Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ervin Equipment, a manufacturer of exercise and workout equipment for sale to institutions, uses job costing. The following transactions occurred in January: 1. Purchased $85,000

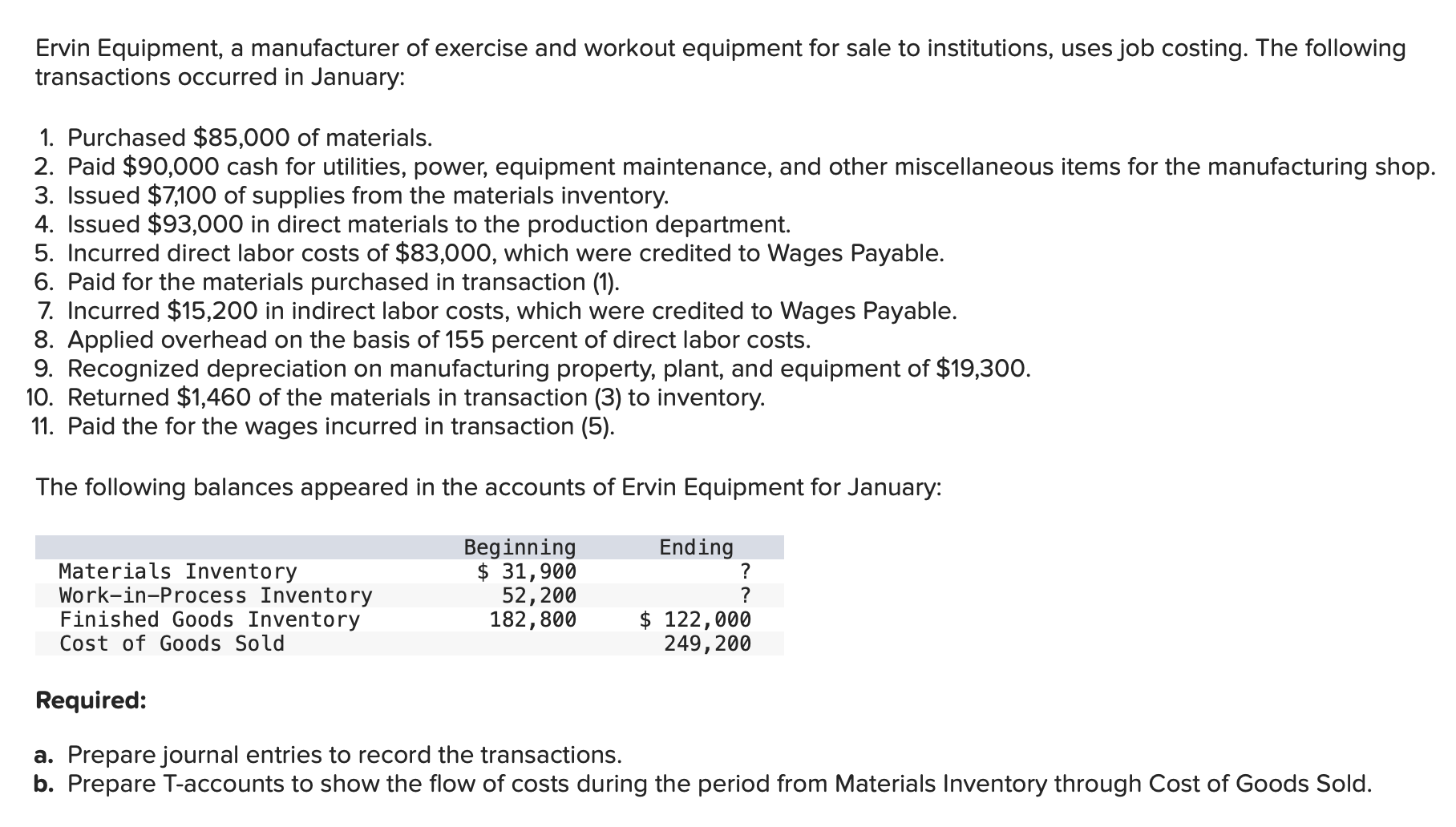

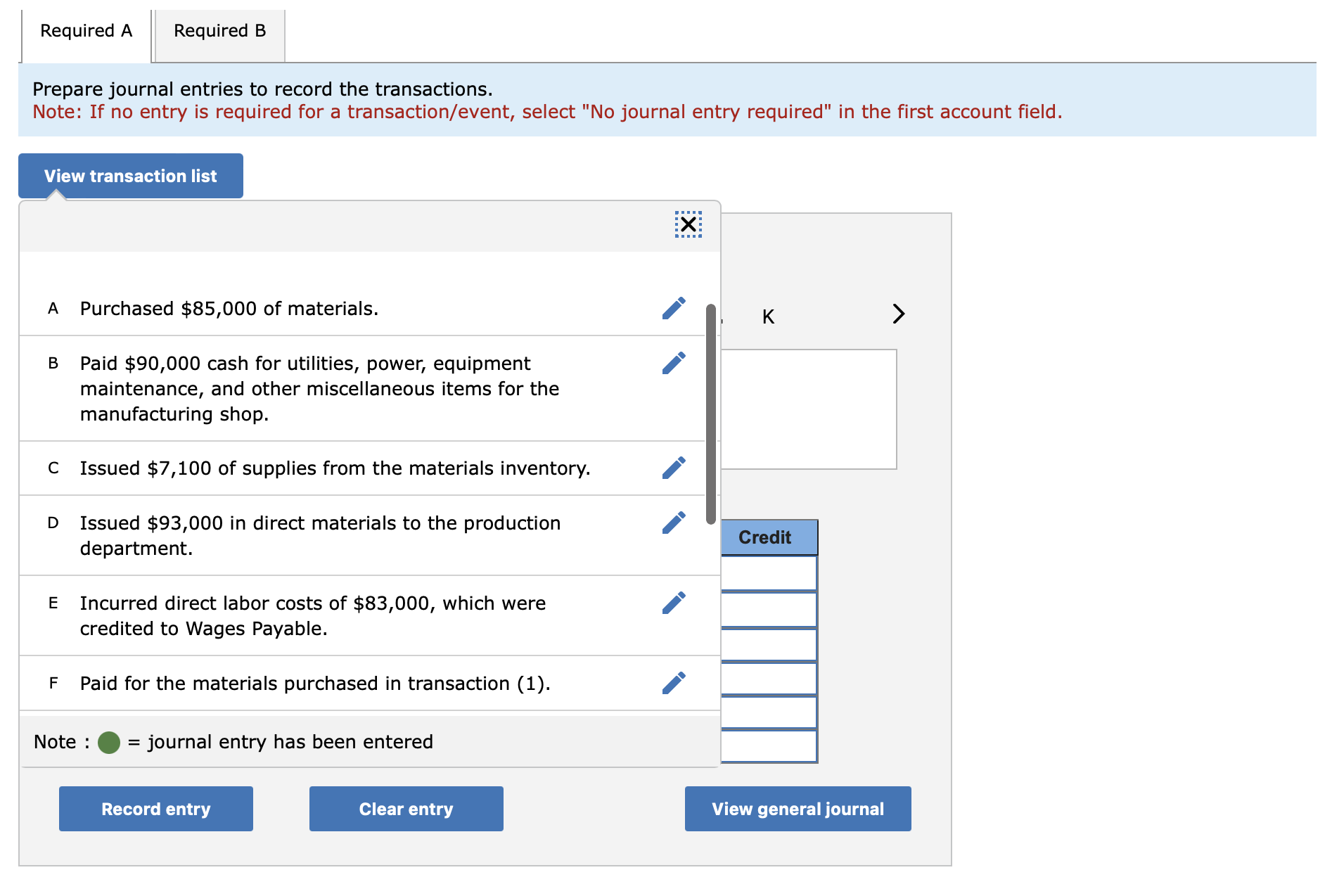

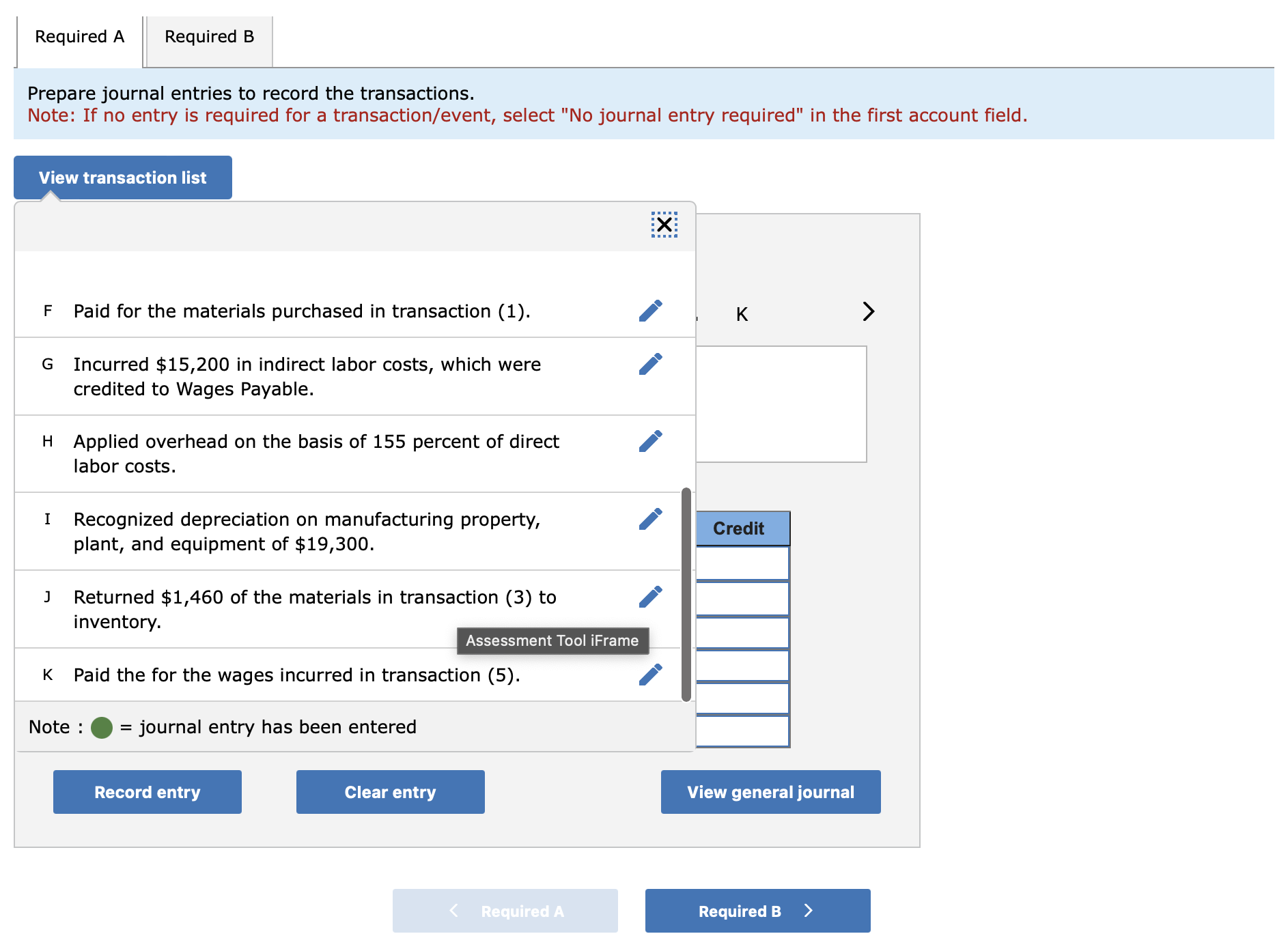

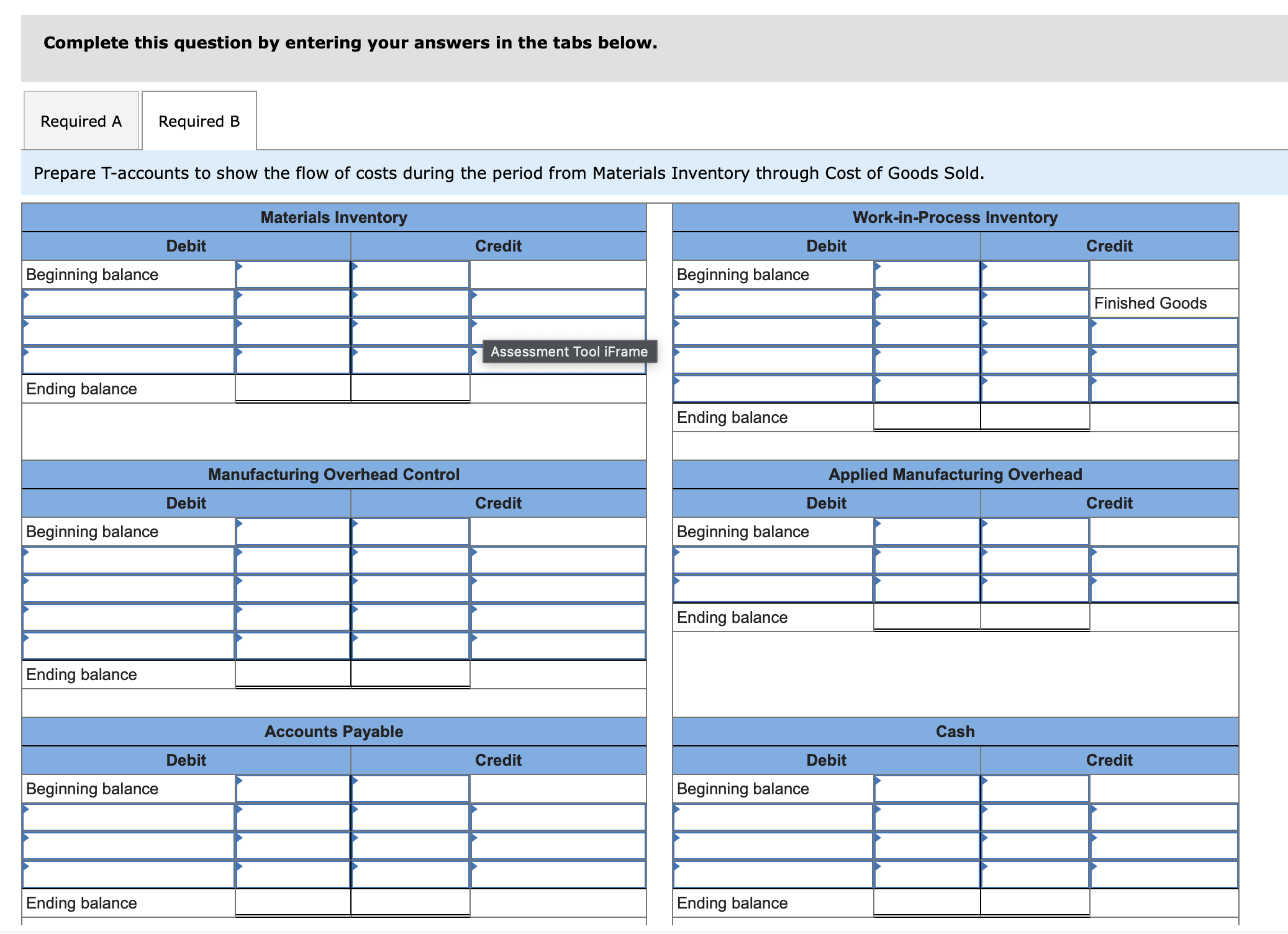

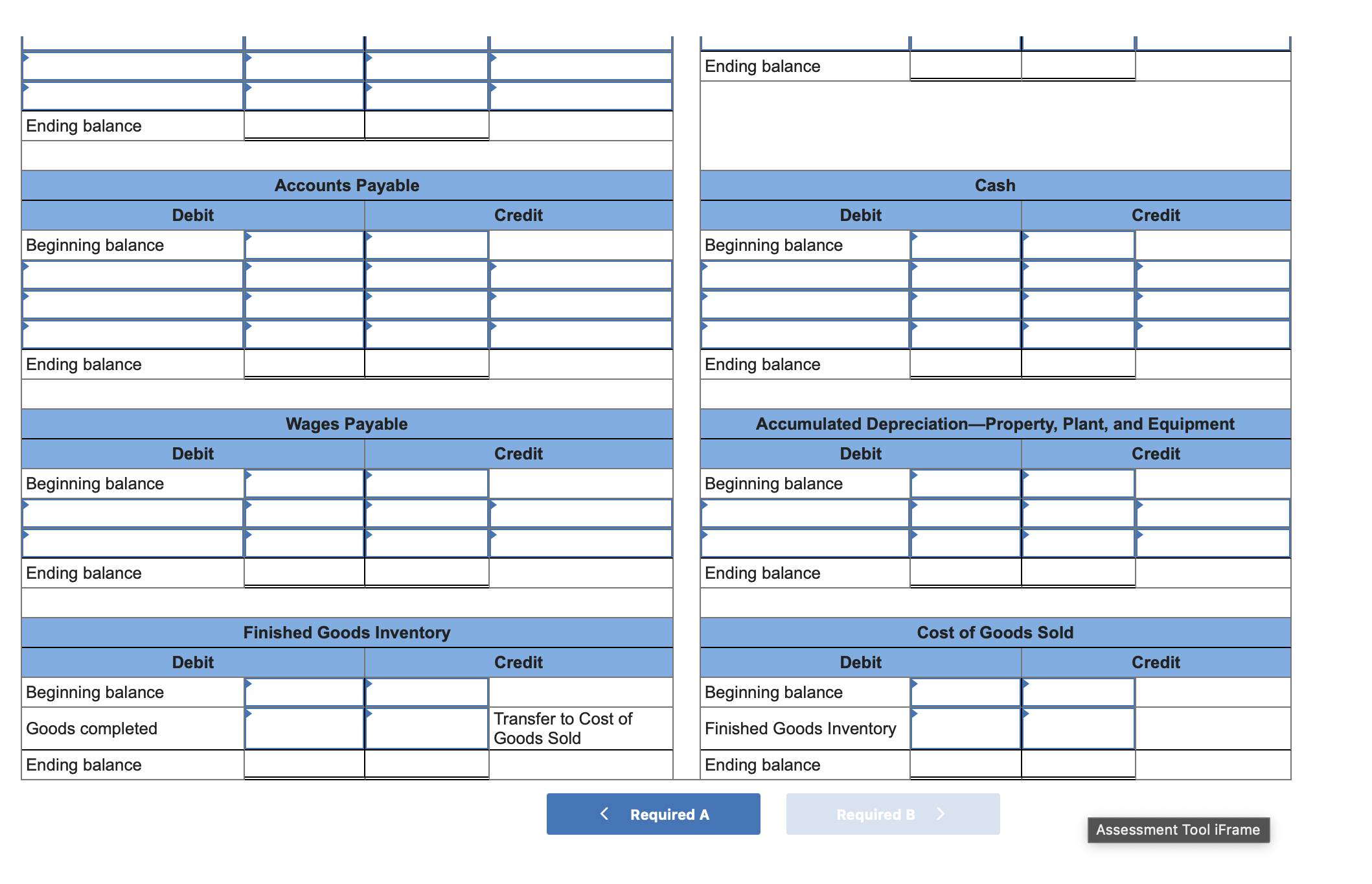

Ervin Equipment, a manufacturer of exercise and workout equipment for sale to institutions, uses job costing. The following transactions occurred in January: 1. Purchased $85,000 of materials. 2. Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. 3. Issued $7,100 of supplies from the materials inventory. 4. Issued $93,000 in direct materials to the production department. 5. Incurred direct labor costs of $83,000, which were credited to Wages Payable. 6. Paid for the materials purchased in transaction (1). 7. Incurred \$15,200 in indirect labor costs, which were credited to Wages Payable. 8. Applied overhead on the basis of 155 percent of direct labor costs. 9. Recognized depreciation on manufacturing property, plant, and equipment of $19,300. 10. Returned $1,460 of the materials in transaction (3) to inventory. 