Answered step by step

Verified Expert Solution

Question

1 Approved Answer

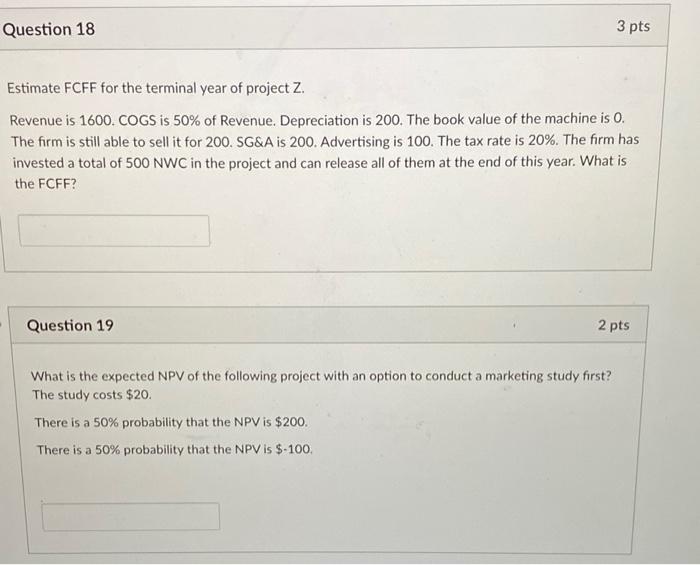

Estimate FCFF for the terminal year of project Z. Revenue is 1600 . COGS is 50% of Revenue. Depreciation is 200 . The book value

Estimate FCFF for the terminal year of project Z. Revenue is 1600 . COGS is 50% of Revenue. Depreciation is 200 . The book value of the machine is 0 . The firm is still able to sell it for 200 . SG\&A is 200 . Advertising is 100 . The tax rate is 20%. The firm has invested a total of 500 NWC in the project and can release all of them at the end of this year. What is the FCFF? Question 19 2pts What is the expected NPV of the following project with an option to conduct a marketing study first? The study costs $20. There is a 50% probability that the NPV is $200. There is a 50% probability that the NPV is $100

Estimate FCFF for the terminal year of project Z. Revenue is 1600 . COGS is 50% of Revenue. Depreciation is 200 . The book value of the machine is 0 . The firm is still able to sell it for 200 . SG\&A is 200 . Advertising is 100 . The tax rate is 20%. The firm has invested a total of 500 NWC in the project and can release all of them at the end of this year. What is the FCFF? Question 19 2pts What is the expected NPV of the following project with an option to conduct a marketing study first? The study costs $20. There is a 50% probability that the NPV is $200. There is a 50% probability that the NPV is $100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started