Answered step by step

Verified Expert Solution

Question

1 Approved Answer

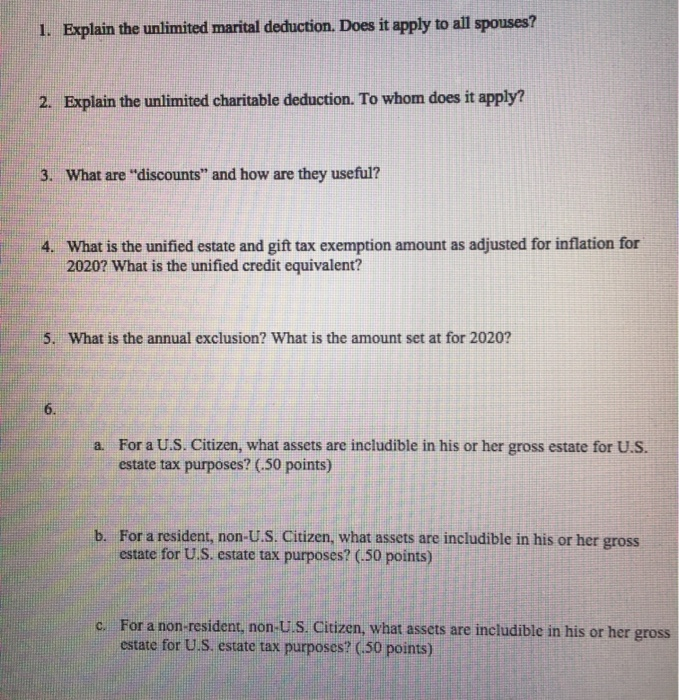

Estate planning class 1. Explain the unlimited marital deduction. Does it apply to all spouses? 2. Explain the unlimited charitable deduction. To whom does it

Estate planning class

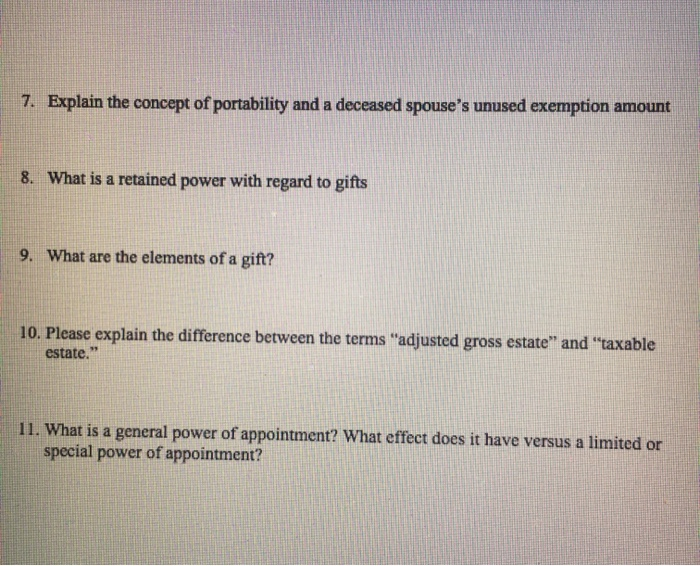

1. Explain the unlimited marital deduction. Does it apply to all spouses? 2. Explain the unlimited charitable deduction. To whom does it apply? 3. What are discounts and how are they useful? 4. What is the unified estate and gift tax exemption amount as adjusted for inflation for 2020? What is the unified credit equivalent? 5. What is the annual exclusion? What is the amount set at for 2020? 6. For a U.S. Citizen, what assets are includible in his or her gross estate for U.S. estate tax purposes? (.50 points) b. For a resident, non-U.S. Citizen, what assets are includible in his or her gross estate for U.S. estate tax purposes? (.50 points) For a non-resident, non-U.S. Citizen, what assets are includible in his or her gross estate for U.S. estate tax purposes? (.50 points) 7. Explain the concept of portability and a deceased spouse's unused exemption amount 8. What is a retained power with regard to gifts 9. What are the elements of a gift? 10. Please explain the difference between the terms "adjusted gross estate" and "taxable estate." 11. What is a general power of appointment? What effect does it have versus a limited or special power of appointment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started