Question

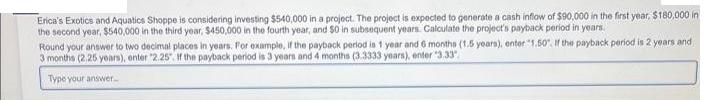

Erica's Exotics and Aquatics Shoppe is considering investing $540,000 in a project. The project is expected to generate a cash inflow of $90,000 in

Erica's Exotics and Aquatics Shoppe is considering investing $540,000 in a project. The project is expected to generate a cash inflow of $90,000 in the first year, $180,000 in the second year, $540,000 in the third year, $450,000 in the fourth year, and $0 in subsequent years. Calculate the project's payback period in years. Round your answer to two decimal places in years. For example, if the payback period is 1 year and 6 months (1.5 years), enter "1.50". If the payback period is 2 years and 3 months (2.25 years), enter 2.25". If the payback period is 3 years and 4 months (3.3333 years), enter 3.33 Type your answer.....

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Payback period InvestmentAnnua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting A Focus on Ethical Decision Making

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins

5th edition

324663854, 978-0324663853

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App