Answered step by step

Verified Expert Solution

Question

1 Approved Answer

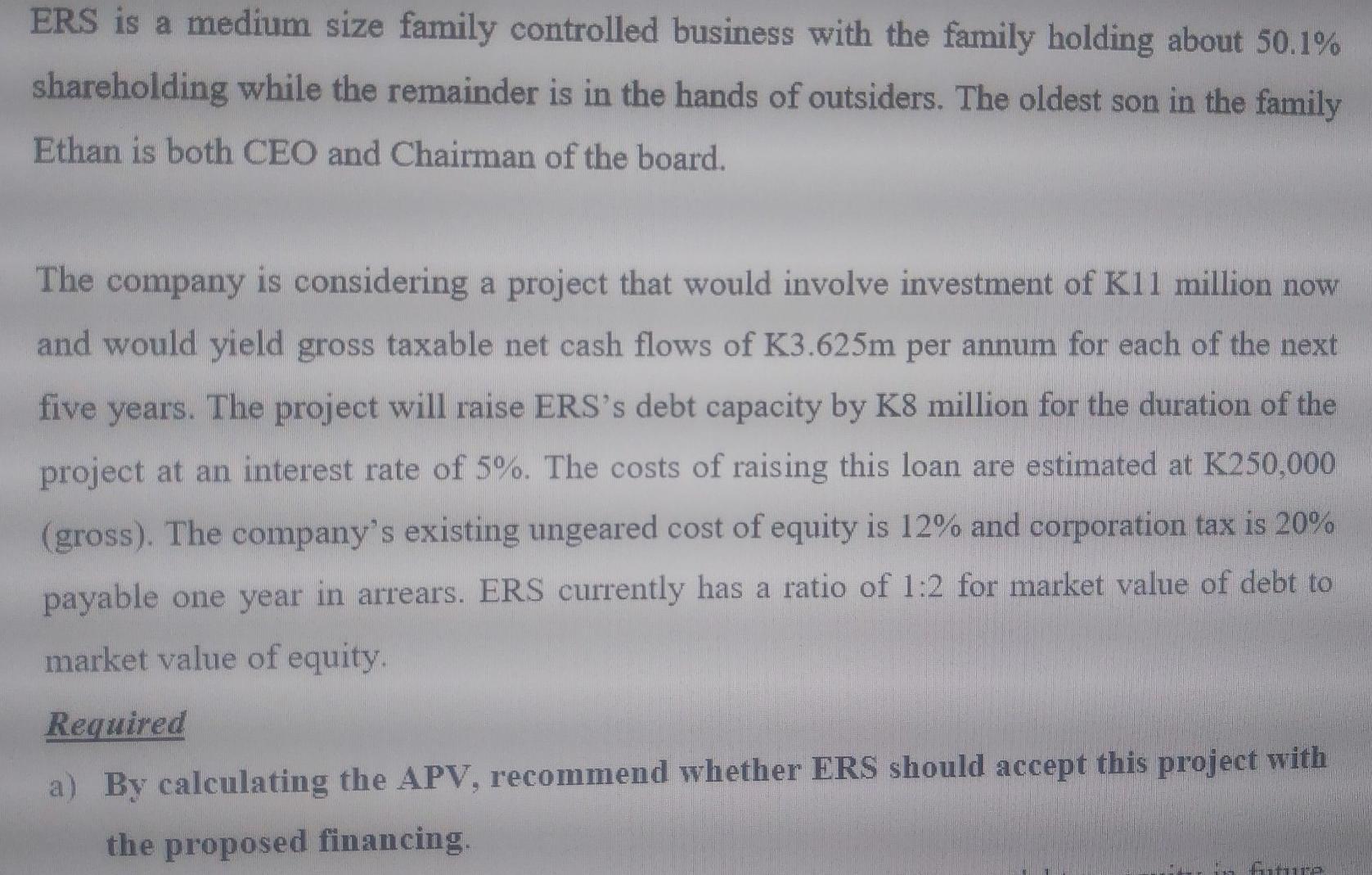

ERS is a medium size family controlled business with the family holding about 50.1% shareholding while the remainder is in the hands of outsiders.

