Answered step by step

Verified Expert Solution

Question

1 Approved Answer

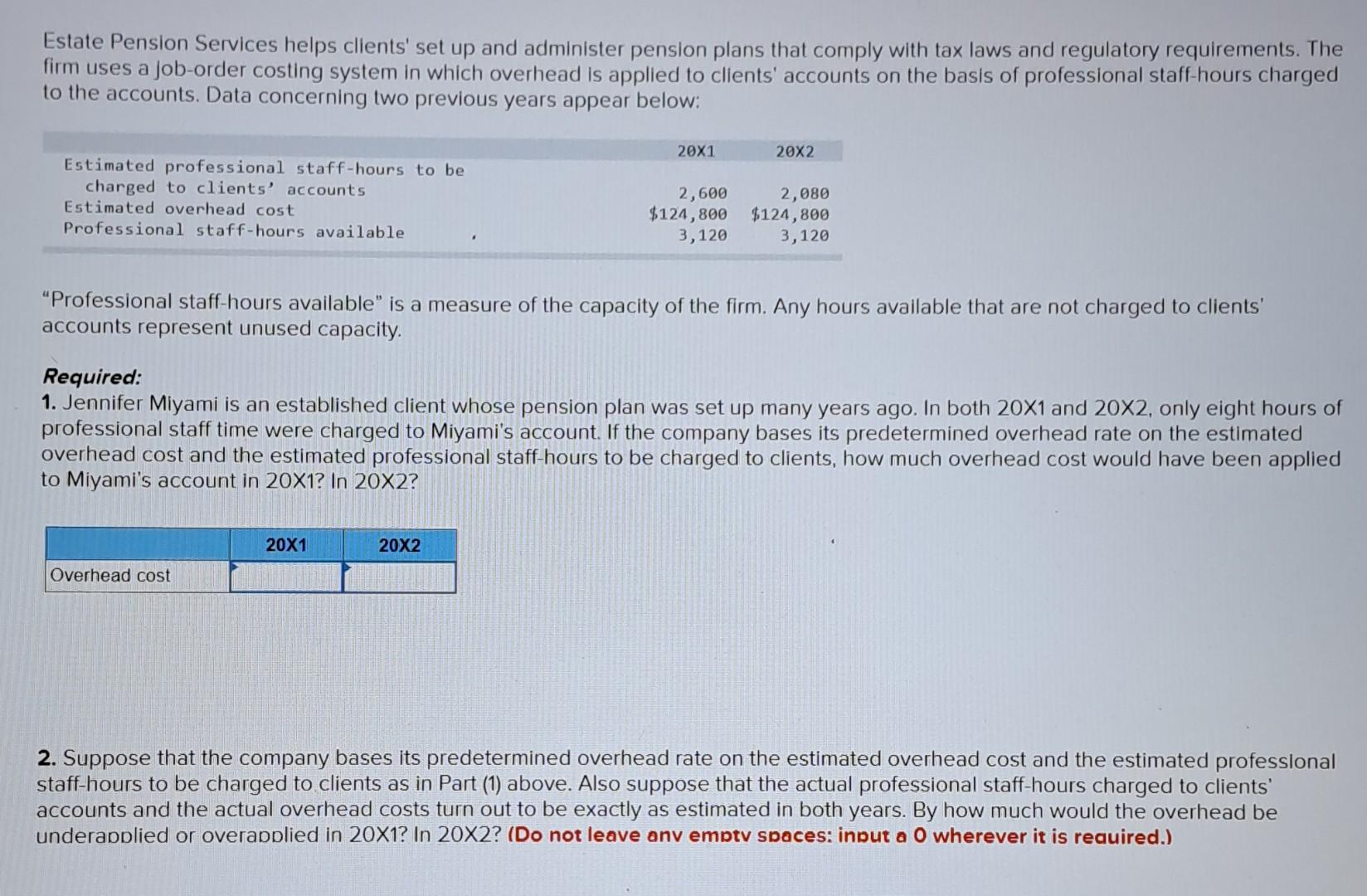

Estate Pension Services helps clients' set up and administer pension plans that comply with tax laws and regulatory requirements. The firm uses a job-order costing

