Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Erin's grandmother gave her some money as a gift, with the instructions that Erin was to invest the money to save for her education.

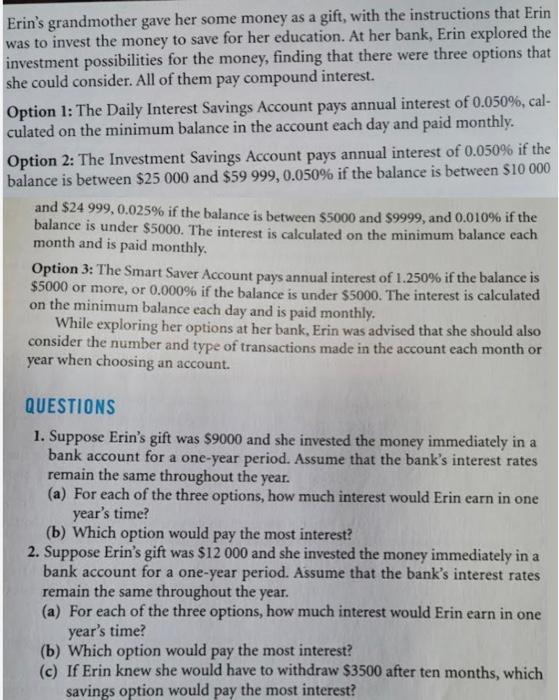

Erin's grandmother gave her some money as a gift, with the instructions that Erin was to invest the money to save for her education. At her bank, Erin explored the investment possibilities for the money, finding that there were three options that she could consider. All of them pay compound interest. Option 1: The Daily Interest Savings Account pays annual interest of 0.050%, cal- culated on the minimum balance in the account each day and paid monthly. Option 2: The Investment Savings Account pays annual interest of 0.050% if the balance is between $25 000 and $59 999, 0.050 % if the balance is between $10 000 and $24 999, 0.025% if the balance is between $5000 and $9999, and 0.010% if the balance is under $5000. The interest is calculated on the minimum balance each month and is paid monthly. Option 3: The Smart Saver Account pays annual interest of 1.250% if the balance is $5000 or more, or 0.000% if the balance is under $5000. The interest is calculated on the minimum balance each day and is paid monthly. While exploring her options at her bank, Erin was advised that she should also consider the number and type of transactions made in the account each month or year when choosing an account. QUESTIONS 1. Suppose Erin's gift was $9000 and she invested the money immediately in a bank account for a one-year period. Assume that the bank's interest rates remain the same throughout the year. (a) For each of the three options, how much interest would Erin earn in one year's time? (b) Which option would pay the most interest? 2. Suppose Erin's gift was $12 000 and she invested the money immediately in a bank account for a one-year period. Assume that the bank's interest rates remain the same throughout the year. (a) For each of the three options, how much interest would Erin earn in one year's time? (b) Which option would pay the most interest? (c) If Erin knew she would have to withdraw $3500 after ten months, which savings option would pay the most interest?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started