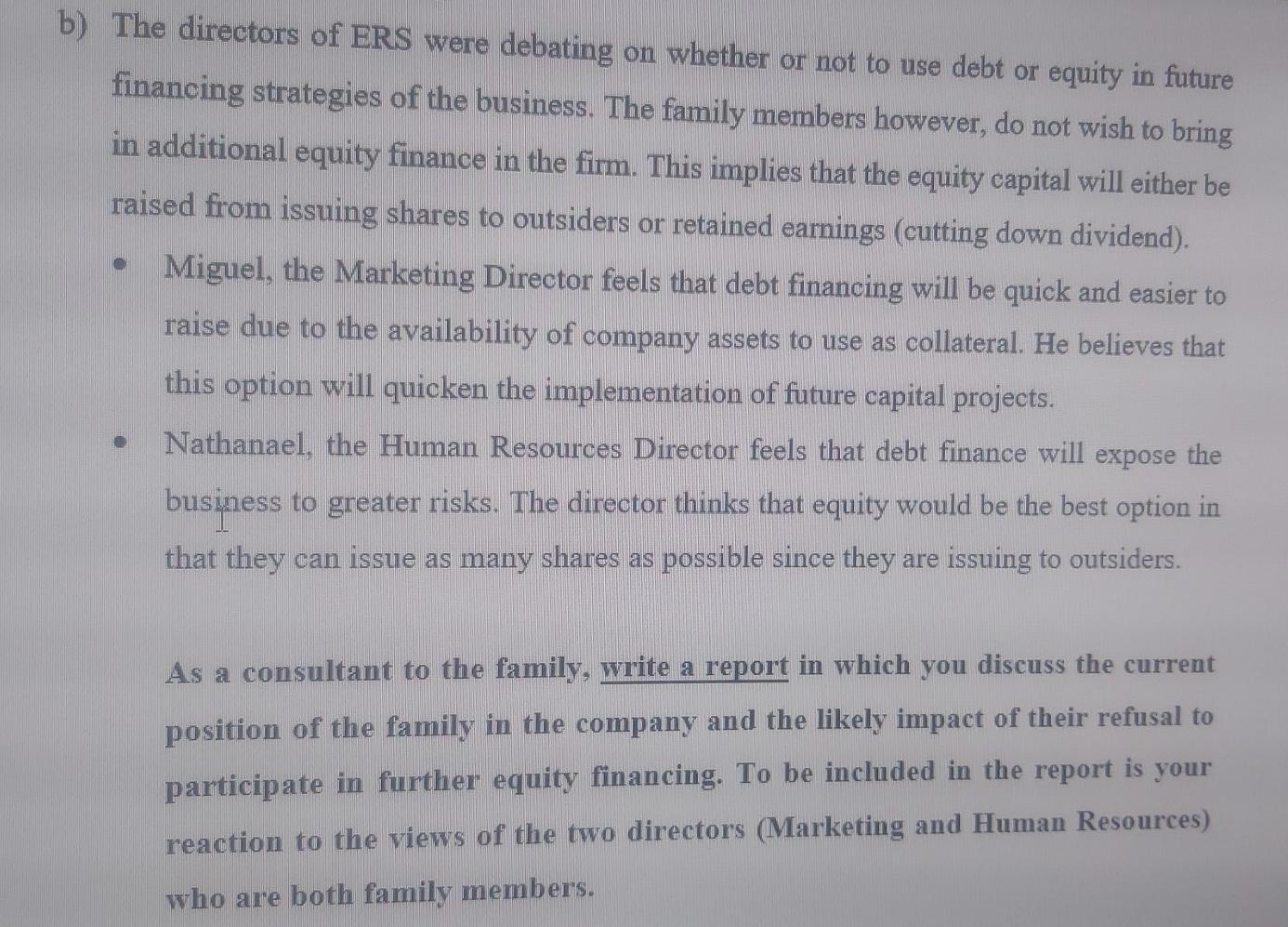

ERS is a medium size family controlled business with the family holding about 50.1% shareholding while the remainder is in the hands of outsiders. The oldest son in the family Ethan is both CEO and Chairman of the board. The company is considering a project that would involve investment of K11 million now and would yield gross taxable net cash flows of K3.625m per annum for each of the next five years. The project will raise ERS's debt capacity by K8 million for the duration of the project at an interest rate of 5%. The costs of raising this loan are estimated at K250,000 (gross). The company's existing ungeared cost of equity is 12% and corporation tax is 20% payable one year in arrears. ERS currently has a ratio of 1:2 for market value of debt to market value of equity. Required a) By calculating the APV, recommend whether ERS should accept this project wit the proposed financing. fiture b) The directors of ERS were debating on whether or not to use debt or equity in future financing strategies of the business. The family members however, do not wish to bring in additional equity finance in the firm. This implies that the equity capital will either be raised from issuing shares to outsiders or retained earnings (cutting down dividend). Miguel, the Marketing Director feels that debt financing will be quick and easier to raise due to the availability of company assets to use as collateral. He believes that this option will quicken the implementation of future capital projects. Nathanael, the Human Resources Director feels that debt finance will expose the business to greater risks. The director thinks that equity would be the best option in that they can issue as many shares as possible since they are issuing to outsiders. As a consultant to the family, write a report in which you discuss the current position of the family in the company and the likely impact of their refusal to participate in further equity financing. To be included in the report is your reaction to the views of the two directors (Marketing and Human Resources) who are both family members.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer A calculate APV are APV Present Value of Unlevered Firm Cost of Debt Financing Present Value of Unlevered Firm As the Firm is Unleveredwe will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started