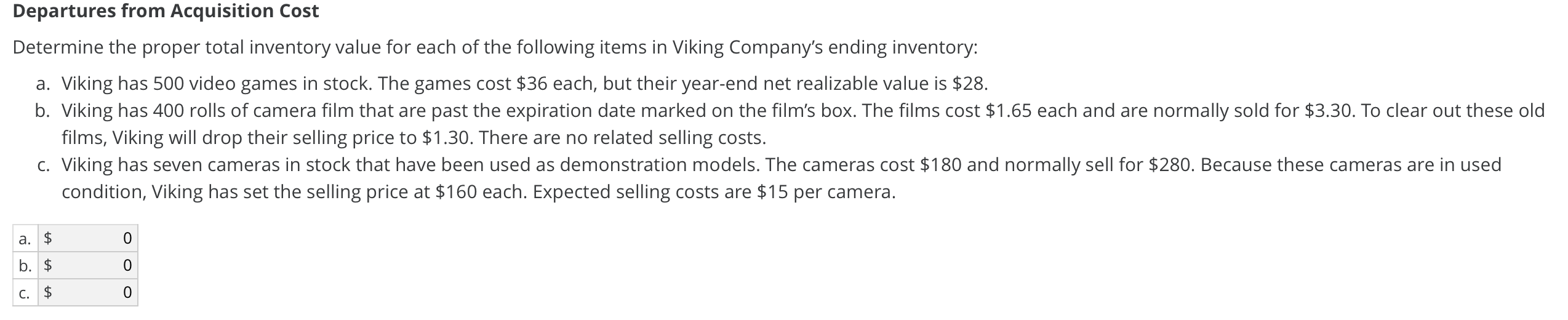

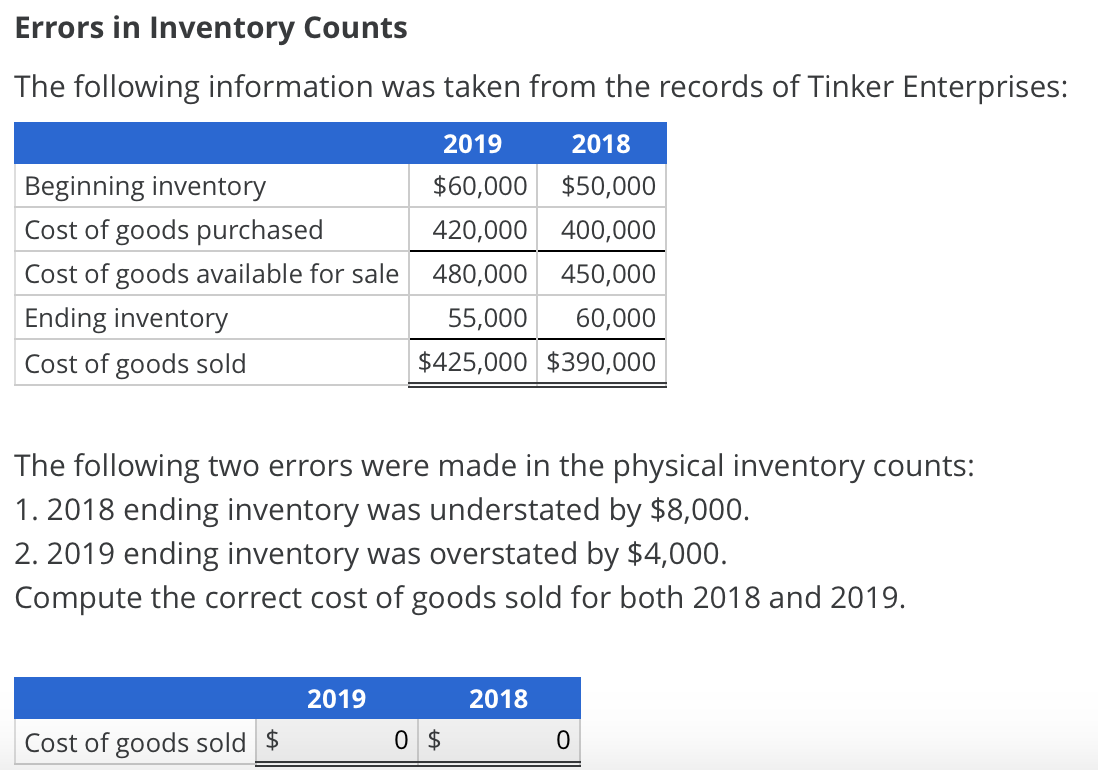

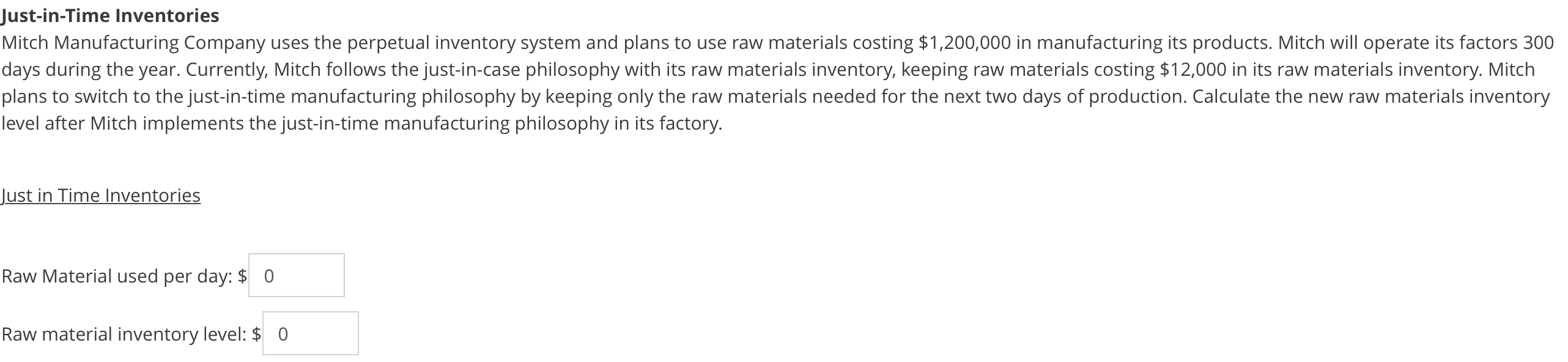

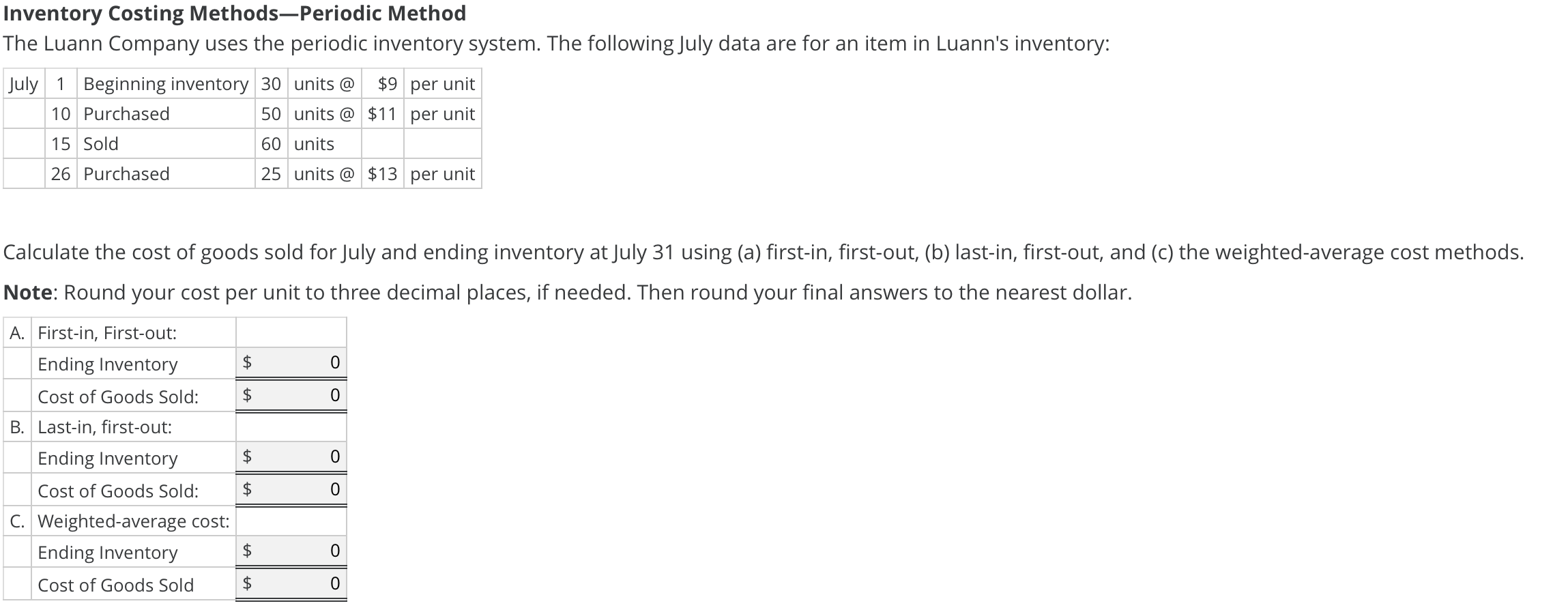

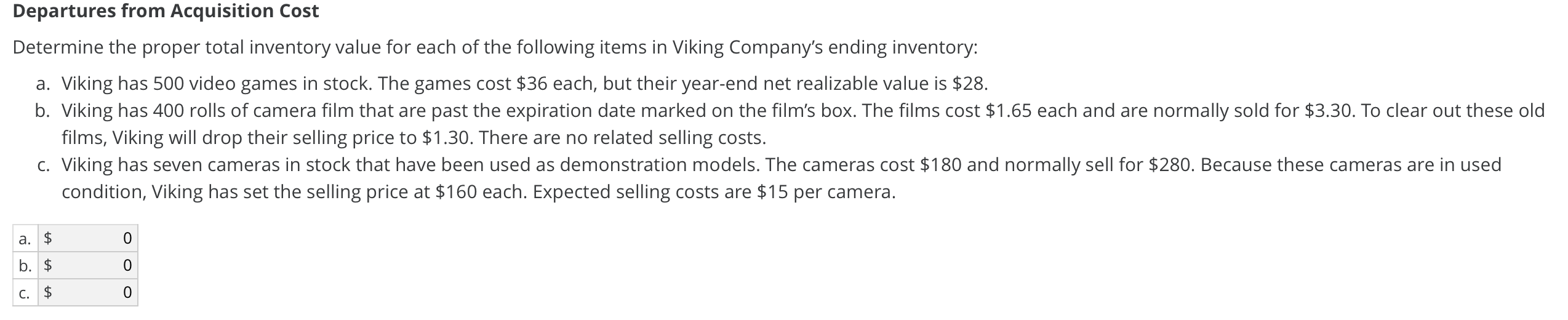

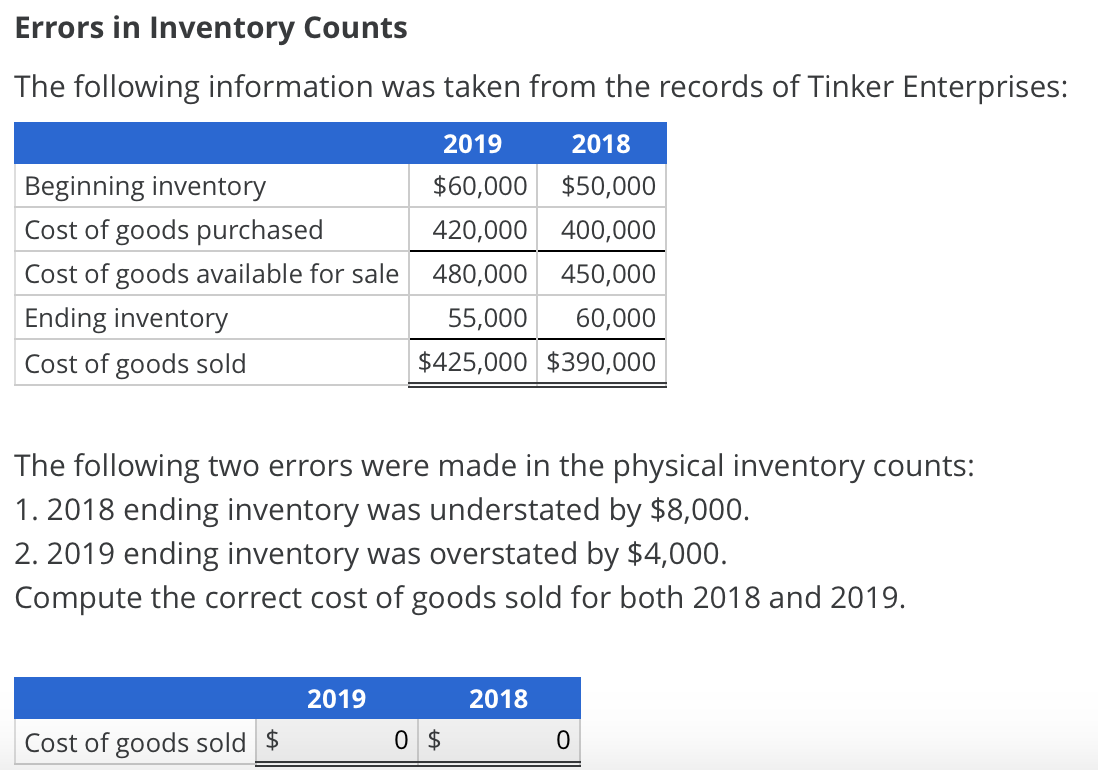

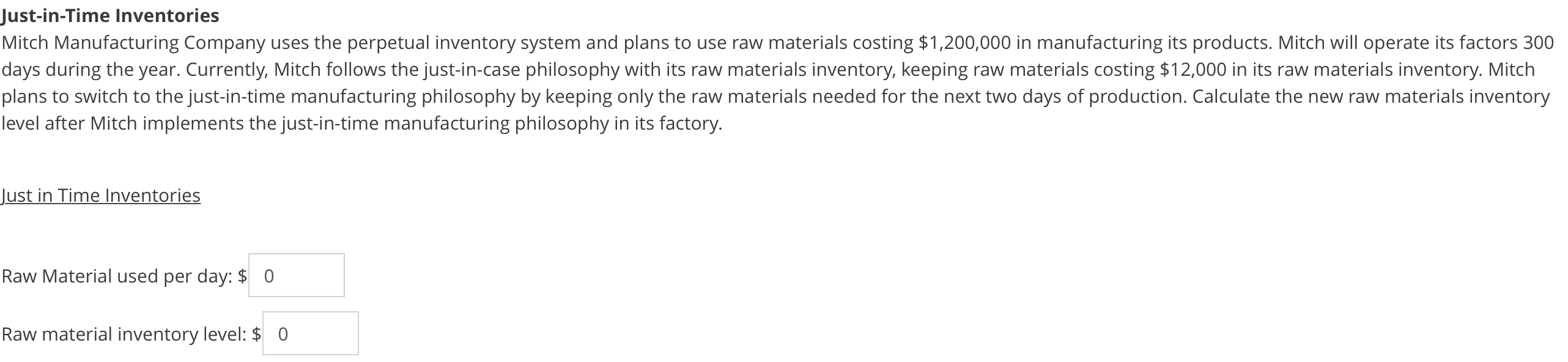

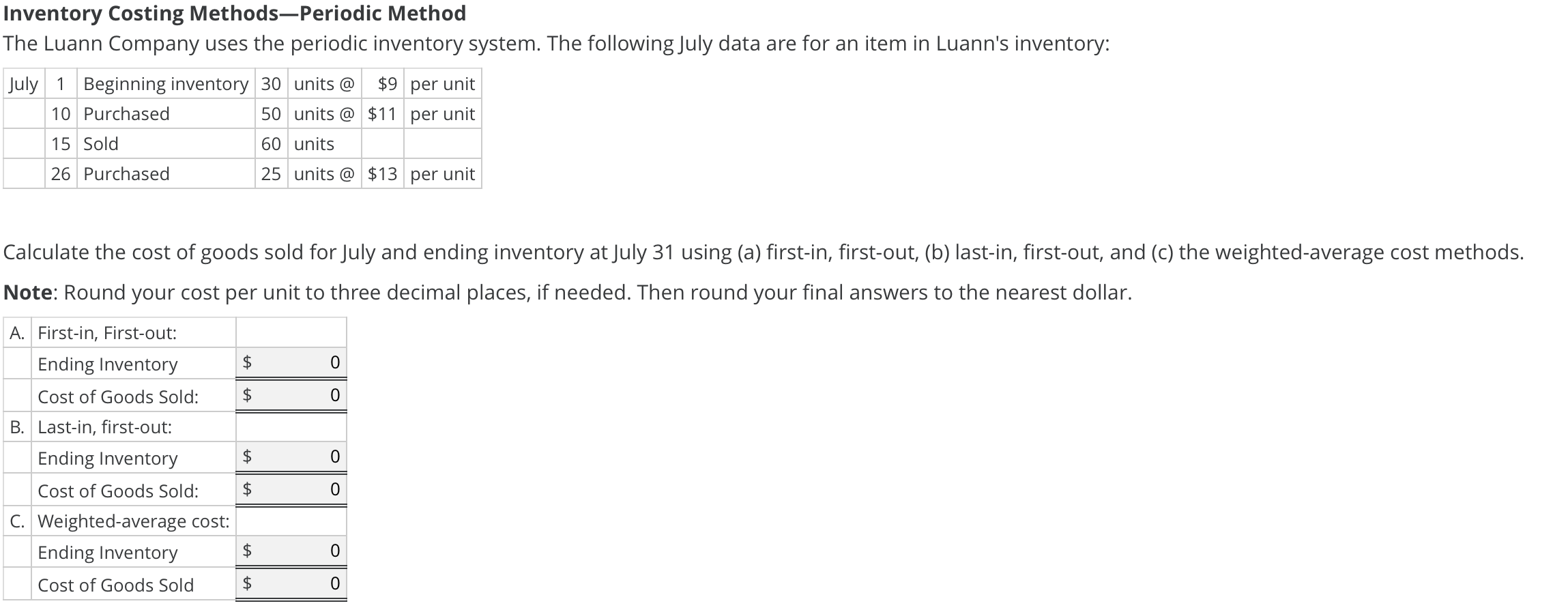

Errors in Inventory Counts The following information was taken from the records of Tinker Enterprises: Beginning inventory Cost of goods purchased Cost of goods available for sale Ending inventory Cost of goods sold 2019 2018 $60,000 $50,000 420,000 400,000 480,000 450,000 55,000 60,000 $425,000 $390,000 The following two errors were made in the physical inventory counts: 1. 2018 ending inventory was understated by $8,000. 2. 2019 ending inventory was overstated by $4,000. Compute the correct cost of goods sold for both 2018 and 2019. 