Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Error in 2021 Financial Statements One of your colleagues provided you with the following information this afternoon: When we were reviewing the 2022 depreciation

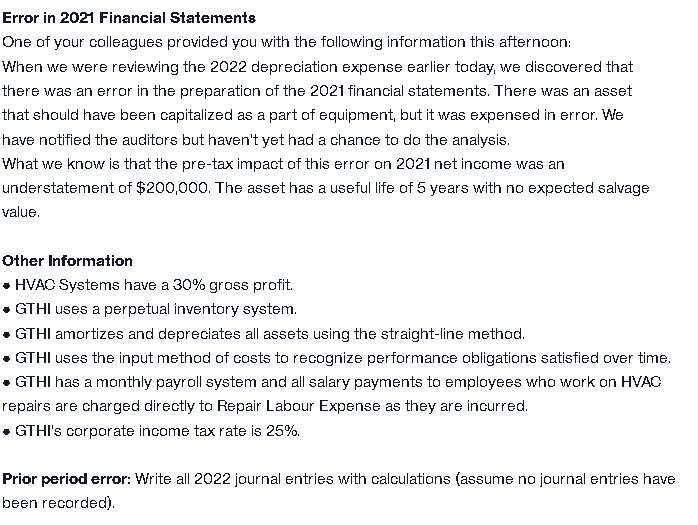

Error in 2021 Financial Statements One of your colleagues provided you with the following information this afternoon: When we were reviewing the 2022 depreciation expense earlier today, we discovered that there was an error in the preparation of the 2021 financial statements. There was an asset that should have been capitalized as a part of equipment, but it was expensed in error. We have notified the auditors but haven't yet had a chance to do the analysis. What we know is that the pre-tax impact of this error on 2021 net income was an understatement of $200,000. The asset has a useful life of 5 years with no expected salvage value. Other Information HVAC Systems have a 30% gross profit. GTHI uses a perpetual inventory system. GTHI amortizes and depreciates all assets using the straight-line method. GTHI uses the input method of costs to recognize performance obligations satisfied over time. GTHI has a monthly payroll system and all salary payments to employees who work on HVAC repairs are charged directly to Repair Labour Expense as they are incurred. GTHI's corporate income tax rate is 25%. Prior period error: Write all 2022 journal entries with calculations (assume no journal entries have been recorded).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Adjustment for the Error in 2021 Financial Statements Accumulated Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started