Answered step by step

Verified Expert Solution

Question

1 Approved Answer

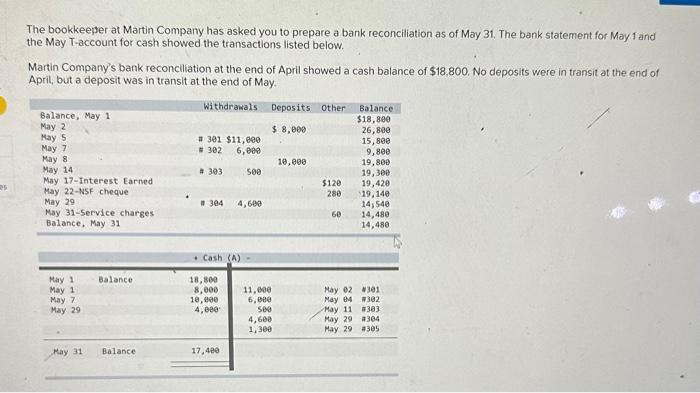

es The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31. The bank statement for May 1 and

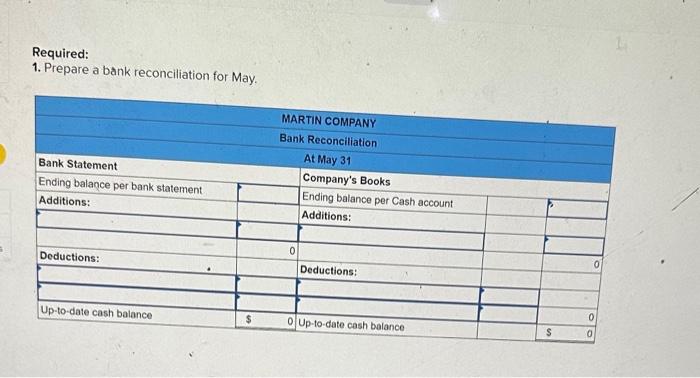

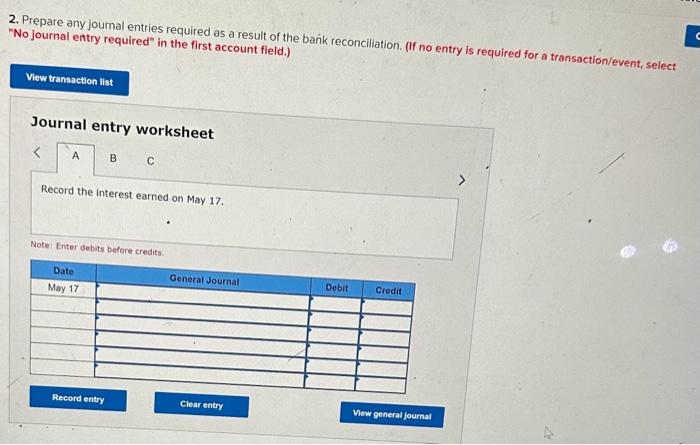

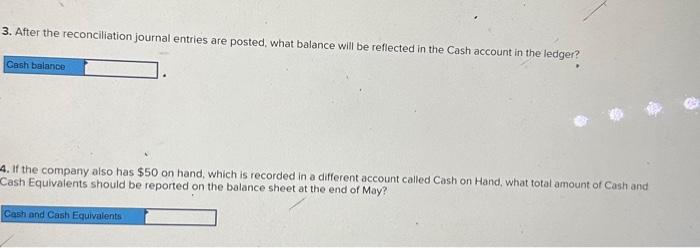

es The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31. The bank statement for May 1 and the May T-account for cash showed the transactions listed below. Martin Company's bank reconciliation at the end of April showed a cash balance of $18,800. No deposits were in transit at the end of April, but a deposit was in transit at the end of May. Withdrawals Deposits Other $ 8,000 Balance, May 1 May 2 May 5 May 7 May 8 May 14 May 17-Interest Earned May 22-NSF cheque May 29 May 31-Service charges Balance, May 31 May 1 May 1 May 7 May 29 May 31 Balance Balance # 301 $11,000 # 302 6,000 # 303 # 304 + Cash (A) 18,800 8,000 10,000 4,000. 17,400 500 4,600 11,000 6,000 500 4,600 1,300 10,000 $120 280 60 May 02 May 04 May 11 May 29 May 29 Balance $18,800 26,800 15,800 9,800 19,800 19,300 19,420 19,140 14,540 14,480 14,480 #301 #302 #303 #304 #305

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started