Answered step by step

Verified Expert Solution

Question

1 Approved Answer

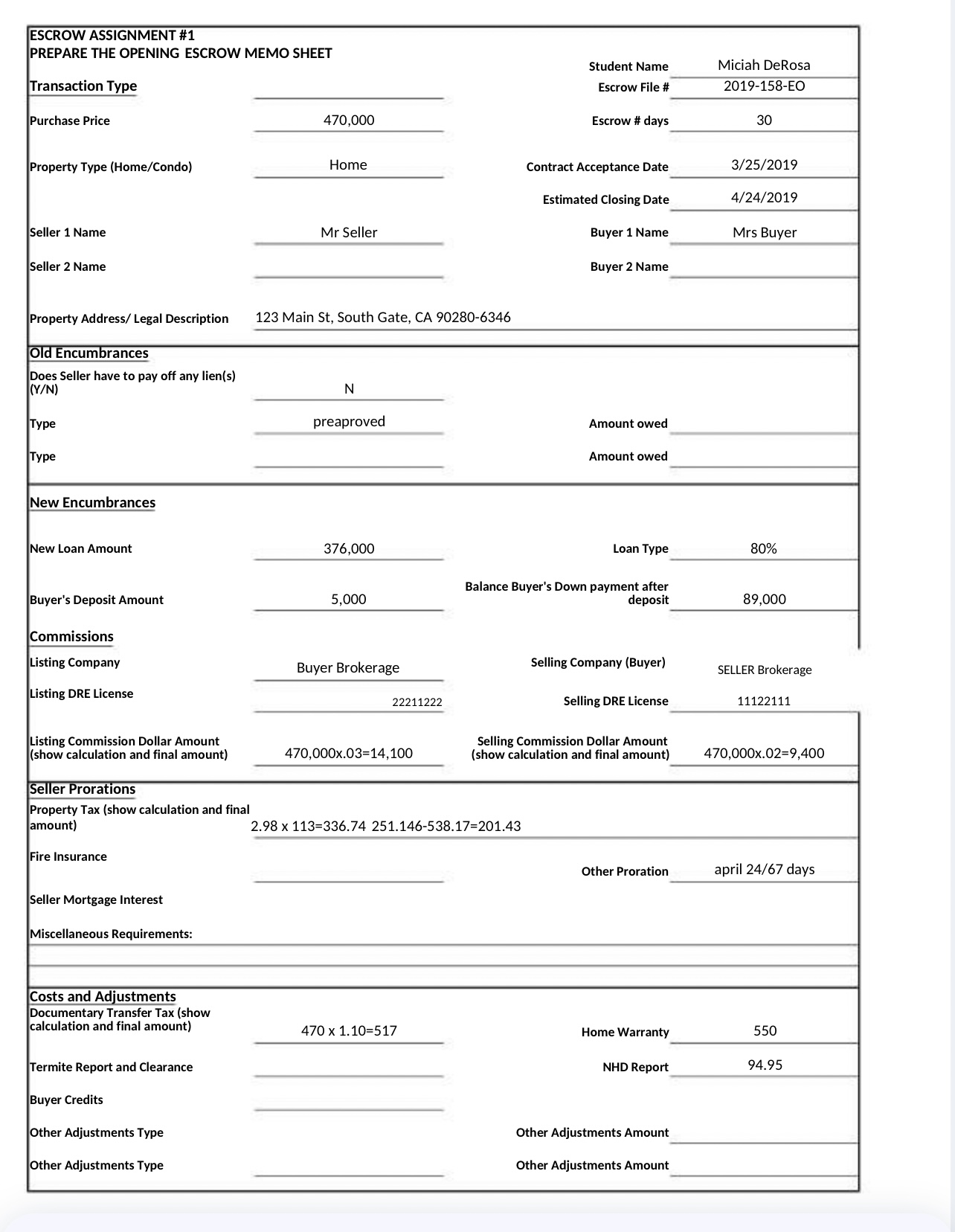

ESCROW ASSIGNMENT #1 PREPARE THE OPENING ESCROW MEMO SHEET Transaction Type Purchase Price 470,000 Student Name Escrow File # Miciah DeRosa 2019-158-EO Escrow #

