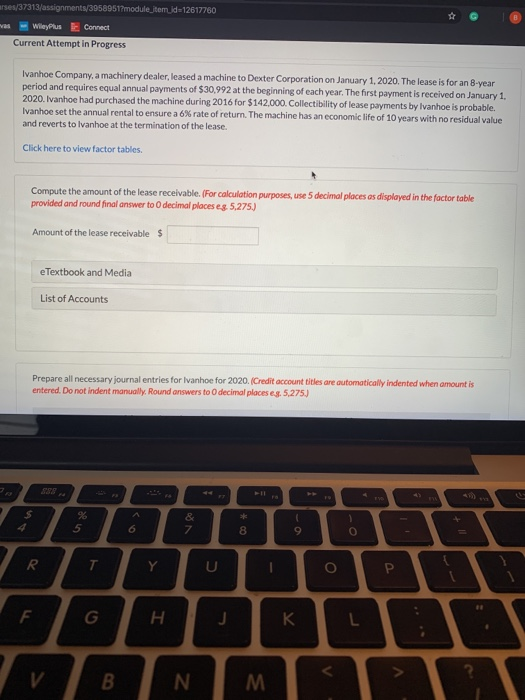

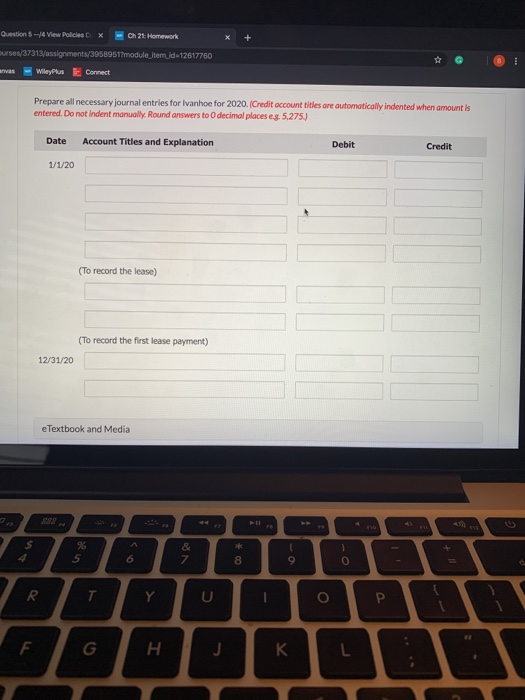

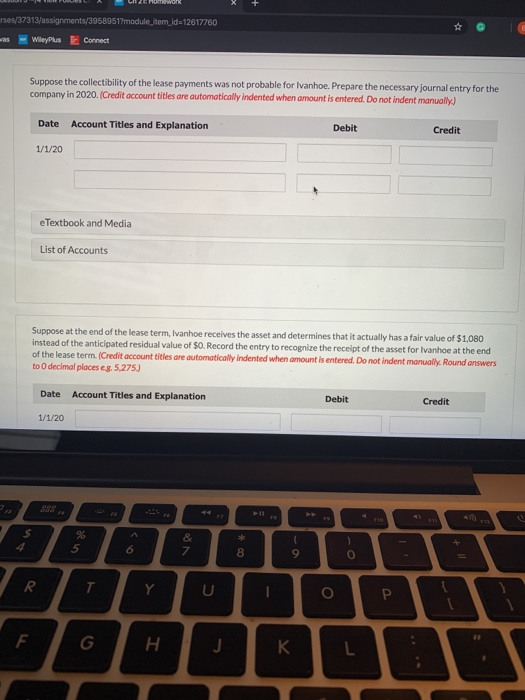

es/37313/assignments/3958951?module_item_id=12617760 WileyPlus E Connect Current Attempt in Progress Ivanhoe Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2020. The lease is for an 8-year period and requires equal annual payments of $30,992 at the beginning of each year. The first payment is received on January 1. 2020. Ivanhoe had purchased the machine during 2016 for $142,000. Collectibility of lease payments by Ivanhoe is probable. Ivanhoe set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Ivanhoe at the termination of the lease. Click here to view factor tables. Compute the amount of the lease receivable. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to decimal places es 5275) Amount of the lease receivable $ e Textbook and Media List of Accounts Prepare all necessary journal entries for Ivanhoe for 2020. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to decimal places . 5.275.) Question 5-4 View Policies X C o mork urses/37313/assignments/3958951?modulejemid=12617750 Wileys Connect Prepare all necessary journal entries for Ivanhoe for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to decimal places es. 5.275.) Date Account Titles and Explanation Debit Credit 1/1/20 (To record the lease) (To record the first lease payment) 12/31/20 e Textbook and Media e/37313/assignments/3958951?module_jtem_id=12617760 WiloyPlus Connect Suppose the collectibility of the lease payments was not probable for Ivanhoe. Prepare the necessary journal entry for the company in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually Date Account Titles and Explanation Debit Credit 1/1/20 e Textbook and Media List of Accounts Suppose at the end of the lease term, Ivanhoe receives the asset and determines that it actually has a fair value of $1,080 instead of the anticipated residual value of $0. Record the entry to recognize the receipt of the asset for Ivanhoe at the end of the lease term. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to decimal places eg. 5,275) Date Account Titles and Explanation Debit Credit 1/1/20 TYTUP es/37313/assignments/3958951?module_item_id=12617760 WileyPlus E Connect Current Attempt in Progress Ivanhoe Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2020. The lease is for an 8-year period and requires equal annual payments of $30,992 at the beginning of each year. The first payment is received on January 1. 2020. Ivanhoe had purchased the machine during 2016 for $142,000. Collectibility of lease payments by Ivanhoe is probable. Ivanhoe set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Ivanhoe at the termination of the lease. Click here to view factor tables. Compute the amount of the lease receivable. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to decimal places es 5275) Amount of the lease receivable $ e Textbook and Media List of Accounts Prepare all necessary journal entries for Ivanhoe for 2020. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to decimal places . 5.275.) Question 5-4 View Policies X C o mork urses/37313/assignments/3958951?modulejemid=12617750 Wileys Connect Prepare all necessary journal entries for Ivanhoe for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to decimal places es. 5.275.) Date Account Titles and Explanation Debit Credit 1/1/20 (To record the lease) (To record the first lease payment) 12/31/20 e Textbook and Media e/37313/assignments/3958951?module_jtem_id=12617760 WiloyPlus Connect Suppose the collectibility of the lease payments was not probable for Ivanhoe. Prepare the necessary journal entry for the company in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually Date Account Titles and Explanation Debit Credit 1/1/20 e Textbook and Media List of Accounts Suppose at the end of the lease term, Ivanhoe receives the asset and determines that it actually has a fair value of $1,080 instead of the anticipated residual value of $0. Record the entry to recognize the receipt of the asset for Ivanhoe at the end of the lease term. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to decimal places eg. 5,275) Date Account Titles and Explanation Debit Credit 1/1/20 TYTUP