2019 2018 Cost of goods sold $ 0 $ Just-in-Time Inventories Mitch Manufacturing Company uses the perpetual inventory system and plans to use raw materials costing $1,200,000 in manufacturing its products. Mitch will operate its factors 300 days during the year. Currently, Mitch follows the just-in-case philosophy with its raw materials inventory, keeping raw materials costing $12,000 in its raw materials inventory. Mitch plans to switch to the just-in-time manufacturing philosophy by keeping only the raw materials needed for the next two days of production. Calculate the new raw materials inventory level after Mitch implements the just-in-time manufacturing philosophy in its factory. lust in Time Inventories Raw Material used per day: $ 0 Raw material inventory level: $ 0 Inventory Costing MethodsPeriodic Method The Luann Company uses the periodic inventory system. The following July data are for an item in Luann's inventory: July 1 Beginning inventory 30 units @ $9 per unit 10 Purchased 50 units @ $11 per unit 15 Sold 60 units 26 Purchased 25 units @ $13 per unit Calculate the cost of goods sold for July and ending inventory at July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) the weighted-average cost methods. Note: Round your cost per unit to three decimal places, if needed. Then round your final answers to the nearest dollar. tA I $ $ 0 0 A A. First-in, First-out: Ending Inventory Cost of Goods Sold: B. Last-in, first-out: Ending Inventory Cost of Goods Sold: C. Weighted-average cost: Ending Inventory Cost of Goods Sold $ 0 A || $ 0 Errors in Inventory Counts The following information was taken from the records of Tinker Enterprises: Beginning inventory Cost of goods purchased Cost of goods available for sale Ending inventory Cost of goods sold 2019 2018 $60,000 $50,000 420,000 400,000 480,000 450,000 55,000 60,000 $425,000 $390,000 The following two errors were made in the physical inventory counts: 1. 