Answered step by step

Verified Expert Solution

Question

1 Approved Answer

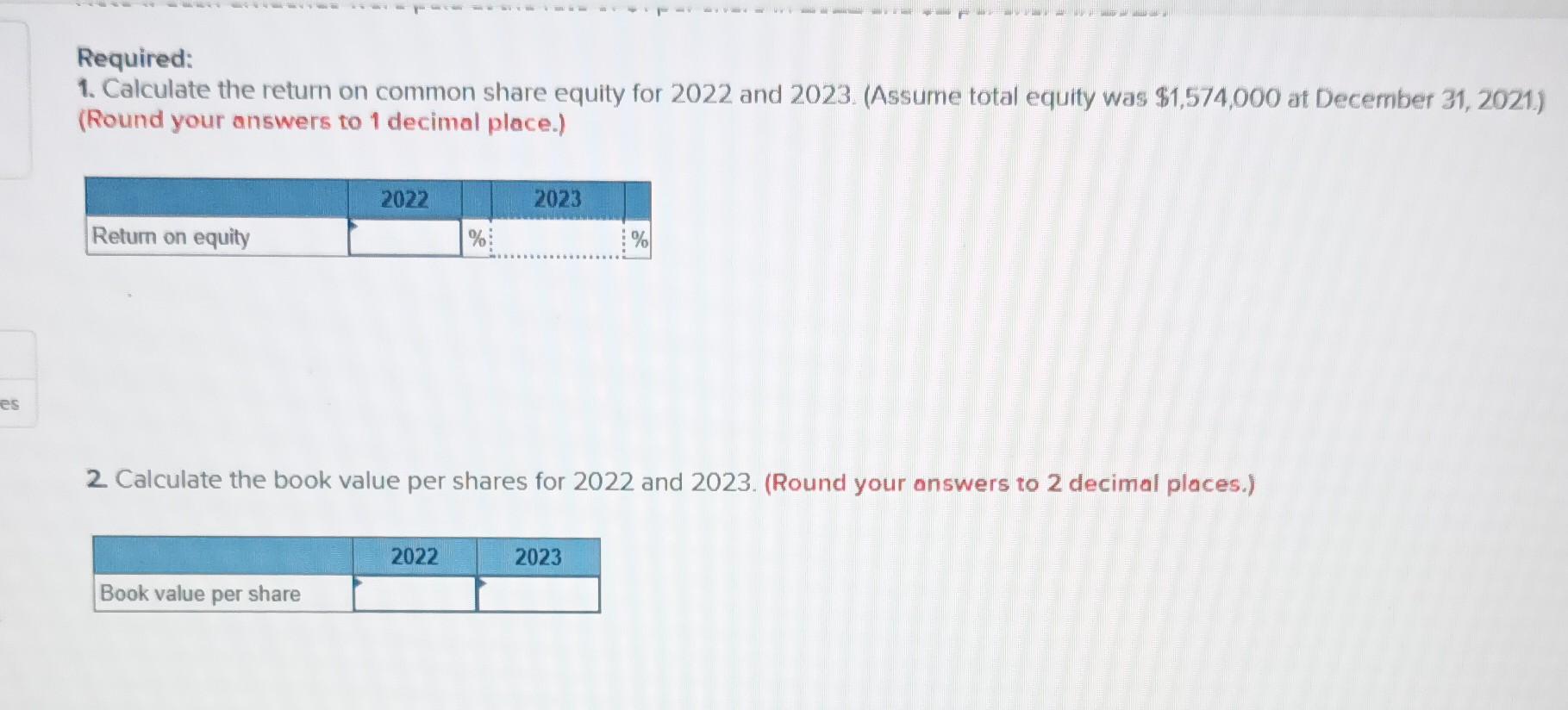

es Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,574,000 at December 31, 2021) (Round