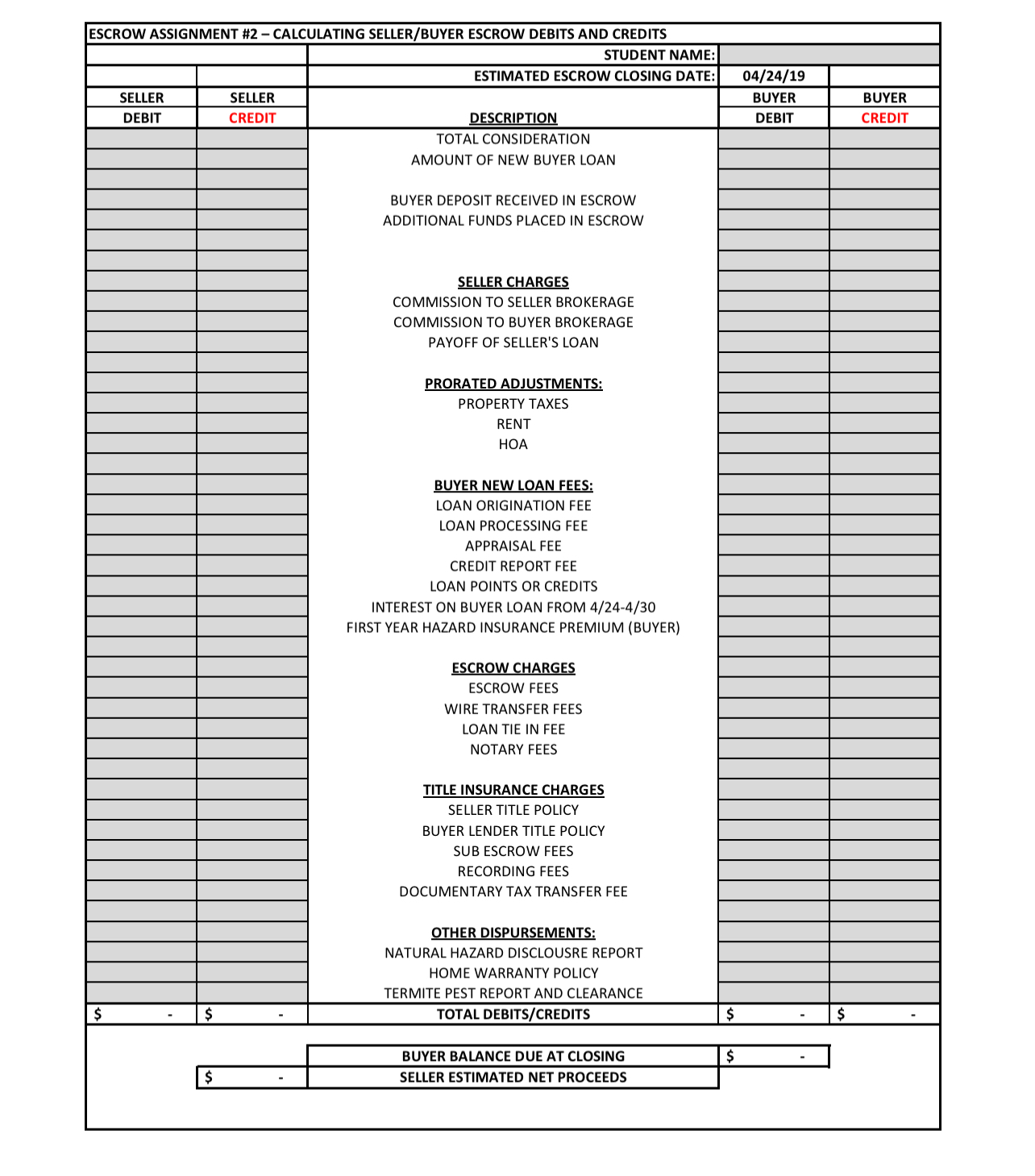

ESCROW ASSIGNMENT #1 PREPARE THE OPENING ESCROW MEMO SHEET Transaction Type Purchase Price 470,000 Student Name Escrow File # Miciah DeRosa 2019-158-EO Escrow # days 30 Property Type (Home/Condo) Home Contract Acceptance Date 3/25/2019 Estimated Closing Date 4/24/2019 Seller 1 Name Mr Seller Buyer 1 Name Mrs Buyer Seller 2 Name Buyer 2 Name Property Address/Legal Description 123 Main St, South Gate, CA 90280-6346 Old Encumbrances Does Seller have to pay off any lien(s) (Y/N) N preaproved Type New Encumbrances New Loan Amount Buyer's Deposit Amount Commissions Listing Company Listing DRE License Listing Commission Dollar Amount (show calculation and final amount) Amount owed Amount owed 376,000 Loan Type 80% 5,000 Balance Buyer's Down payment after deposit 89,000 Buyer Brokerage 22211222 470,000x.03=14,100 Selling Company (Buyer) SELLER Brokerage Selling DRE License 11122111 Selling Commission Dollar Amount (show calculation and final amount) 470,000x.02=9,400 Seller Prorations Property Tax (show calculation and final amount) 2.98 x 113-336.74 251.146-538.17-201.43 Fire Insurance Seller Mortgage Interest Miscellaneous Requirements: Costs and Adjustments Documentary Transfer Tax (show calculation and final amount) Termite Report and Clearance