Answered step by step

Verified Expert Solution

Question

1 Approved Answer

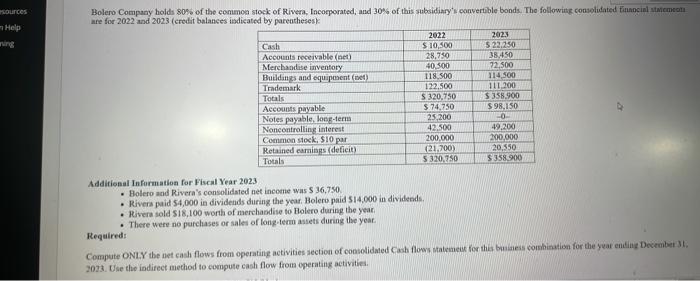

esources n Help ning Bolero Company holds 80% of the common stock of Rivera, Incorporated, and 30% of this subsidiary's convertible bonds. The following consolidated

esources n Help ning Bolero Company holds 80% of the common stock of Rivera, Incorporated, and 30% of this subsidiary's convertible bonds. The following consolidated financial statements are for 2022 and 2023 (credit balances indicated by parentheses): Additional Information for Fiscal Year 2023 O Cash Accounts receivable (net) Merchandise inventory Buildings and equipment (net) Trademark Totals Accounts payable Notes payable, long-term Noncontrolling interest Common stock, $10 par Retained earnings (deficit) Totals Bolero and Rivera's consolidated net income was $ 36,750. Rivera paid $4,000 in dividends during the year. Bolero paid $14,000 in dividends. Rivera sold $18,100 worth of merchandise to Bolero during 2022 $ 10,500 28,750 the year. . There were no purchases or sales of long-term assets during the year. 40,500 118,500 122,500 $320,750 $74,750 25,200 42,500 200,000 (21,700) $320,750 2023 $ 22,250 38,450 72,500 114,500 111,200 $ 358,900 $ 98,150 -0- 49,200 200,000 20,550 $ 358,900 Required: Compute ONLY the net cash flows from operating activities section of consolidated Cash flows statement for this business combination for the year ending December 31, 2023. Use the indirect method to compute cash flow from operating activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started