2018 ending inventory was understated by $8,000. 2. 2019 ending inventory was overstated by $4,000. Compute the correct cost of goods sold for both 2018 and 2019. 2019 2018 Cost of goods sold $ 0 $ Just-in-Time Inventories Mitch Manufacturing Company uses the perpetual inventory system and plans to use raw materials costing $1,200,000 in manufacturing its products. Mitch will operate its factors 300 days during the year. Currently, Mitch follows the just-in-case philosophy with its raw materials inventory, keeping raw materials costing $12,000 in its raw materials inventory. Mitch plans to switch to the just-in-time manufacturing philosophy by keeping only the raw materials needed for the next two days of production. Calculate the new raw materials inventory level after Mitch implements the just-in-time manufacturing philosophy in its factory. lust in Time Inventories Raw Material used per day: $ 0 Raw material inventory level: $ 0 Inventory Costing MethodsPeriodic Method The Luann Company uses the periodic inventory system. The following July data are for an item in Luann's inventory: July 1 Beginning inventory 30 units @ $9 per unit 10 Purchased 50 units @ $11 per unit 15 Sold 60 units 26 Purchased 25 units @ $13 per unit Calculate the cost of goods sold for July and ending inventory at July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) the weighted-average cost methods. Note: Round your cost per unit to three decimal places, if needed. Then round your final answers to the nearest dollar. tA I $ $ 0 0 A A. First-in, First-out: Ending Inventory Cost of Goods Sold: B. Last-in, first-out: Ending Inventory Cost of Goods Sold: C. Weighted-average cost: Ending Inventory Cost of Goods Sold $ 0 A || $ 0