Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Errors often occur in financial accounting. Below are three different errors and each error is independent from the others. a. On 12/31/17, Milwaukee Co.

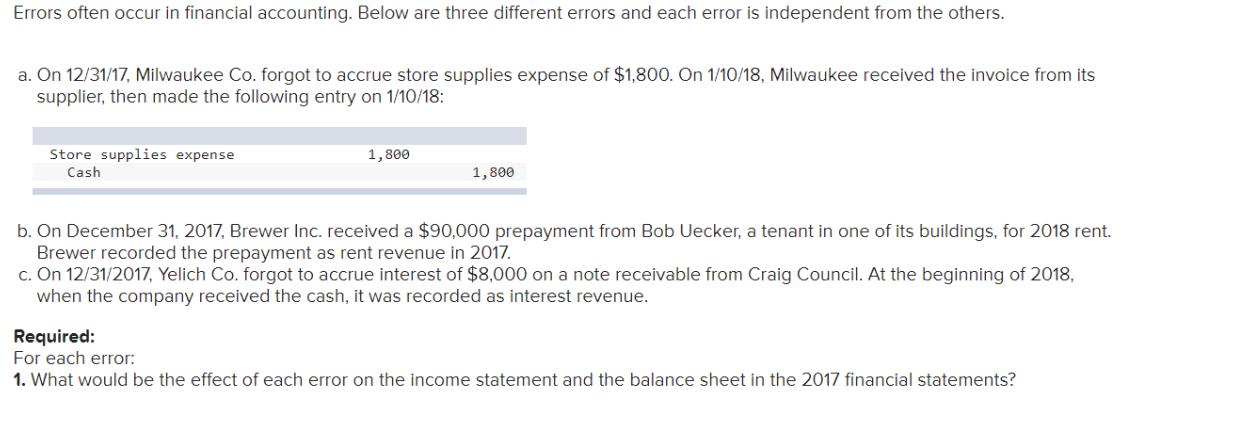

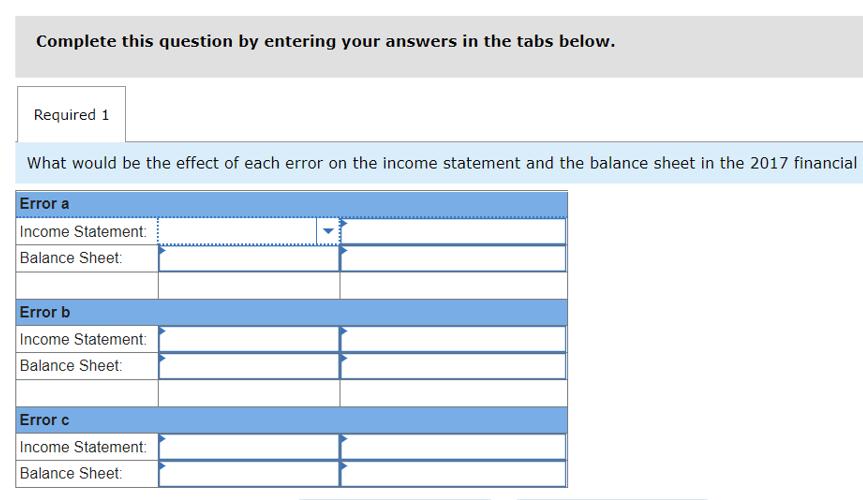

Errors often occur in financial accounting. Below are three different errors and each error is independent from the others. a. On 12/31/17, Milwaukee Co. forgot to accrue store supplies expense of $1,800. On 1/10/18, Milwaukee received the invoice from its supplier, then made the following entry on 1/10/18: Store supplies expense Cash 1,800 1,800 b. On December 31, 2017, Brewer Inc. received a $90,000 prepayment from Bob Uecker, a tenant in one of its buildings, for 2018 rent. Brewer recorded the prepayment as rent revenue in 2017. c. On 12/31/2017, Yelich Co. forgot to accrue interest of $8,000 on a note receivable from Craig Council. At the beginning of 2018, when the company received the cash, it was recorded as interest revenue. Required: For each error: 1. What would be the effect of each error on the income statement and the balance sheet in the 2017 financial statements? Complete this question by entering your answers in the tabs below. Required 1 What would be the effect of each error on the income statement and the balance sheet in the 2017 financial Error a Income Statement: Balance Sheet: Error b Income Statement: Balance Sheet: Error c Income Statement: Balance Sheet:

Step by Step Solution

★★★★★

3.38 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Answer ERROR A Income Statement Expenses understated Net income overstated Balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started