Buyer Credits Other Adjustments Type Other Adjustments Type 470 x 1.10=517 Other Proration april 24/67 days Home Warranty 550 NHD Report 94.95 Other Adjustments Amount Other Adjustments Amount ESCROW ASSIGNMENT #2 - CALCULATING SELLER/BUYER ESCROW DEBITS AND CREDITS SELLER DEBIT SELLER CREDIT $ $ STUDENT NAME: ESTIMATED ESCROW CLOSING DATE: 04/24/19 BUYER BUYER DESCRIPTION DEBIT CREDIT TOTAL CONSIDERATION AMOUNT OF NEW BUYER LOAN BUYER DEPOSIT RECEIVED IN ESCROW ADDITIONAL FUNDS PLACED IN ESCROW SELLER CHARGES COMMISSION TO SELLER BROKERAGE COMMISSION TO BUYER BROKERAGE PAYOFF OF SELLER'S LOAN PRORATED ADJUSTMENTS: PROPERTY TAXES RENT HOA BUYER NEW LOAN FEES: LOAN ORIGINATION FEE LOAN PROCESSING FEE APPRAISAL FEE CREDIT REPORT FEE LOAN POINTS OR CREDITS INTEREST ON BUYER LOAN FROM 4/24-4/30 FIRST YEAR HAZARD INSURANCE PREMIUM (BUYER) ESCROW CHARGES ESCROW FEES WIRE TRANSFER FEES LOAN TIE IN FEE NOTARY FEES TITLE INSURANCE CHARGES SELLER TITLE POLICY BUYER LENDER TITLE POLICY SUB ESCROW FEES RECORDING FEES DOCUMENTARY TAX TRANSFER FEE OTHER DISPURSEMENTS: NATURAL HAZARD DISCLOUSRE REPORT HOME WARRANTY POLICY TERMITE PEST REPORT AND CLEARANCE TOTAL DEBITS/CREDITS $ $ $ BUYER BALANCE DUE AT CLOSING SELLER ESTIMATED NET PROCEEDS $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started