Question

Esther is a property manager. On 1 June 2015, it listed 1,000 bonds with interest of 13.0 percent p.a. paid semi-annually at a face

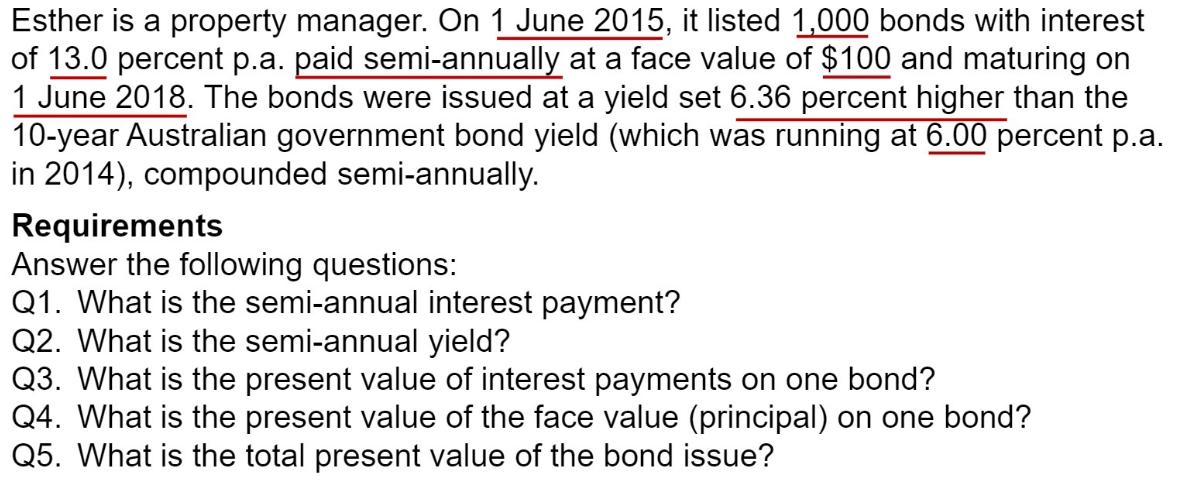

Esther is a property manager. On 1 June 2015, it listed 1,000 bonds with interest of 13.0 percent p.a. paid semi-annually at a face value of $100 and maturing on 1 June 2018. The bonds were issued at a yield set 6.36 percent higher than the 10-year Australian government bond yield (which was running at 6.00 percent p.a. in 2014), compounded semi-annually. Requirements Answer the following questions: Q1. What is the semi-annual interest payment? Q2. What is the semi-annual yield? Q3. What is the present value of interest payments on one bond? Q4. What is the present value of the face value (principal) on one bond? Q5. What is the total present value of the bond issue?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App