Question

es Mrs. Stuart paid the following taxes: Local property tax on: 20 acres of land held for investment Condominium used as principal residence Sailboat

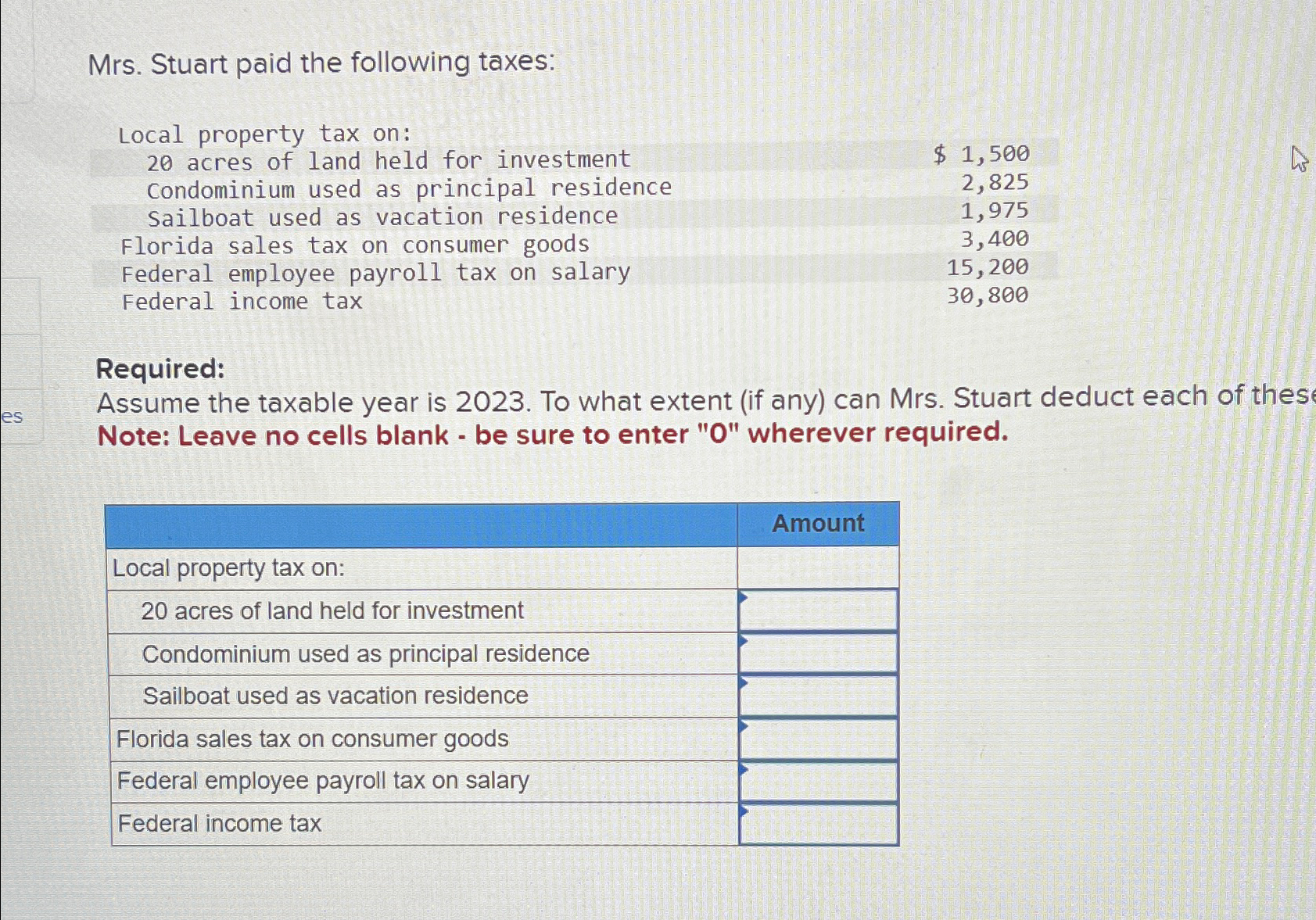

es Mrs. Stuart paid the following taxes: Local property tax on: 20 acres of land held for investment Condominium used as principal residence Sailboat used as vacation residence Florida sales tax on consumer goods Federal employee payroll tax on salary Federal income tax Required: $ 1,500 2,825 1,975 3,400 15,200 30,800 Assume the taxable year is 2023. To what extent (if any) can Mrs. Stuart deduct each of these Note: Leave no cells blank - be sure to enter "O" wherever required. Local property tax on: 20 acres of land held for investment Condominium used as principal residence Sailboat used as vacation residence Florida sales tax on consumer goods Federal employee payroll tax on salary Federal income tax Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2018

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

21st Edition

978-1259713729

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App