Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Espada Real Estate Investment Company (EREIC) purchases new apartment complexes, establishes a stable group of residents, and then sells the complexes to apartment management companies.

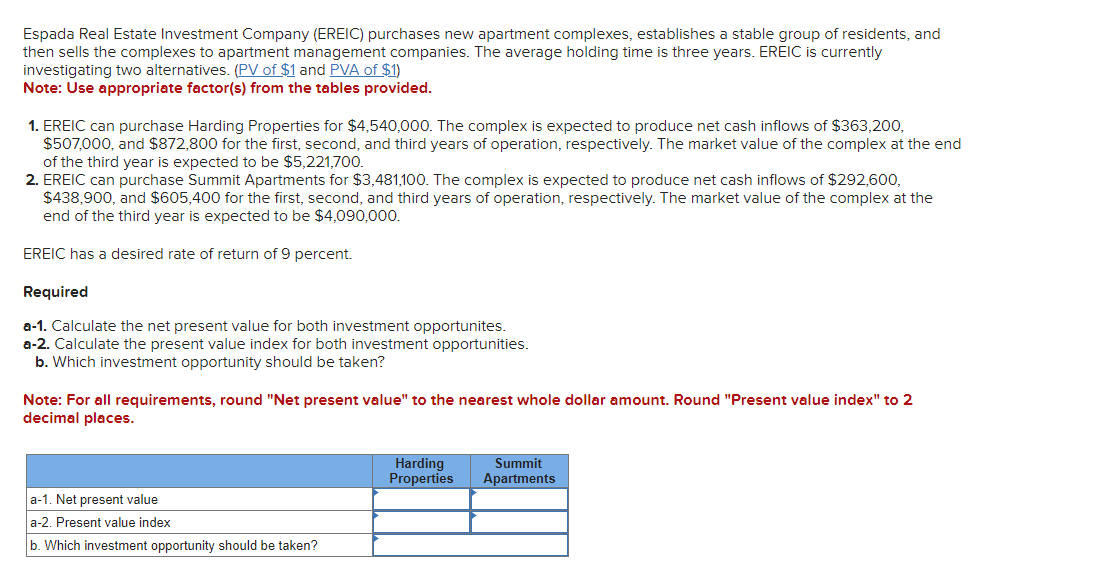

Espada Real Estate Investment Company (EREIC) purchases new apartment complexes, establishes a stable group of residents, and then sells the complexes to apartment management companies. The average holding time is three years. EREIC is currently investigating two alternatives. (PV of $1 and PVA of $1 ) Note: Use appropriate factor(s) from the tables provided. 1. EREIC can purchase Harding Properties for $4,540,000. The complex is expected to produce net cash inflows of $363,200, $507,000, and $872,800 for the first, second, and third years of operation, respectively. The market value of the complex at the end of the third year is expected to be $5,221,700. 2. EREIC can purchase Summit Apartments for $3,481,100. The complex is expected to produce net cash inflows of $292,600, $438,900, and $605,400 for the first, second, and third years of operation, respectively. The market value of the complex at the end of the third year is expected to be $4,090,000. EREIC has a desired rate of return of 9 percent. Required a-1. Calculate the net present value for both investment opportunites. a-2. Calculate the present value index for both investment opportunities. b. Which investment opportunity should be taken? Note: For all requirements, round "Net present value" to the nearest whole dollar amount. Round "Present value index" to 2 decimal places

Espada Real Estate Investment Company (EREIC) purchases new apartment complexes, establishes a stable group of residents, and then sells the complexes to apartment management companies. The average holding time is three years. EREIC is currently investigating two alternatives. (PV of $1 and PVA of $1 ) Note: Use appropriate factor(s) from the tables provided. 1. EREIC can purchase Harding Properties for $4,540,000. The complex is expected to produce net cash inflows of $363,200, $507,000, and $872,800 for the first, second, and third years of operation, respectively. The market value of the complex at the end of the third year is expected to be $5,221,700. 2. EREIC can purchase Summit Apartments for $3,481,100. The complex is expected to produce net cash inflows of $292,600, $438,900, and $605,400 for the first, second, and third years of operation, respectively. The market value of the complex at the end of the third year is expected to be $4,090,000. EREIC has a desired rate of return of 9 percent. Required a-1. Calculate the net present value for both investment opportunites. a-2. Calculate the present value index for both investment opportunities. b. Which investment opportunity should be taken? Note: For all requirements, round "Net present value" to the nearest whole dollar amount. Round "Present value index" to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started