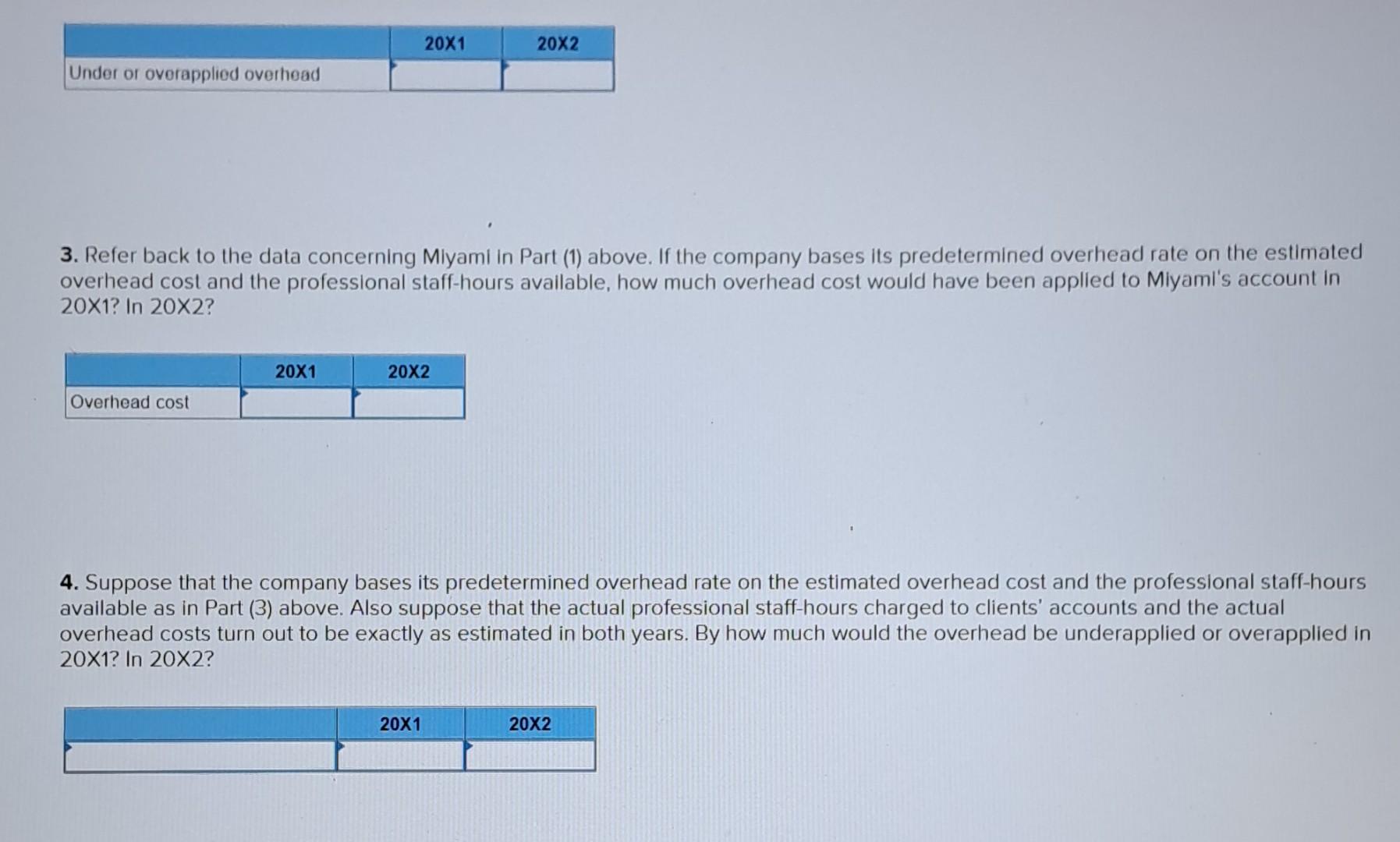

Estate Pension Services helps clients' set up and administer pension plans that comply with tax laws and regulatory requirements. The firm uses a job-order costing system in which overhead is applied to cllents' accounts on the basis of professional staff-hours charged to the accounts. Data concerning two previous years appear below: "Professional staff-hours available" is a measure of the capacity of the firm. Any hours available that are not charged to clients' accounts represent unused capacity. Required: 1. Jennifer Miyami is an established client whose pension plan was set up many years ago. In both 201 and 202, only eight hours of professional staff time were charged to Miyami's account. If the company bases its predetermined overhead rate on the estimated overhead cost and the estimated professional staff-hours to be charged to clients, how much overhead cost would have been applied to Miyami's account in 20X1? In 20X2? 2. Suppose that the company bases its predetermined overhead rate on the estimated overhead cost and the estimated professlonal staff-hours to be charged to clients as in Part (1) above. Also suppose that the actual professional staff-hours charged to clients' accounts and the actual overhead costs turn out to be exactly as estimated in both years. By how much would the overhead be underabolied or overabolied in 201 ? In 202 ? (Do not leave anv embtv spoces: input a 0 wherever it is required.) 3. Refer back to the data concerning Mlyaml in Part (1) above. If the company bases its predetermined overhead rate on the estimated overhead cost and the professional staff-hours avallable, how much overhead cost would have been applied to Miyaml's account in 201?ln202? 4. Suppose that the company bases its predetermined overhead rate on the estimated overhead cost and the professional staff-hours available as in Part (3) above. Also suppose that the actual professional staff-hours charged to clients' accounts and the actual overhead costs turn out to be exactly as estimated in both years. By how much would the overhead be underapplied or overapplied in 201?ln202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started