Answered step by step

Verified Expert Solution

Question

1 Approved Answer

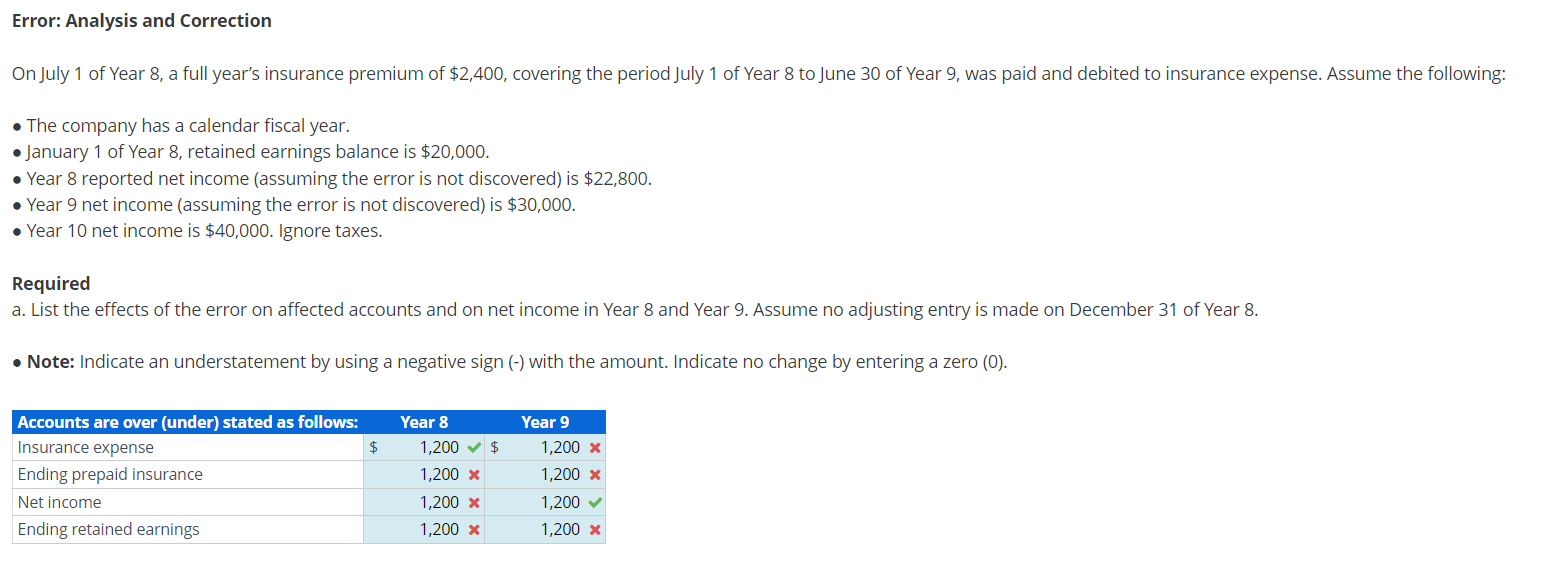

Error: Analysis and Correction On July 1 of Year 8, a full year's insurance premium of $2,400, covering the period July 1 of Year