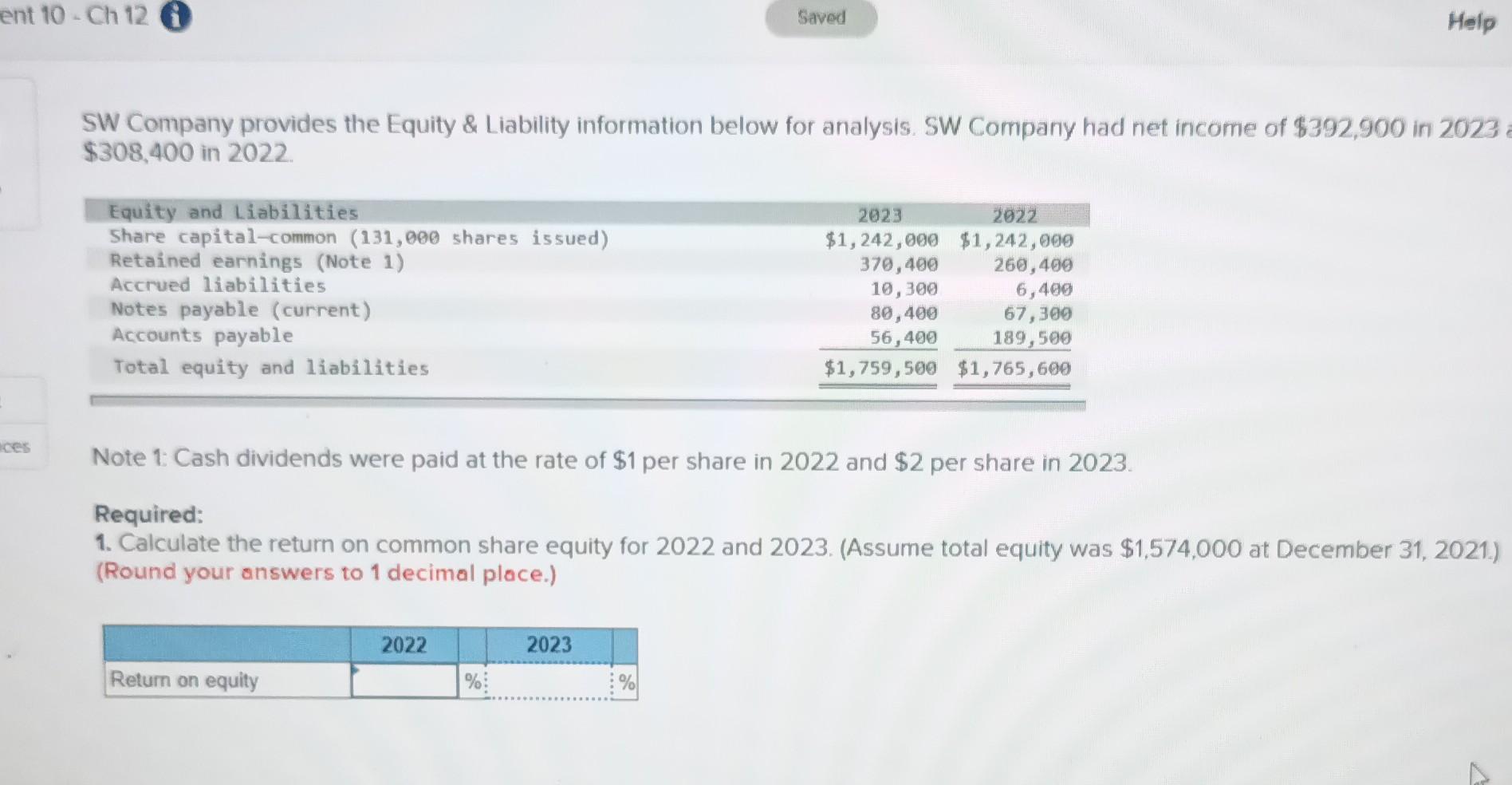

es Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,574,000 at December 31, 2021) (Round your answers to 1 decimal place.) 2022 2023 Return on equity % % 2. Calculate the book value per shares for 2022 and 2023. (Round your answers to 2 decimal places.) 2022 2023 Book value per share ent 10-Ch 12 ces Saved Help SW Company provides the Equity & Liability information below for analysis. SW Company had net income of $392,900 in 2023 $308,400 in 2022. Equity and Liabilities Share capital-common (131,000 shares issued) Retained earnings (Note 1) Accrued liabilities Notes payable (current) Accounts payable Total equity and liabilities 2023 2022 $1,242,000 $1,242,000 370,400 260,400 10,300 6,400 80,400 67,300 56,400 189,500 $1,759,500 $1,765,600 Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023. Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,574,000 at December 31, 2021.) (Round your answers to 1 decimal place.) 2022 2023 Return on equity %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started