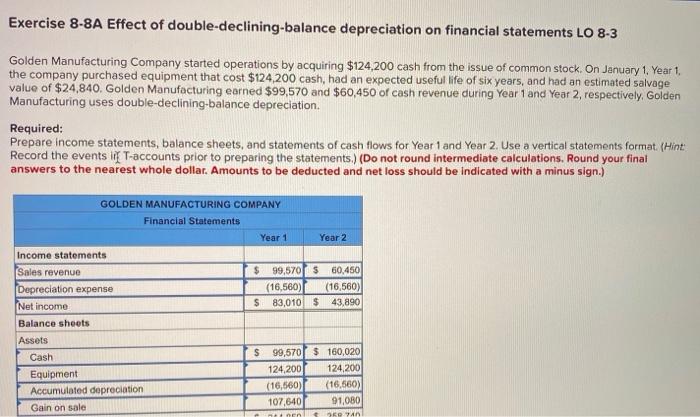

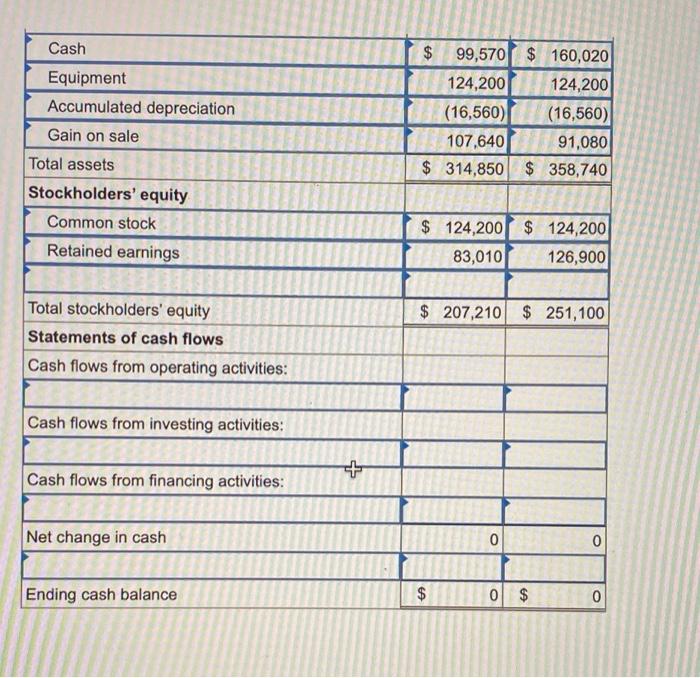

Eserce Act of double-declining cederaciones financiamento GOLDEN MANUFACTURING COMPANY Income statements Serevenue 59.570S 60.450 $ 20.570 S50 650 Netcome Balance sheets Ats Cash Equipment A depreciation OOO $ 3 Stockholders' equity 5 0 5 0 Total stockholders equity Statements of cash flows Cashflows from operating activiti Cashflows from west S Accumulated depreciation $ 0 $ 0 Total assets Stockholders' equity 0 $ $ 0 Total stockholders' equity Statements of cash flows Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities: Not change in cash 0 0 Ending cash balance 0 $ 0 Exercise 8-8A Effect of double-declining-balance depreciation on financial statements LO 8-3 Golden Manufacturing Company started operations by acquiring $124,200 cash from the issue of common stock. On January 1, Year 1, the company purchased equipment that cost $124,200 cash, had an expected useful life of six years, and had an estimated salvage value of $24,840. Golden Manufacturing earned $99,570 and $60,450 of cash revenue during Year 1 and Year 2, respectively, Golden Manufacturing uses double-declining-balance depreciation. Required: Prepare income statements, balance sheets, and statements of cash flows for Year 1 and Year 2. Use a vertical statements format. (Hint: Record the events T-accounts prior to preparing the statements.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Amounts to be deducted and net loss should be indicated with a minus sign.) GOLDEN MANUFACTURING COMPANY Financial Statements Year 1 Year 2 Income statements Sales revenue $ 99,5705 60,450 Depreciation expense (16,560) (16,560) $ Net income 83,010 $ 43,890 Balance sheets Assets Cash 99,570 $ 160,020 Equipment 124.200 124,200 Accumulated depreciation (16,560) (16,560) Gain on sale 107,640 91,080 259 Yan S .nl Cash Equipment Accumulated depreciation Gain on sale Total assets Stockholders' equity Common stock Retained earnings $ 99,570 $ 160,020 124,200 124,200 (16,560) (16,560) 107,640 91,080 $ 314,850 $ 358,740 $ 124,200 $ 124,200 83,010 126,900 $ 207,210 $ 251,100 Total stockholders' equity Statements of cash flows Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities: + Net change in cash 0 0 Ending cash balance $ 0 $ 0