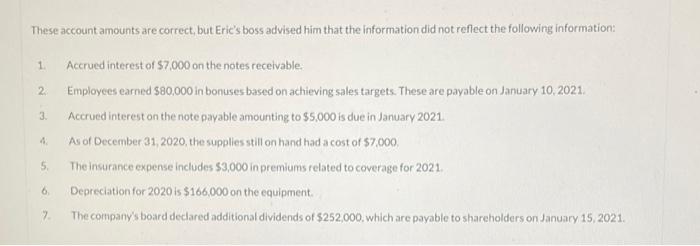

Eric Shehan is a student working on an internship at Mahon Ltd. On December 31, 2020, the company hadits year end. Eric's boss brought him the following information: Accounts Payable $217,000 $363,000 Cash Wages Expense Notes Receivable 116,000 201,000 Notes Payable 250,000 Rent Expense 32.000 Inventory 308,000 Dividends Declared 181000 Common Shares 347.000 Supplies 11,000 Sales Revenue 3.427.000 Insurance Expense 16,000 Retained Earnings (at January 1, 2020) 1.168.000 Equipment 1.703,000 Cost of Goods Sold 2,063.000 Accumulated Depreciation Equipment 158,000 Utilities Expense 86.000 Miscellaneous Expense 32.000 Interest Revenue 9,000 Unearned Revenue 28,000 Accounts Receivable 430,000 Advertising Expense 54000 Interest Expense 8.000 These account amounts are correct, but Eric's boss advised him that the information did not reflect the following information: 1 2 3 4 Accrued interest of $7,000 on the notes receivable Employees earned $80,000 in bonuses based on achieving sales targets. These are payable on January 10, 2021 Accrued interest on the note payable amounting to $5,000 is due in January 2021 As of December 31, 2020, the supplies still on hand had a cost of 57.000 The Insurance expense includes $3,000 in premiums related to coverage for 2021 Depreciation for 2020 is $166,000 on the equipment The company's board declared additional dividends of $252,000 which are payable to shareholders on January 15, 2021. 5 6 2 Determine the amounts that would appear in an adjusted trial balance for Mahon Ltd as at December 31, 2020, Mahon Ltd. Adjusted Trial Balance December 31, 2020 Debits Credits Prepare a statement of income for the year ended December 31, 2020, Mahon Ltd. Statement of Income Calculate the amount of retained earnings as at December 31, 2020, Ending retained earnings, Dec 31, 2020 $ Prepare a classified statement of financial position as at December 31, 2020. (Note: The note receivable and note payable are due In 2021.) (Last Current Assets in order of liquidity) Mahon Ltd. Statement of Financial Position Assets Uabilities and Shareholders' Equity