Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Erica, Deana & Tara had average capital balances of $350,000, $380,000 and $400,000 respectively during the current fiscal year. The partnership agreement provides for

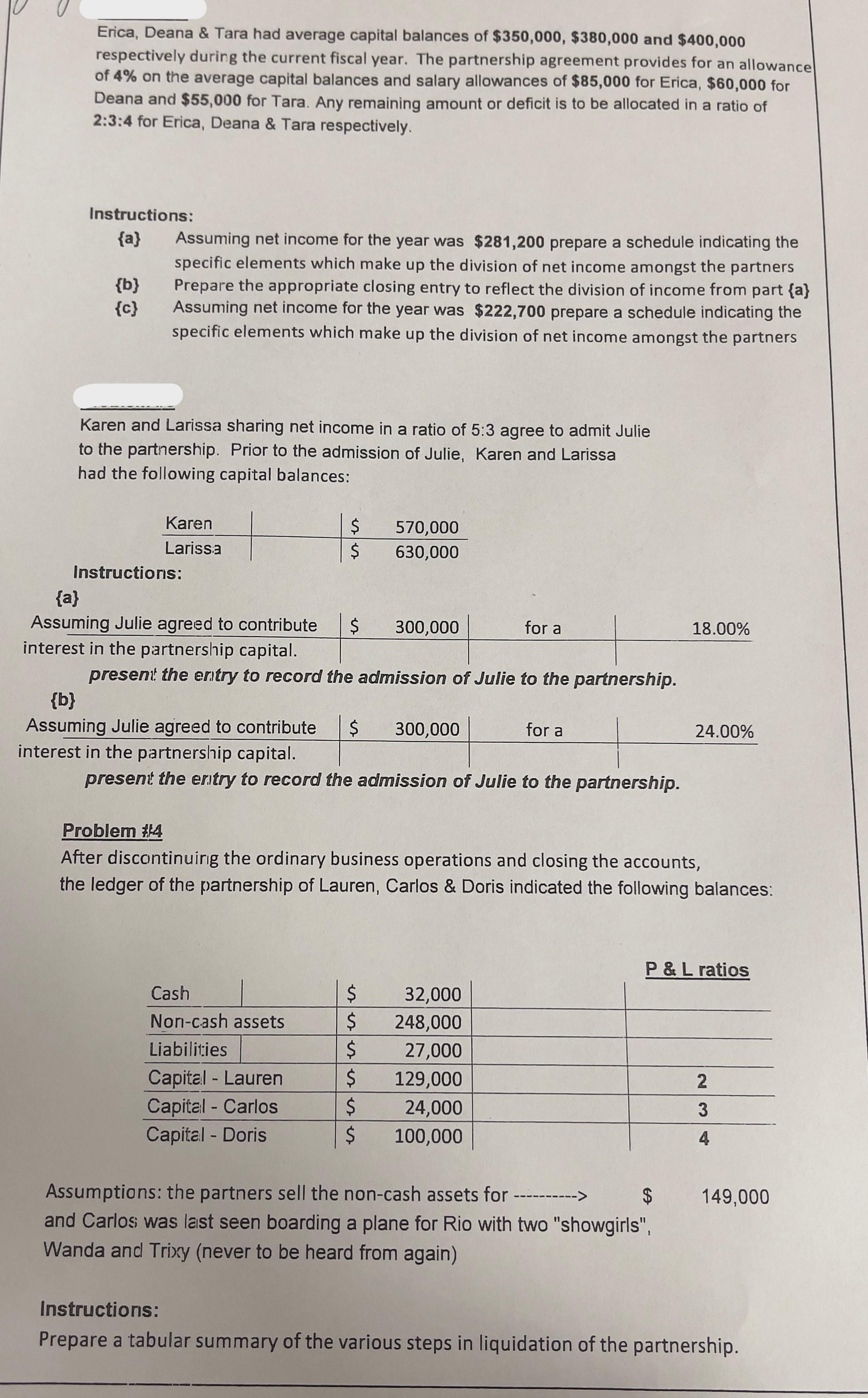

Erica, Deana & Tara had average capital balances of $350,000, $380,000 and $400,000 respectively during the current fiscal year. The partnership agreement provides for an allowance of 4% on the average capital balances and salary allowances of $85,000 for Erica, $60,000 for Deana and $55,000 for Tara. Any remaining amount or deficit is to be allocated in a ratio of 2:3:4 for Erica, Deana & Tara respectively. Instructions: {a} {b} {c} Assuming net income for the year was $281,200 prepare a schedule indicating the specific elements which make up the division of net income amongst the partners Prepare the appropriate closing entry to reflect the division of income from part {a} Assuming net income for the year was $222,700 prepare a schedule indicating the specific elements which make up the division of net income amongst the partners Karen and Larissa sharing net income in a ratio of 5:3 agree to admit Julie to the partnership. Prior to the admission of Julie, Karen and Larissa had the following capital balances: Karen Larissa Instructions: {a} SS $ 570,000 $ 630,000 Assuming Julie agreed to contribute $ 300,000 interest in the partnership capital. for a 18.00% present the entry to record the admission of Julie to the partnership. {b} Assuming Julie agreed to contribute $ 300,000 for a 24.00% interest in the partnership capital. present the entry to record the admission of Julie to the partnership. Problem #4 After discontinuing the ordinary business operations and closing the accounts, the ledger of the partnership of Lauren, Carlos & Doris indicated the following balances: P & L ratios Cash Non-cash assets Liabilities SSS $ 32,000 $ 248,000 $ 27,000 Capital - Lauren $ 129,000 Capital - Carlos $ 24,000 Capital - Doris $ 100,000 2 3 4 Assumptions: the partners sell the non-cash assets for ----------> $ 149,000 and Carlos was last seen boarding a plane for Rio with two "showgirls", Wanda and Trixy (never to be heard from again) Instructions: Prepare a tabular summary of the various steps in liquidation of the partnership.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started