Question

es David Company uses the aging method to adjust the allowance for uncollectible accounts at the end of the period. On December 31, 20XX,

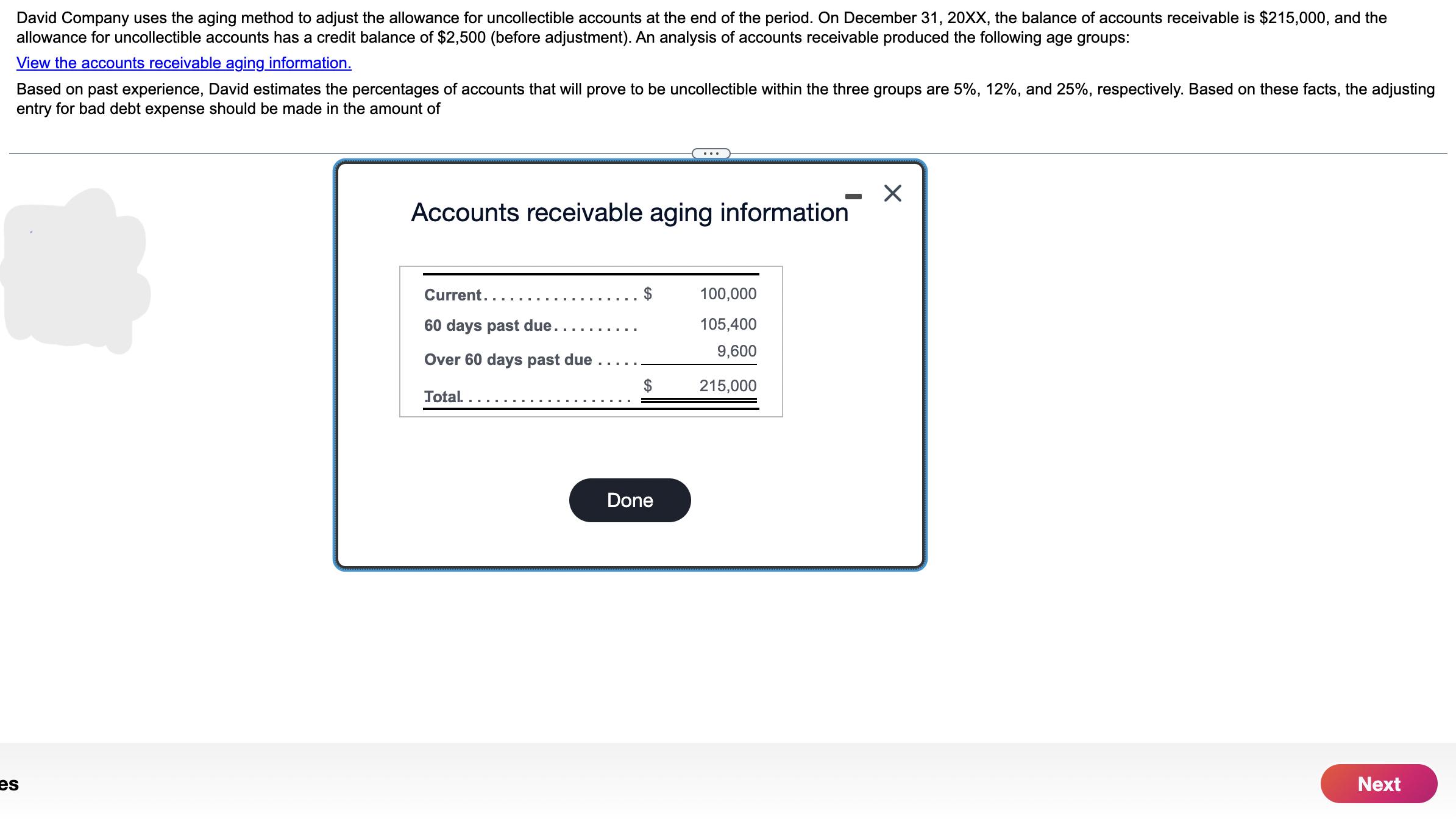

es David Company uses the aging method to adjust the allowance for uncollectible accounts at the end of the period. On December 31, 20XX, the balance of accounts receivable is $215,000, and the allowance for uncollectible accounts has a credit balance of $2,500 (before adjustment). An analysis of accounts receivable produced the following age groups: View the accounts receivable aging information. Based on past experience, David estimates the percentages of accounts that will prove to be uncollectible within the three groups are 5%, 12%, and 25%, respectively. Based on these facts, the adjusting entry for bad debt expense should be made in the amount of Accounts receivable aging information Current. 100,000 60 days past due. 105,400 9,600 Over 60 days past due 215,000 Total. Done Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: C. William Thomas, Wendy M Tietz

13th Edition

013689903X, 9780136899037

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App