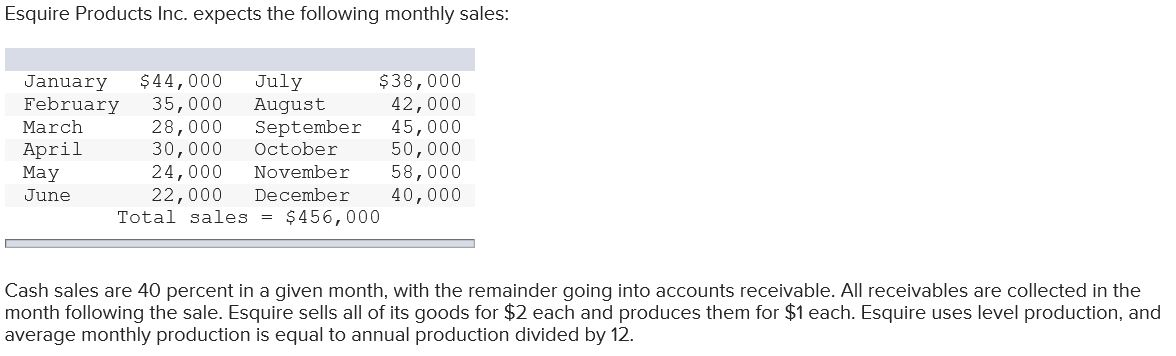

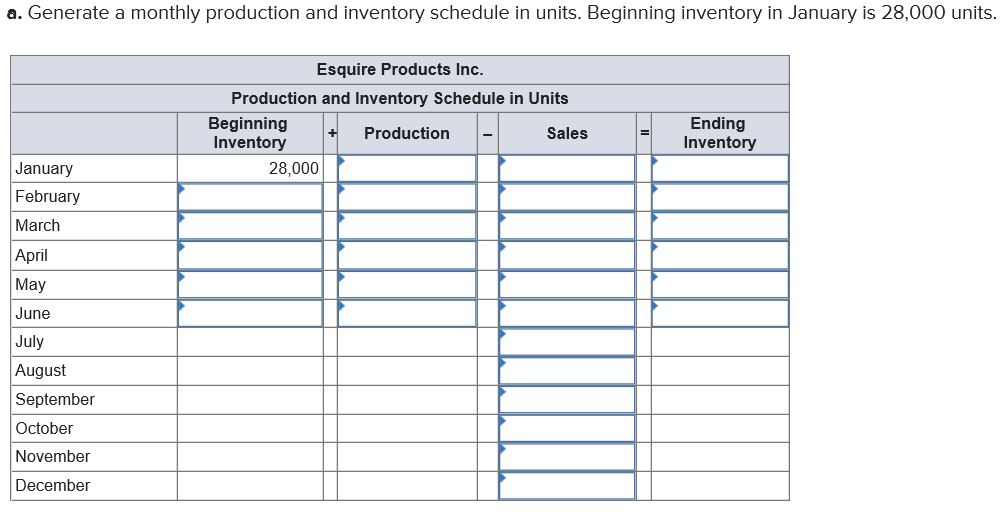

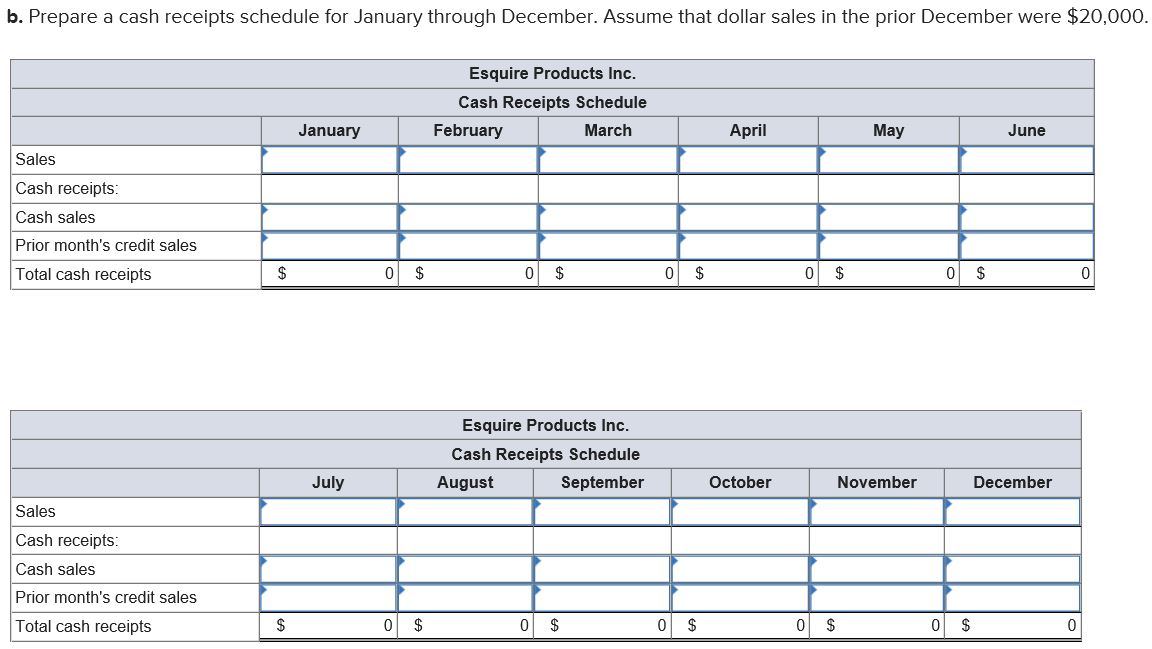

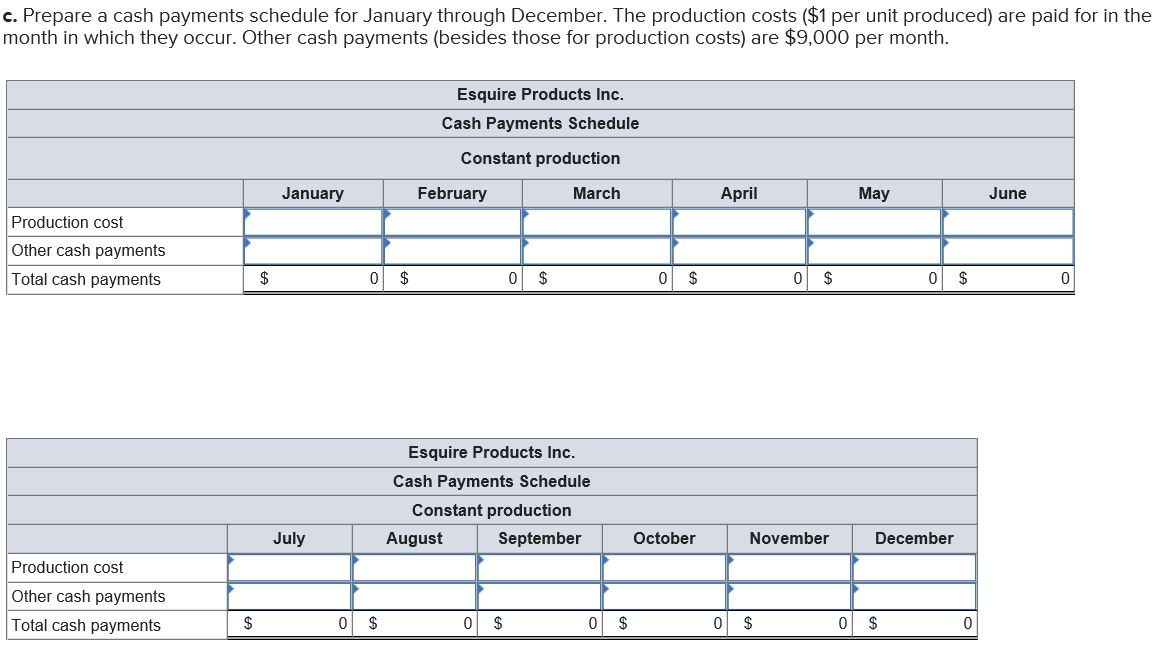

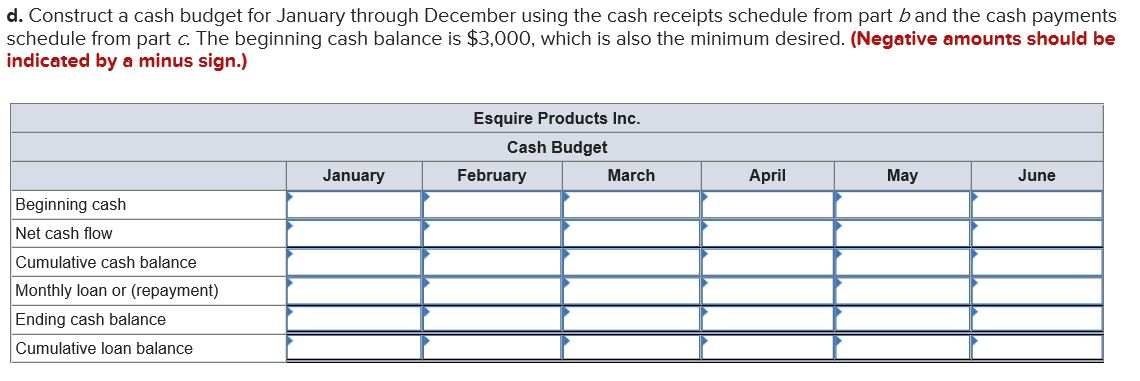

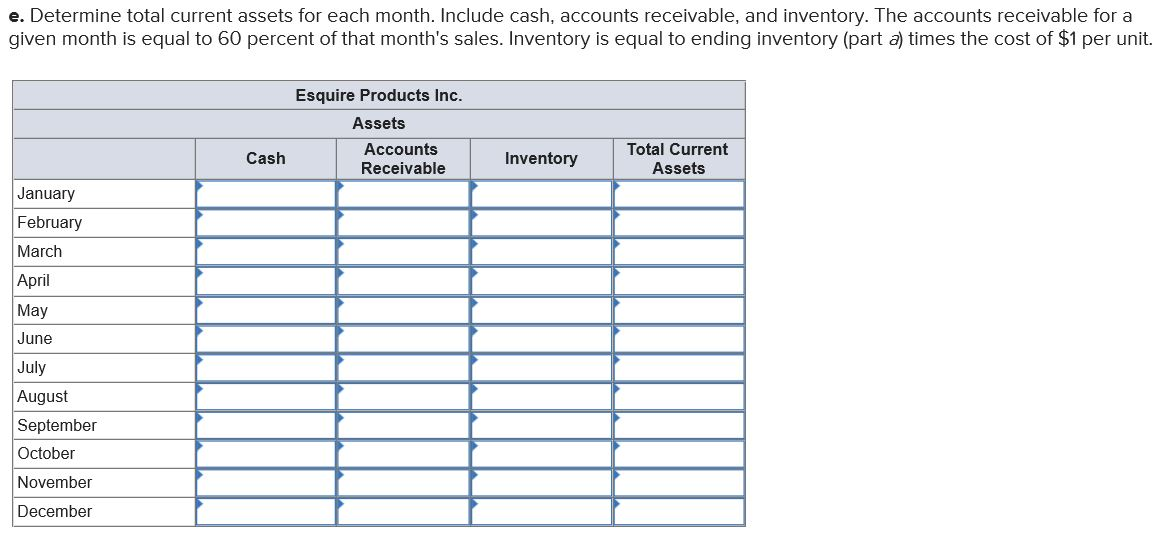

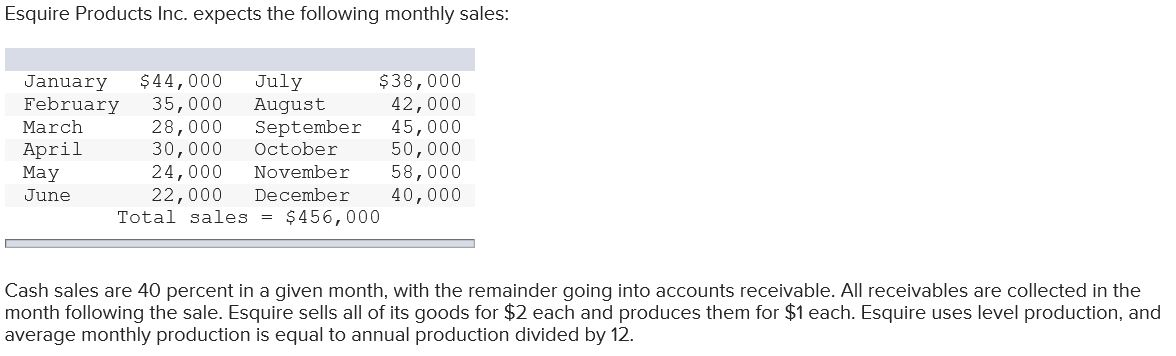

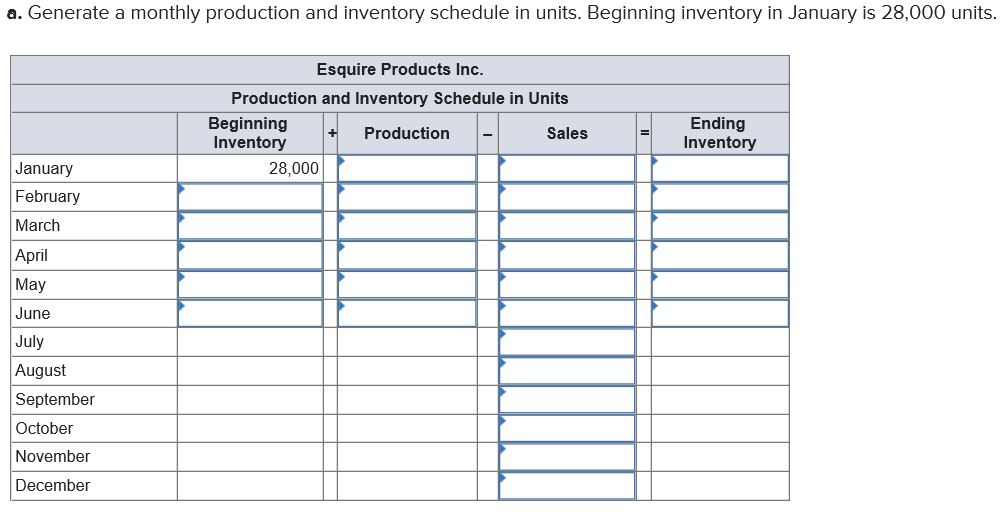

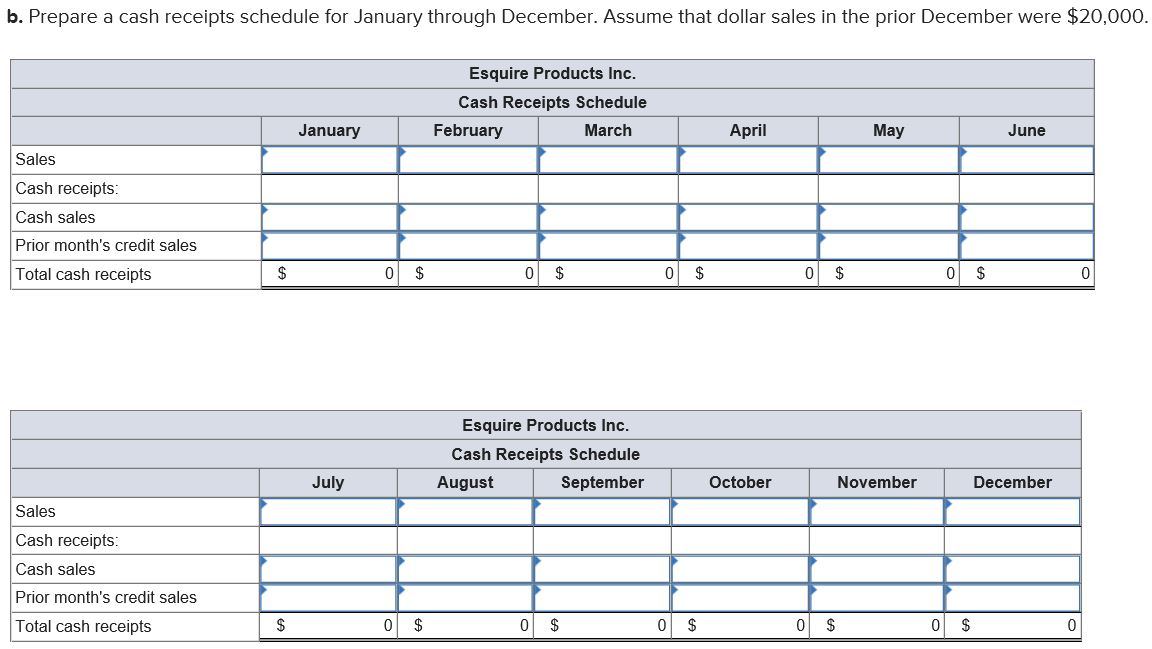

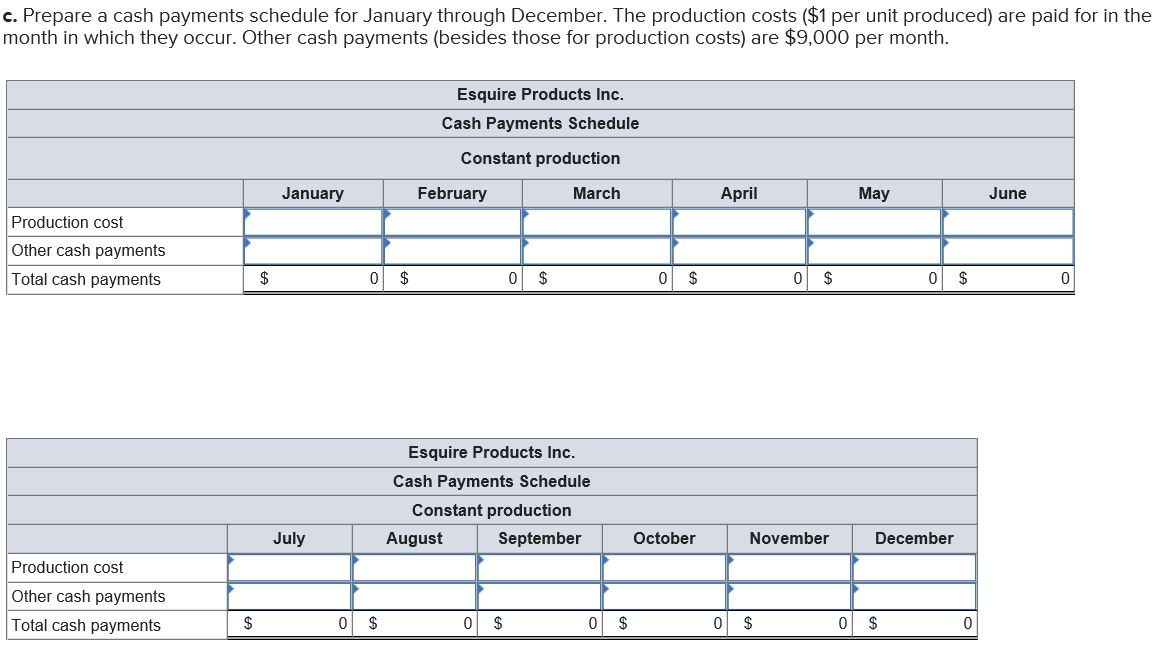

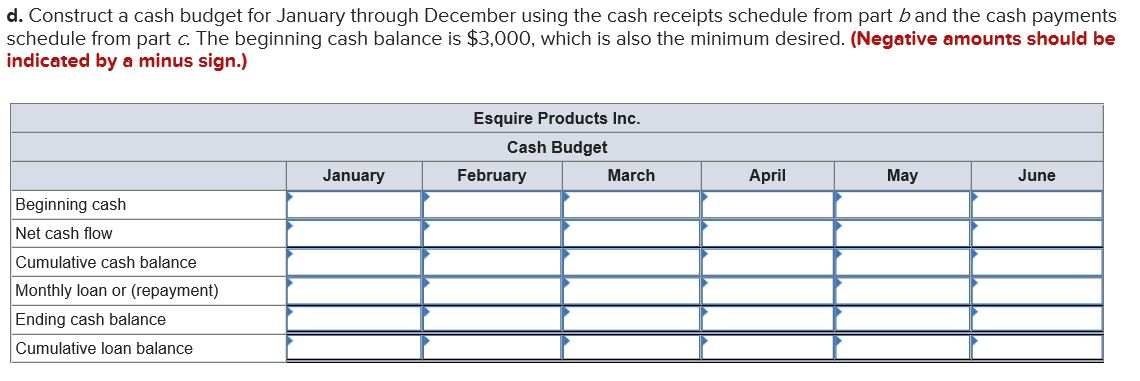

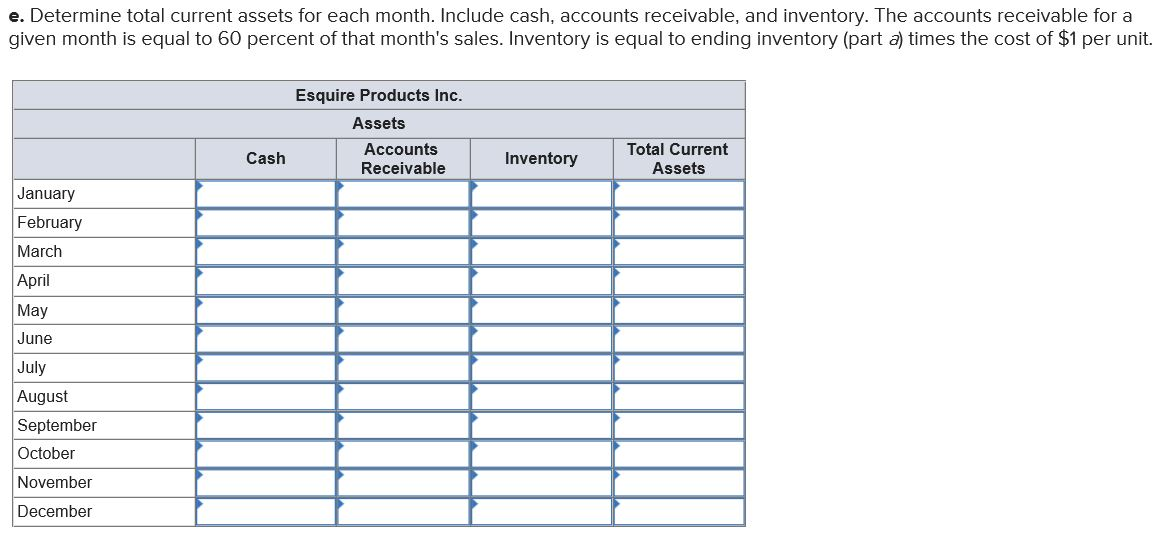