11. Paid the for the wages incurred in transaction (5). The following balances appeared in the accounts of Ervin Equipment for January: Required: a. Prepare journal entries to record the transactions. b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. A Purchased $85,000 of materials. B Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. C Issued $7,100 of supplies from the materials inventory. D Issued $93,000 in direct materials to the production department. Credit E Incurred direct labor costs of $83,000, which were credited to Wages Payable. F Paid for the materials purchased in transaction (1). Note : = journal entry has been entered Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. F Paid for the materials purchased in transaction (1). G Incurred $15,200 in indirect labor costs, which were credited to Wages Payable. H Applied overhead on the basis of 155 percent of direct labor costs. I Recognized depreciation on manufacturing property, plant, and equipment of $19,300. Credit J Returned $1,460 of the materials in transaction (3) to inventory. K Paid the for the wages incurred in transaction (5). Complete this question by entering your answers in the tabs below. Ervin Equipment, a manufacturer of exercise and workout equipment for sale to institutions, uses job costing. The following transactions occurred in January: 1. Purchased $85,000 of materials. 2. Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. 3. Issued $7,100 of supplies from the materials inventory. 4. Issued $93,000 in direct materials to the production department. 5. Incurred direct labor costs of $83,000, which were credited to Wages Payable. 6. Paid for the materials purchased in transaction (1). 7. Incurred \$15,200 in indirect labor costs, which were credited to Wages Payable. 8. Applied overhead on the basis of 155 percent of direct labor costs. 9. Recognized depreciation on manufacturing property, plant, and equipment of $19,300. 10. Returned $1,460 of the materials in transaction (3) to inventory. 11. Paid the for the wages incurred in transaction (5). The following balances appeared in the accounts of Ervin Equipment for January: Required: a. Prepare journal entries to record the transactions. b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. A Purchased $85,000 of materials. B Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. C Issued $7,100 of supplies from the materials inventory. D Issued $93,000 in direct materials to the production department. Credit E Incurred direct labor costs of $83,000, which were credited to Wages Payable. F Paid for the materials purchased in transaction (1). Note : = journal entry has been entered Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. F Paid for the materials purchased in transaction (1). G Incurred $15,200 in indirect labor costs, which were credited to Wages Payable. H Applied overhead on the basis of 155 percent of direct labor costs. I Recognized depreciation on manufacturing property, plant, and equipment of $19,300. Credit J Returned $1,460 of the materials in transaction (3) to inventory. K Paid the for the wages incurred in transaction (5). Complete this question by entering your answers in the tabs below