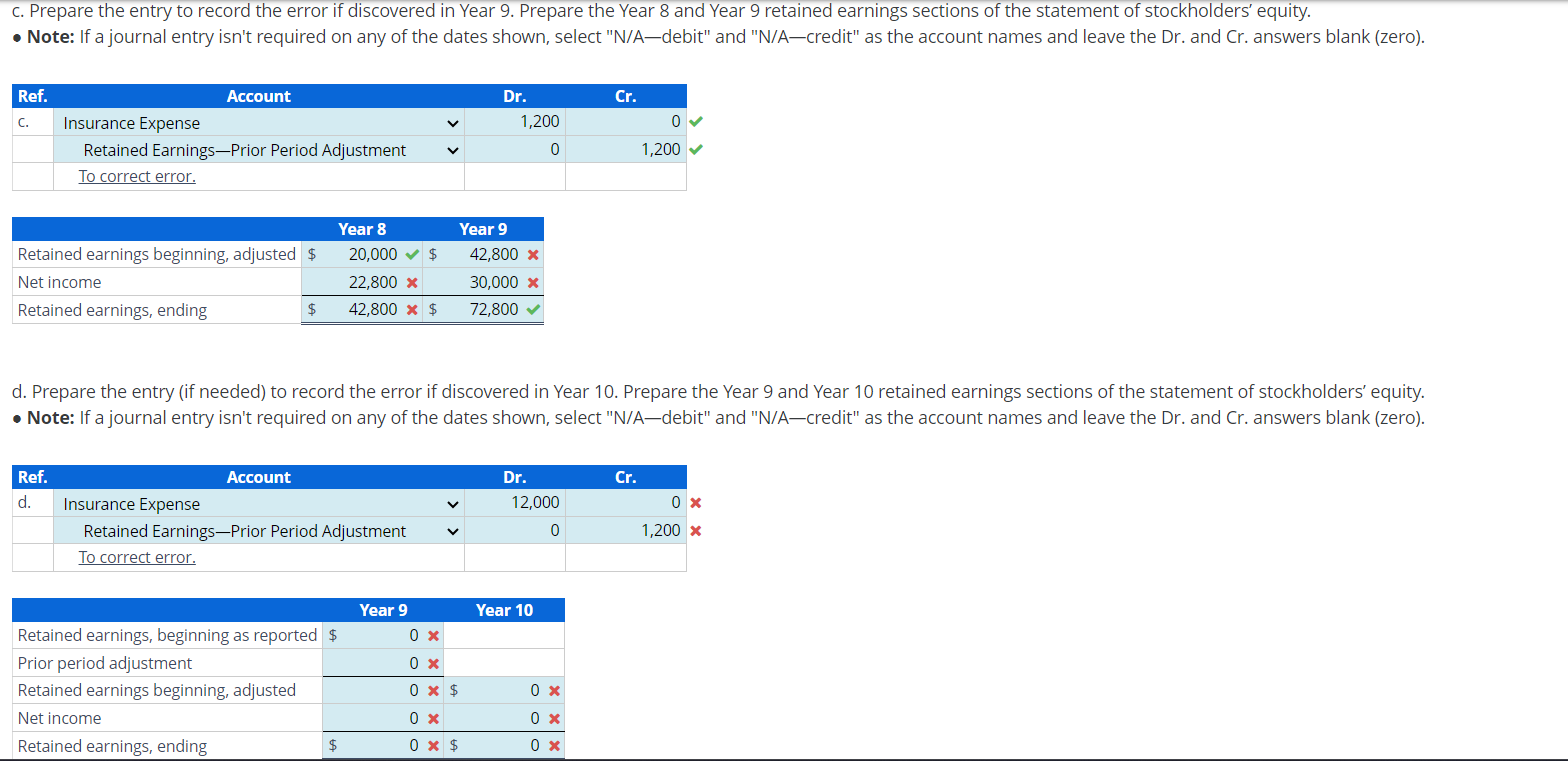

Error: Analysis and Correction On July 1 of Year 8, a full year's insurance premium of $2,400, covering the period July 1 of Year 8 to June 30 of Year 9, was paid and debited to insurance expense. Assume the following: The company has a calendar fiscal year. January 1 of Year 8, retained earnings balance is $20,000. Year 8 reported net income (assuming the error is not discovered) is $22,800. Year 9 net income (assuming the error is not discovered) is $30,000. Year 10 net income is $40,000. Ignore taxes. Required a. List the effects of the error on affected accounts and on net income in Year 8 and Year 9. Assume no adjusting entry is made on December 31 of Year 8. Note: Indicate an understatement by using a negative sign (-) with the amount. Indicate no change by entering a zero (0). Accounts are over (under) stated as follows: Year 8 Insurance expense $ 1,200 $ Ending prepaid insurance 1,200 x Year 9 1,200 x 1,200 x Net income 1,200 x Ending retained earnings 1,200 x 1,200 1,200 x c. Prepare the entry to record the error if discovered in Year 9. Prepare the Year 8 and Year 9 retained earnings sections of the statement of stockholders' equity. Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/A-credit" as the account names and leave the Dr. and Cr. answers blank (zero). Ref. Account C. Insurance Expense Retained Earnings-Prior Period Adjustment To correct error. Dr. Cr. 1,200 0 0 1,200 Year 8 Year 9 Retained earnings beginning, adjusted $ 20,000 $ 42,800 x Net income 22,800 x Retained earnings, ending $ 42,800 * $ 30,000 x 72,800 d. Prepare the entry (if needed) to record the error if discovered in Year 10. Prepare the Year 9 and Year 10 retained earnings sections of the statement of stockholders' equity. Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/A-credit" as the account names and leave the Dr. and Cr. answers blank (zero). Ref. d. Insurance Expense To correct error. Account Retained Earnings-Prior Period Adjustment Dr. Cr. 12,000 0 x 0 1,200 x Year 9 Year 10 Retained earnings, beginning as reported $ 0 Prior period adjustment Retained earnings beginning, adjusted Net income Retained earnings, ending 0 x 0 x $ 0 x 0 0 * $ 0 * $ 0 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started