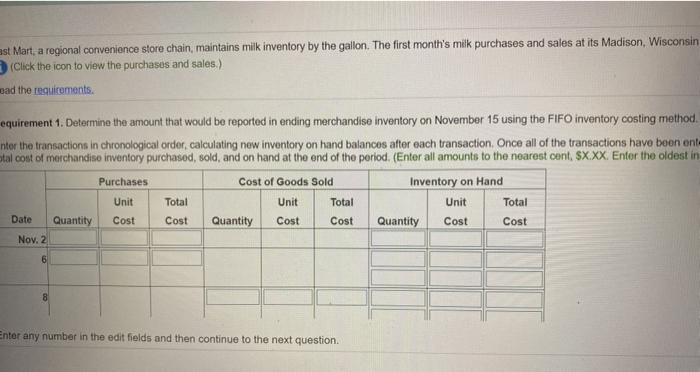

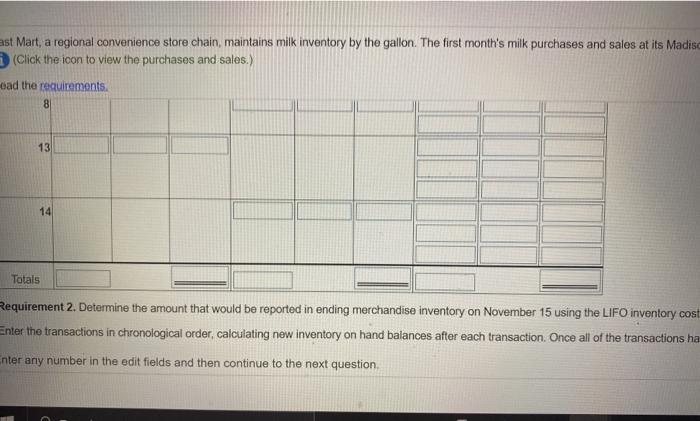

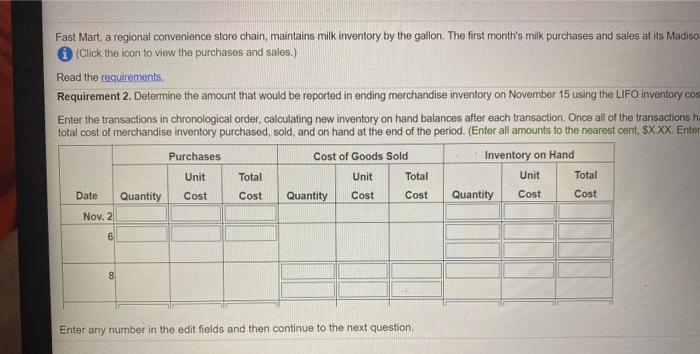

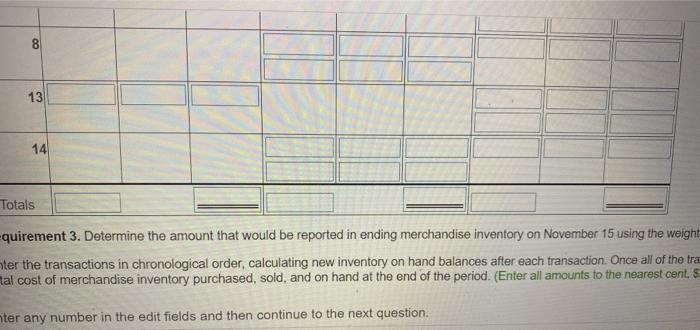

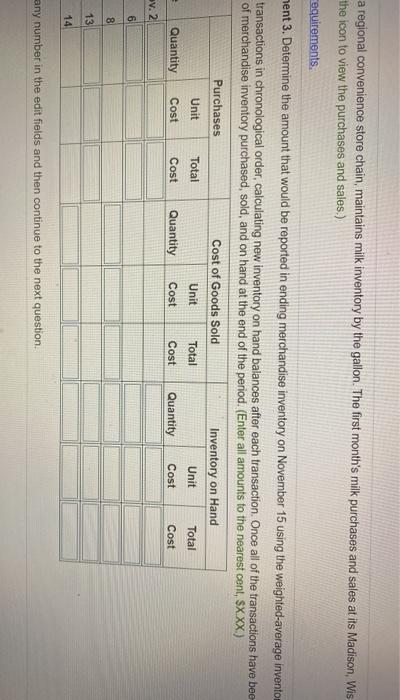

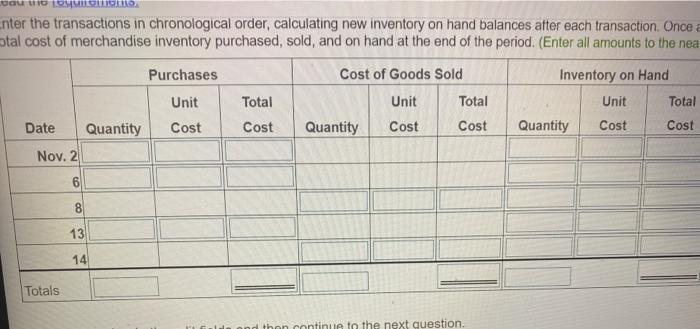

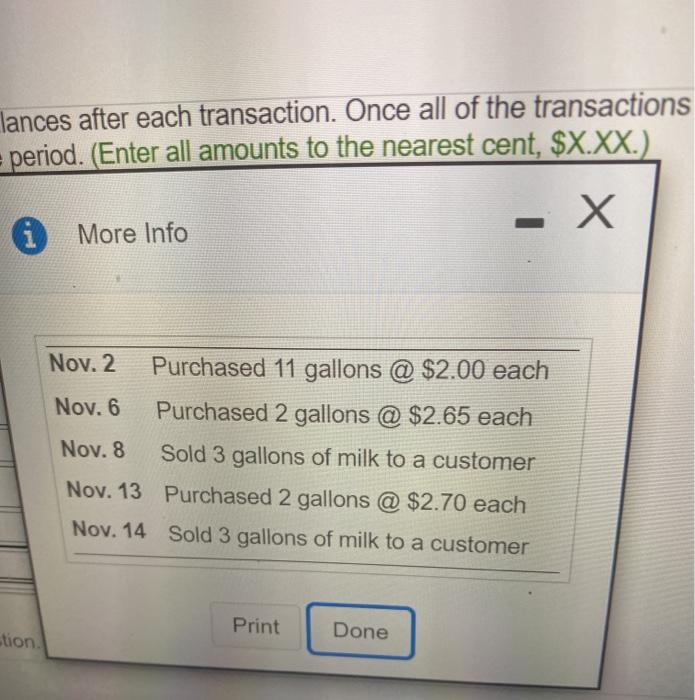

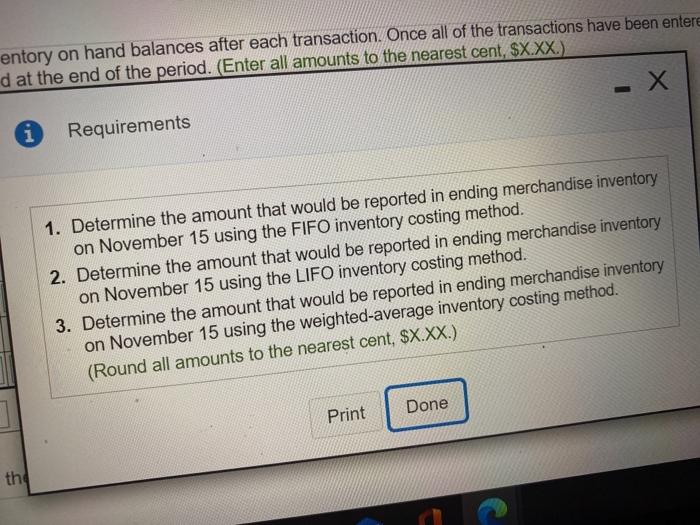

est Mart, a regional convenience store chain, maintains milk inventory by the gallon. The first month's milk purchases and sales at its Madison, Wisconsin (Click the icon to view the purchases and sales.) ead the requicements. equirement 1. Determine the amount that would be reported in ending merchandise inventory on November 15 using the FIFO inventory costing method. nter the transactions in chronological order, calculating new inventory on hand balancos after each transaction Once all of the transactions have been ent- tal cost of merchandiso inventory purchased, sold, and on hand at the end of the period. (Enter all amounts to the nearest cont, X.XX. Enter the oldest in Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Nov. 2 6 8 Enter any number in the edit fields and then continue to the next question ast Mart, a regional convenience store chain, maintains milk inventory by the gallon. The first month's milk purchases and sales at its Madisc (Click the icon to view the purchases and sales.) ead the requirements. 8 13 14 Totals Requirement 2. Determine the amount that would be reported in ending merchandise inventory on November 15 using the LIFO inventory cost Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions ha Enter any number in the edit fields and then continue to the next question. Fast Mart, a regional convenience store chain, maintains milk inventory by the gallon. The first month's milk purchases and sales at its Madiso (Click the icon to view the purchases and sales.) Read the requirements Requirement 2. Determine the amount that would be reported in ending merchandise inventory on November 15 using the LIFO inventory cos Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions h total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter all amounts to the nearest cent $XXX. Enter Purchases Cost of Goods Sold Inventory on Hand Total Unit Total Unit Total Date Quantity Cost Cost Quantity Quantity Nov. 2 Unit Cost Cost Cost Cost 6 8 Enter any number in the edit