Question

Eric transferred land worth 245,000 (basis of 145,000) and cash of 50000 in exchange for a 40% INTEREST IN A PARTNER SHIP. SARA OWNS

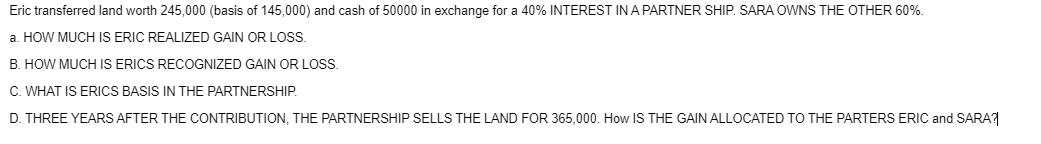

Eric transferred land worth 245,000 (basis of 145,000) and cash of 50000 in exchange for a 40% INTEREST IN A PARTNER SHIP. SARA OWNS THE OTHER 60%. a. HOW MUCH IS ERIC REALIZED GAIN OR LOSS. B. HOW MUCH IS ERICS RECOGNIZED GAIN OR LOSS. C. WHAT IS ERICS BASIS IN THE PARTNERSHIP. D. THREE YEARS AFTER THE CONTRIBUTION, THE PARTNERSHIP SELLS THE LAND FOR 365,000. How IS THE GAIN ALLOCATED TO THE PARTERS ERIC and SARA?

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Given Eric transfers land with a fair market value of 245000 basis of 145000 and cash of 50000 in ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Precalculus

Authors: Michael Sullivan

9th edition

321716835, 321716833, 978-0321716835

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App