Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eric Wright conducts a dry cleaning business as a sole proprietorship. The business operates in a building that Eric owns. Last year, Eric mortgaged for

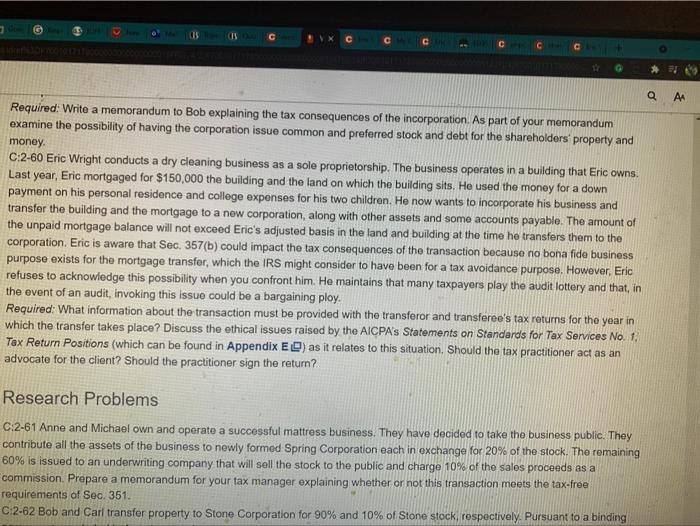

Eric Wright conducts a dry cleaning business as a sole proprietorship. The business operates in a building that Eric owns. Last year, Eric mortgaged for $150,000 the building and the land on which the building sits. He used the money for a down payment on his personal residence and college expenses for his two children. He now wants to incorporate his business and transfer the building and the mortgage to a new corporation, along with other assets and some accounts payable. The amount of the unpaid mortgage balance will not exceed Erics adjusted basis in the land and building at the time he transfers them to the corporation. Eric is aware that Sec. 357(b) could impact the tax consequences of the transaction because no bona fide business purpose exists for the mortgage transfer, which the IRS might consider to have been for a tax avoidance purpose. However, Eric refuses to acknowledge this possibility when you confront him. He maintains that many taxpayers play the audit lottery and that, in the event of an audit, invoking this issue could be a bargaining ploy.

Required: What information about the transaction must be provided with the transferor and transferees tax returns for the year in which the transfer takes place? Discuss the ethical issues raised by the AICPAs Statements on Standards for Tax Services No. 1, Tax Return Positions (which can be found in Appendix E) as it relates to this situation. Should the tax practitioner act as an advocate for the client? Should the practitioner sign the return?

For statement on standard for tax service no.1 follow the link

ES CIS C Q AM Required: Write a memorandum to Bob explaining the tax consequences of the incorporation. As part of your memorandum examine the possibility of having the corporation issue common and preferred stock and debt for the shareholders' property and money C:2-60 Eric Wright conducts a dry cleaning business as a sole proprietorship. The business operates in a building that Eric owns. Last year, Eric mortgaged for $150,000 the building and the land on which the building sits. He used the money for a down payment on his personal residence and college expenses for his two children. He now wants to incorporate his business and transfer the building and the mortgage to a new corporation, along with other assets and some accounts payable. The amount of the unpaid mortgage balance will not exceed Eric's adjusted basis in the land and building at the time he transfers them to the corporation. Eric is aware that Sec. 357(b) could impact the tax consequences of the transaction because no bona fide business purpose exists for the mortgage transfer, which the IRS might consider to have been for a tax avoidance purpose. However, Eric refuses to acknowledge this possibility when you confront him. He maintains that many taxpayers play the audit lottery and that, in the event of an audit, invoking this issue could be a bargaining ploy. Required: What information about the transaction must be provided with the transferor and transferee's tax returns for the year in which the transfer takes place? Discuss the ethical issues raised by the AICPA's Statements on Standards for Tax Services No. 1, Tax Return Positions (which can be found in Appendix EO) as it relates to this situation. Should the tax practitioner act as an advocate for the client? Should the practitioner sign the return? Research Problems C:2-61 Anne and Michael own and operate a successful mattress business. They have decided to take the business public. They contribute all the assets of the business to newly formed Spring Corporation each in exchange for 20% of the stock. The remaining 60% is issued to an underwriting company that will sell the stock to the public and charge 10% of the sales proceeds as a commission. Prepare a memorandum for your tax manager explaining whether or not this transaction meets the tax-free requirements of Sec. 351. C:2-62 Bob and Carl transfer property to Stone Corporation for 90% and 10% of Stone stock, respectively. Pursuant to a binding ES CIS C Q AM Required: Write a memorandum to Bob explaining the tax consequences of the incorporation. As part of your memorandum examine the possibility of having the corporation issue common and preferred stock and debt for the shareholders' property and money C:2-60 Eric Wright conducts a dry cleaning business as a sole proprietorship. The business operates in a building that Eric owns. Last year, Eric mortgaged for $150,000 the building and the land on which the building sits. He used the money for a down payment on his personal residence and college expenses for his two children. He now wants to incorporate his business and transfer the building and the mortgage to a new corporation, along with other assets and some accounts payable. The amount of the unpaid mortgage balance will not exceed Eric's adjusted basis in the land and building at the time he transfers them to the corporation. Eric is aware that Sec. 357(b) could impact the tax consequences of the transaction because no bona fide business purpose exists for the mortgage transfer, which the IRS might consider to have been for a tax avoidance purpose. However, Eric refuses to acknowledge this possibility when you confront him. He maintains that many taxpayers play the audit lottery and that, in the event of an audit, invoking this issue could be a bargaining ploy. Required: What information about the transaction must be provided with the transferor and transferee's tax returns for the year in which the transfer takes place? Discuss the ethical issues raised by the AICPA's Statements on Standards for Tax Services No. 1, Tax Return Positions (which can be found in Appendix EO) as it relates to this situation. Should the tax practitioner act as an advocate for the client? Should the practitioner sign the return? Research Problems C:2-61 Anne and Michael own and operate a successful mattress business. They have decided to take the business public. They contribute all the assets of the business to newly formed Spring Corporation each in exchange for 20% of the stock. The remaining 60% is issued to an underwriting company that will sell the stock to the public and charge 10% of the sales proceeds as a commission. Prepare a memorandum for your tax manager explaining whether or not this transaction meets the tax-free requirements of Sec. 351. C:2-62 Bob and Carl transfer property to Stone Corporation for 90% and 10% of Stone stock, respectively. Pursuant to a binding https://future.aicpa.org/resources/article/statement-on-standards-for-tax-services-no-1-tax-return-positions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started