Answered step by step

Verified Expert Solution

Question

1 Approved Answer

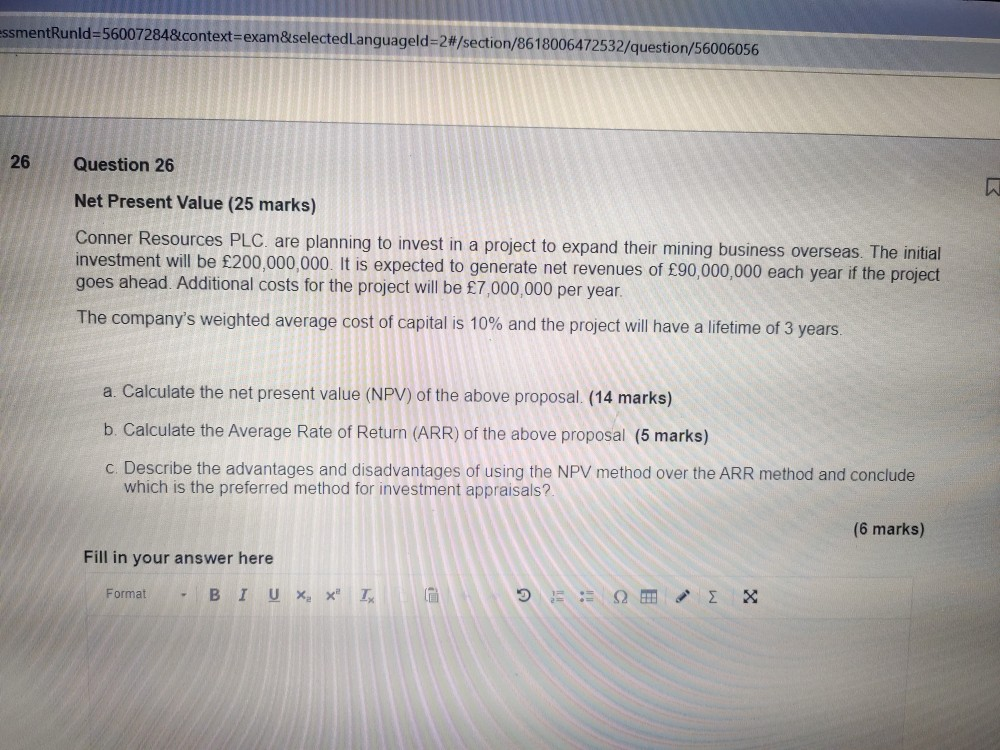

EsmentRunld=560072848.context=exam&selected Languageld=2#/section/8618006472532/question/56006056 26 Question 26 Net Present Value (25 marks) Conner Resources PLC. are planning to invest in a project to expand their mining business

EsmentRunld=560072848.context=exam&selected Languageld=2#/section/8618006472532/question/56006056 26 Question 26 Net Present Value (25 marks) Conner Resources PLC. are planning to invest in a project to expand their mining business overseas. The initial investment will be 200,000,000. It is expected to generate net revenues of 90,000,000 each year if the project goes ahead. Additional costs for the project will be 7,000,000 per year. The company's weighted average cost of capital is 10% and the project will have a lifetime of 3 years. a. Calculate the net present value (NPV) of the above proposal (14 marks) b. Calculate the Average Rate of Return (ARR) of the above proposal (5 marks) c. Describe the advantages and disadvantages of using the NPV method over the ARR method and conclude which is the preferred method for investment appraisals? (6 marks) Fill in your answer here Format - B IUX, X" @ 3: Ex

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started