Answered step by step

Verified Expert Solution

Question

1 Approved Answer

es The Rovet Spints Company produces two products-methanol (wood aloohol) and turpentine-by a joint process Joint costs amount to $122,000 per batch of output.

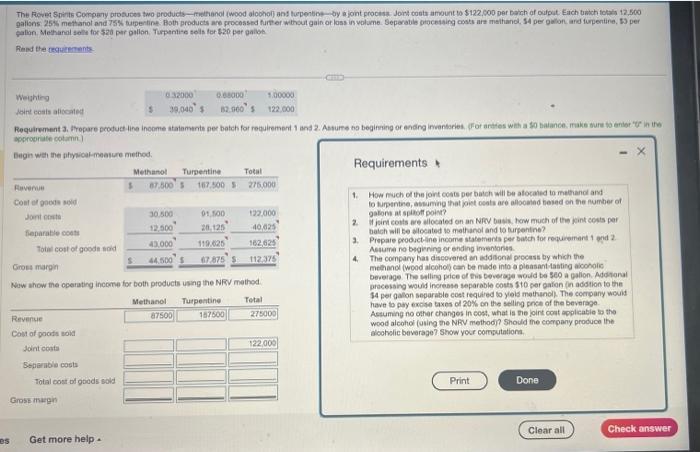

es The Rovet Spints Company produces two products-methanol (wood aloohol) and turpentine-by a joint process Joint costs amount to $122,000 per batch of output. Each batch totals 12,500 gations 25% methanol and 75% turpentine Both products are processed further without gain or loss in volume. Separable processing costs are methanol, $4 per gallon, and furpentine, 53 per gation Methanol sells for $20 per gallon. Turpentine sells for $20 per gallon Read the requirements Weighting Joint costs allocated Revenue Cost of goods sold Joint costs Requirement 3. Prepare product line income statements per batch for requirement 1 and 2. Assume no beginning or ending inventories. (For entries with a 50 balance, make sure to enter in the appropriate column) Begin with the physical-measure method. Separable costs Total cost of goods sold Revenue Cost of goods sold Joint costs Separable costs Total cost of goods sold Gross margin Get more help. 032000 0.68000 9,040 $ 82.000 $ Methanol Turpentine 87,500 $ 167.500 S S Gross margin Now show the operating income for both products using the NRV method 91,500 30.500 12,500 43.000 20,125 119.625 44,500 $ 67.875 Methanol 87500 Turpentine 167500 1.00000 122,000 Total 275.000 122,000 40,025 162,625 112.375 Total 275000 122,000 Requirements 1. How much of the joint costs per batch will be alocated to methanol and to turpentine, assuming that joint costs are allocated based on the number of gations at spitoff point? 2. If joint costs are allocated on an NRV basis, how much of the joint costs per batch will be allocated to methanol and to turpentine? 3. Prepare product-ine income statements per batch for requirement 1 and 2 Assume no beginning or ending inventories 4. The company has discovered an additional process by which the methanol (wood alcohol) can be made into a pleasant tasting alcoholic beverage. The selling price of this beverage would be 560 a gallon. Additional processing would increase separable costs $10 per gation in addition to the $4 per gallon separable cost required to yield methanol). The company would have to pay excise taxes of 20% on the selling price of the beverage Assuming no other changes in cost, what is the joint cost applicable to the wood alcohol (using the NRV method)? Should the company produce the alcoholic beverage? Show your computations. Print Done Clear all Check answer

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the allocation of joint costs per batch for methanol and turpentine we need to use the physicalmeasure method based on the number of gall...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started