Ervin Equipment, a manufacturer of exercise and workout equipment for sale to institutions, uses job costing. The following transactions occurred in January: 1. Purchased $85,000 of materials. 2. Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. 3. Issued $7,100 of supplies from the materials inventory. 4. Issued $93,000 in direct materials to the production department. 5. Incurred direct labor costs of $83,000, which were credited to Wages Payable. 6. Paid for the materials purchased in transaction (1). 7. Incurred \$15,200 in indirect labor costs, which were credited to Wages Payable. 8. Applied overhead on the basis of 155 percent of direct labor costs. 9. Recognized depreciation on manufacturing property, plant, and equipment of $19,300. 10. Returned $1,460 of the materials in transaction (3) to inventory. 11. Paid the for the wages incurred in transaction (5). The following balances appeared in the accounts of Ervin Equipment for January: Required: a. Prepare journal entries to record the transactions. b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. A Purchased $85,000 of materials. B Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. C Issued $7,100 of supplies from the materials inventory. D Issued $93,000 in direct materials to the production department. Credit E Incurred direct labor costs of $83,000, which were credited to Wages Payable. F Paid for the materials purchased in transaction (1). Note : = journal entry has been entered Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. F Paid for the materials purchased in transaction (1). G Incurred $15,200 in indirect labor costs, which were credited to Wages Payable. H Applied overhead on the basis of 155 percent of direct labor costs. I Recognized depreciation on manufacturing property, plant, and equipment of $19,300. Credit J Returned $1,460 of the materials in transaction (3) to inventory. K Paid the for the wages incurred in transaction (5). Complete this question by entering your answers in the tabs below. Ervin Equipment, a manufacturer of exercise and workout equipment for sale to institutions, uses job costing. The following transactions occurred in January: 1. Purchased $85,000 of materials. 2. Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. 3. Issued $7,100 of supplies from the materials inventory. 4. Issued $93,000 in direct materials to the production department. 5. Incurred direct labor costs of $83,000, which were credited to Wages Payable. 6. Paid for the materials purchased in transaction (1). 7. Incurred \$15,200 in indirect labor costs, which were credited to Wages Payable. 8. Applied overhead on the basis of 155 percent of direct labor costs. 9. Recognized depreciation on manufacturing property, plant, and equipment of $19,300. 10. Returned $1,460 of the materials in transaction (3) to inventory. 11. Paid the for the wages incurred in transaction (5). The following balances appeared in the accounts of Ervin Equipment for January: Required: a. Prepare journal entries to record the transactions. b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold. Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. A Purchased $85,000 of materials. B Paid $90,000 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing shop. C Issued $7,100 of supplies from the materials inventory. D Issued $93,000 in direct materials to the production department. Credit E Incurred direct labor costs of $83,000, which were credited to Wages Payable. F Paid for the materials purchased in transaction (1). Note : = journal entry has been entered Prepare journal entries to record the transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. F Paid for the materials purchased in transaction (1). G Incurred $15,200 in indirect labor costs, which were credited to Wages Payable. H Applied overhead on the basis of 155 percent of direct labor costs. I Recognized depreciation on manufacturing property, plant, and equipment of $19,300. Credit J Returned $1,460 of the materials in transaction (3) to inventory. K Paid the for the wages incurred in transaction (5). Complete this question by entering your answers in the tabs below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started