fields and then continue to the next question 13 14 Totals Equirement 3. Determine the amount that would be reported in ending merchandise inventory on November 15 using the weight ter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the tra tal cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter all amounts to the nearest cent, $ ter any number in the edit fields and then continue to the next question. a regional convenience store chain, maintains milk inventory by the gallon. The first month's milk purchases and sales at its Madison, Wis the icon to view the purchases and sales.) requirements. hent 3. Determine the amount that would be reported in ending merchandise inventory on November 15 using the weighted average invento transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have bee of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter all amounts to the nearest cont, SXXX) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost ov. 2 6 8 13 14 any number in the edit fields and then continue to the next question. Sau 4 | | | | | | | Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once a otal cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter all amounts to the nea Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Nov. 2 6 6 13 14 Totals nude and then continue to the next question. lances after each transaction. Once all of the transactions period. (Enter all amounts to the nearest cent, $X.XX.) - X More Info Nov. 2 Purchased 11 gallons @ $2.00 each Nov. 6 Purchased 2 gallons @ $2.65 each Nov. 8 Sold 3 gallons of milk to a customer Nov. 13 Purchased 2 gallons @ $2.70 each Nov. 14 Sold 3 gallons of milk to a customer Print Done stion entory on hand balances after each transaction. Once all of the transactions have been entere d at the end of the period. (Enter all amounts to the nearest cent, $X.XX.) i Requirements 1. Determine the amount that would be reported in ending merchandise inventory on November 15 using the FIFO inventory costing method. 2. Determine the amount that would be reported in ending merchandise inventory on November 15 using the LIFO inventory costing method. 3. Determine the amount that would be reported in ending merchandise inventory on November 15 using the weighted average inventory costing method. (Round all amounts to the nearest cent, $X.XX.) Done Print the