Esquire Products Inc. expects the following monthly sales: v January $44,000 July $38,000 February 35,000 August 42,000 March 28,000 September 45,000 April 30,000 October 50,000 May 24,000 November 58,000 June 22,000 December 40,000 Total sales = $456,000 Cash sales are 40 percent in a given month, with the remainder going into accounts receivable. All receivables are collected in the month following the sale. Esquire sells all of its goods for $2 each and produces them for $1 each. Esquire uses level production, and average monthly production is equal to annual production divided by 12. a. Generate a monthly production and inventory schedule in units. Beginning inventory in January is 28,000 units. Esquire Products Inc. Production and Inventory Schedule in Units Beginning + Production Sales Inventory 28,000 Ending Inventory January February March April May June July August September October November December b. Prepare a cash receipts schedule for January through December. Assume that dollar sales in the prior December were $20,000. Esquire Products Inc. Cash Receipts Schedule February March January April May June Sales Cash receipts: Cash sales Prior month's credit sales Total cash receipts $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 Esquire Products Inc. Cash Receipts Schedule August September I October December July I November I Sales Cash receipts: Cash sales Prior month's credit sales Total cash receipts 0 $ 0 $ 0 $ 0 $ ol 0 $ c. Prepare a cash payments schedule for January through December. The production costs ($1 per unit produced) are paid for in the month in which they occur. Other cash payments (besides those for production costs) are $9,000 per month. Esquire Products Inc. Cash Payments Schedule Constant production February March January April May June Production cost Other cash payments Total cash payments 0 $ 0 $ 0 $ 0 $ 0 $ Esquire Products Inc. Cash Payments Schedule Constant production August September July October November December Production cost Other cash payments Total cash payments 0 $ 0 $ 0 $ 0 $ 0 $ d. Construct a cash budget for January through December using the cash receipts schedule from part band the cash payments schedule from part c. The beginning cash balance is $3,000, which is also the minimum desired. (Negative amounts should be indicated by a minus sign.) Esquire Products Inc. Cash Budget February March January April May June Beginning cash Net cash flow Cumulative cash balance Monthly loan or (repayment) Ending cash balance Cumulative loan balance e. Determine total current assets for each month. Include cash, accounts receivable, and inventory. The accounts receivable for a given month is equal to 60 percent of that month's sales. Inventory is equal to ending inventory (part a) times the cost of $1 per unit. Esquire Products Inc. Assets Accounts Receivable Cash Inventory Total Current Assets January February March April May June July August September October November December